Download Pintu App

Impact of Bitcoin Open Interest Decline on Bullish Trend at the End of March 2025

Jakarta, Pintu News – The nearly $12 billion(Rp195.6 trillion) drop in Bitcoin open interest (OI) earlier this month may be the catalyst needed to restore the asset’s bullish momentum, according to crypto analysts.

CryptoQuant contributor DarkFost mentioned in a market report on March 17 that this is part of the market’s natural reset that is necessary to maintain the uptrend. He added that in the history of the market, whenever there has been deleveraging like this, there have always been good investment opportunities in the short to medium term.

Data and Factors Causing the Decline in Open Interest

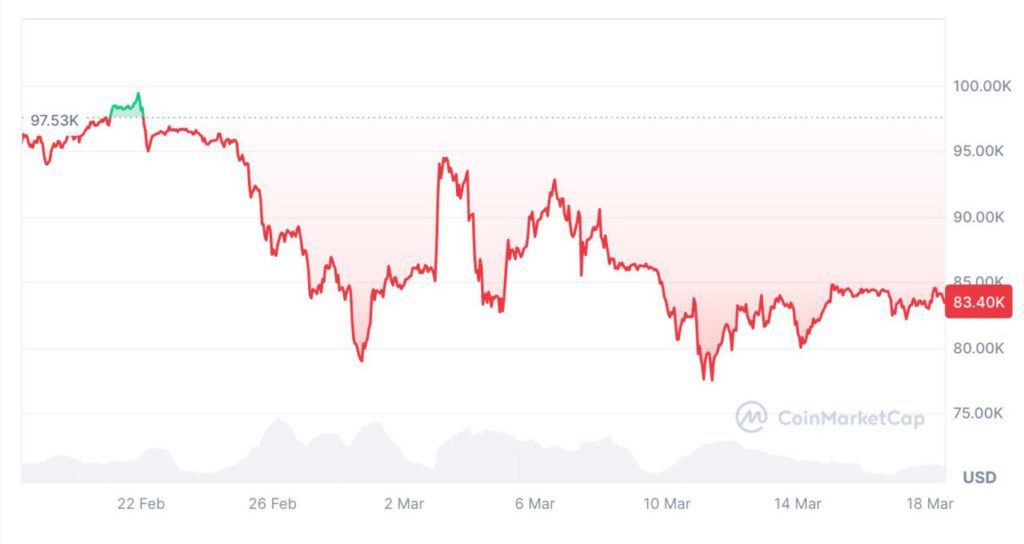

According to CoinGlass data, on February 20, Bitcoin’s open interest stood at $61.42 billion(Rp1,000 trillion). However, in the two weeks to March 4, the figure dropped by 19% to $49.71 billion(IDR 810.3 trillion).

This drop came amid market volatility caused by uncertainty surrounding trade tariff policies imposed by US President Donald Trump as well as speculation regarding interest rates in the United States. DarkFost analysts noted that this political panic triggered a massive liquidation of leveraged Bitcoin positions.

During this period, Bitcoin price fell below two important price levels. On February 25, Bitcoin corrected below $90,000(Rp1.47 billion), and two days later, on February 27, the price fell below $80,000(Rp1.3 billion) for the first time since November.

Also Read: Bitcoin Miner Sales Still High, On-Chain Data Reveals Bearish Trend (3/19/25)

The Fed’s Policy Impact on Bitcoin

Ryan Lee, Chief Analyst at Bitget, said that with Bitcoin’s price currently hovering around $83,000(Rp1.35 billion), market volatility could still increase depending on the outcome of the Federal Open Market Committee (FOMC) meeting on March 19.

Lee explained that although the majority of markets expect the Fed to keep rates on hold, any more aggressive(hawkish) statements could put pressure on Bitcoin and other risky assets.

Currently, the market estimates a 99% probability that the Fed will not change interest rates, according to CME Group’s FedWatch prediction tool. With this expectation, Bitcoin’s OI has risen by around 6.5% in the last five days and currently stands at $49.02 billion.

Conclusion: Market Adjustment as a New Opportunity

A drop in Bitcoin open interest is not a sign of the end of a bullish trend, but rather part of the market adjustment process. In the history of Bitcoin price movements, shakeout moments like this have often been an opportunity for investors to enter before the next uptrend occurs.

However, with the macroeconomic and monetary policy uncertainties in the US, the crypto market still has the potential to experience further fluctuations. Investors are advised to keep researching and considering various factors before making investment decisions.

Also Read: Ethereum (ETH) has the potential to surge sharply, analysts reveal similarities with 2020 trends

That’s the latest information about crypto news today. Get more information about crypto academy from beginner to expert level only at Pintu Academy and enrich your knowledge about the world of crypto and blockchain.

Follow us on Google News to get the latest information about crypto and blockchain technology. Enjoy an easy and secure crypto trading experience by downloading Pintu Crypto via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Click Register Pintu if you don’t have an account or click Login Pintu if you are already registered.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- Cointelegraph. Bitcoin Open Interest Wipeout: Essential Phase for Bullish Uptrend Accessed March 19, 2025.

- Featured Image: Experian

Berita Terbaru

© 2025 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan kontrak berjangka atas aset crypto dilakukan oleh PT Porto Komoditi Berjangka, suatu perusahaan Pialang Berjangka yang berizin dan diawasi oleh BAPPEBTI serta merupakan anggota CFX dan KKI. Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja dan PT Porto Komoditi Berjangka tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.