XRP has the potential to reach $10 by 2030 after SEC case ends according to analyst Ryan Lee

Jakarta, Pintu News – Positive momentum is surrounding Ripple after the United States Securities and Exchange Commission (SEC) ended its lengthy lawsuit against Ripple Labs last week. This decision has sparked optimism among XRP watchers, with some analysts predicting a price increase to $10 by 2030. Factors such as regulatory clarity, Ripple’s adoption of the RLUSD stablecoin, and Ripple Labs’ potential IPO are the main catalysts.

Short and Medium Term Analysis

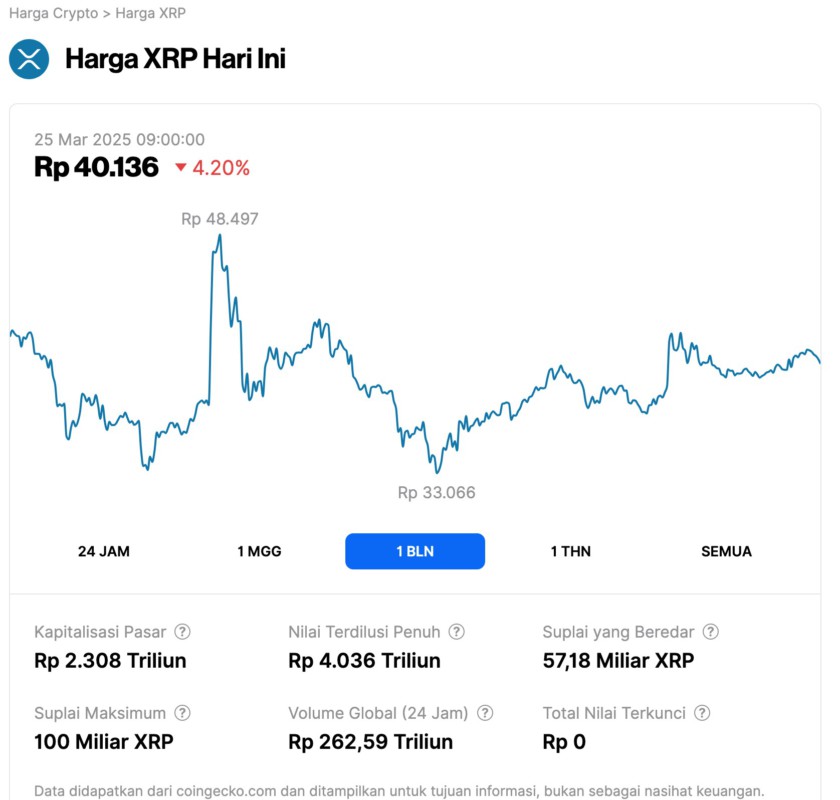

Bitget’s Ryan Lee highlights that XRP is currently in a trading range of $2.35 to $2.55 and could move significantly in either direction if it breaks out of that range. In the short term, the price of XRP could drop to a range of $2.00 to $2.17 or rise to $2.65 to $3.00.

Technical indicators such as a neutral Relative Strength Index (RSI) and a bearish Moving Average Convergence Divergence (MACD) suggest a possible price consolidation in the near term. This analysis is reinforced by the SEC withdrawal and potential approval of the XRP ETF which could push the price in the medium term to a range of $1.50 to $5.89. However, keep in mind that the $2.50 level will be crucial to determine the next direction of XRP’s price movement.

Also Read: Trump Family Invests Big in MNT Token Post Mantle Network Update!

XRP’s Long-term Potential

With the SEC lawsuit over, Ripple (XRP) gained much-needed regulatory clarity that could strengthen its position in the market. Analysts estimate that if Ripple Labs manages to capitalize on the adoption of global payments, the price of XRP could reach between $4.20 to over $10 by 2030.

This success will also be influenced by the widespread adoption of RLUSD as a stablecoin and the possible IPO of Ripple Labs which further strengthens the company’s prospects. Nick Ruck of LVRG Research adds that XRP’s relatively low price volatility is indicative of bullish market sentiment. However, US macroeconomic factors and tariffs could affect this momentum.

IPO Speculation and Its Impact

Speculation regarding a possible Ripple Labs IPO has been increasing, especially after CEO Brad Garlinghouse mentioned that an IPO is “possible” in his last interview. This IPO would not only raise the profile of Ripple Labs but also provide a significant boost to XRP. Investors and crypto market watchers are paying close attention to this development as an important indicator for a long-term bullish position on XRP.

This possible IPO, along with the resolution of the case with the SEC, gives investors plenty of reasons to be optimistic about the future of XRP. Regulatory clarity and the expansion of financial products associated with Ripple are the main keys that will determine how high XRP can fly.

Conclusion

With various positive developments taking place, Ripple (XRP) seems to be on the right track towards long-term growth. Despite some challenges and uncertainties in the market, XRP’s prospects appear bright with support from strong fundamental factors. Investors and crypto enthusiasts are advised to keep a close eye on these dynamics.

Also Read: Metaplanet Adds 150 Bitcoins, New Strategy After Eric Trump’s Advisor Appointment!

That’s the latest information about crypto news today. Get more information about crypto academy from beginner to expert level only at Pintu Academy and enrich your knowledge about the world of crypto and blockchain.

Follow us on Google News to get the latest information about crypto and blockchain technology. Enjoy an easy and secure crypto trading experience by downloading Pintu Crypto via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Click Register Pintu if you don’t have an account or click Login Pintu if you are already registered.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- Coindesk. XRP Could Hit $10 by 2030 as Ripple Wraps Up SEC Case: Analyst. Accessed on March 25, 2025

- Featured Image: Track Insight