Bitcoin Towards $75K: Bear Trap Behind Recent Decline? (9/4/25)

Jakarta, Pintu News – When the crypto market takes a dip, many wonder if this is the beginning of a bear trap. Bitcoin recently experienced an 8.66% drop, touching back below $80,000 after liquidations reached $1.30 billion. However, market indicators suggest that this could be a golden opportunity for risk-taking investors.

Current Market Analysis

Currently, there are 478,000 addresses at $78,981 that are close to breaking even, while 5.94 million wallets of $61,129 have taken profits. This suggests that many investors are opting to exit as the price of Bitcoin (BTC) declines. However, the rising bid-ask ratio indicates a stronger buying interest from the market side.

Retail long positions remain steady at 73%, an indicator that often precedes sharp price reversals. On the other hand, a similar setup last March managed to bring Bitcoin (BTC) back up from $77,000. The question that arises now is, is this dip also a bear trap that will trigger a price increase?

Also Read: Bitcoin (BTC) is recovering, but big hurdles still loom in April 2025

Market Dynamics and Their Impact

With the Federal Open Market Committee (FOMC) decision approaching, crypto markets are bracing for potential volatility. Despite mounting concerns, bid-ask ratios remain high, suggesting that buying interest is still strong. Predictions about interest rate cuts are also gaining ground, with some analysts predicting up to four cuts to address the post-tariff demand slowdown.

This increases the chances of a recession from 40% to 60%, and even JP Morgan predicts an interest rate cut is imminent. Bitcoin (BTC) is in a crucial position, depending on the next move from the Federal Reserve. Although short-term volatility is likely to occur, long-term holders of Bitcoin (BTC) have increased their accumulation, adding 14,000 BTC since April 6, hitting a three-month high.

Market Structure and Rebound Potential

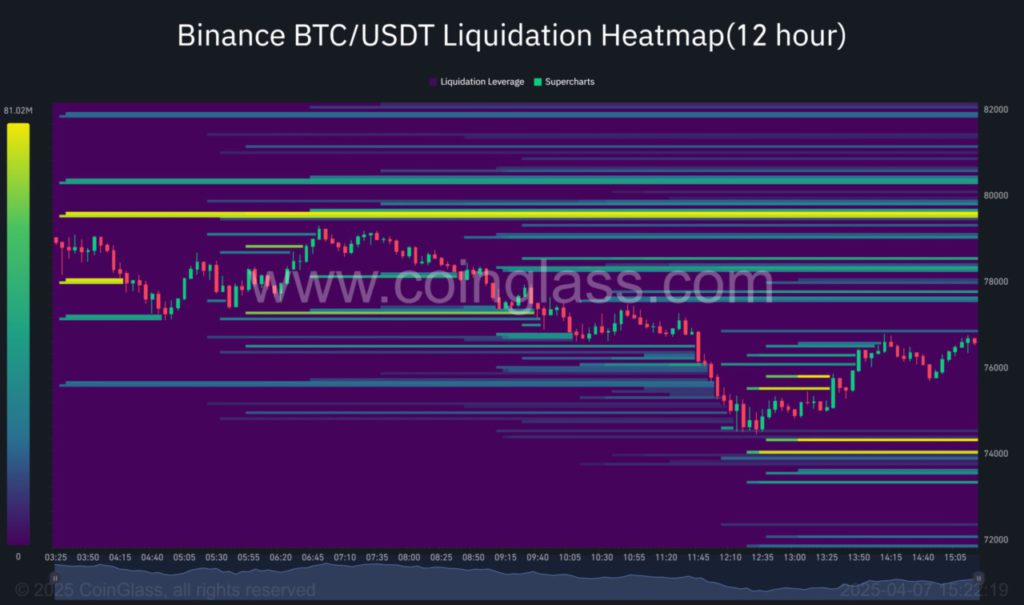

Although Bitcoin’s (BTC) bullish structure is starting to show cracks, key support levels are starting to split. However, if the buy-side absorption can hold, there is potential for a sharp rebound. On the 12-hour heatmap, a liquidity cluster of $72.94 million at $75,798 has been triggered, resulting in a bounce of 1.20%. This could be an indication of absorption or just a temporary relief.

However, with rising Open Interest and continued pressure from the Federal Reserve, as well as accumulation by long-term holders (LTH) hitting a three-month high, the current decline may fit the “high risk, high reward” scenario. If the liquidity cluster continues to be absorbed, Bitcoin (BTC) may be poised for an aggressive recovery.

Conclusion

With all these indicators, investors should stay alert to the fast-changing market dynamics. While risks remain, opportunities to profit from a potential Bitcoin (BTC) rebound are also wide open. Readiness to take quick action and the right information will be key in dealing with the current crypto market volatility.

Also Read: First XRP ETF in the US Launched, Provides New Investment Opportunities!

That’s the latest information about crypto news today. Get more information about crypto academy from beginner to expert level only at Pintu Academy and enrich your knowledge about the world of crypto and blockchain.

Follow us on Google News to get the latest information about crypto and blockchain technology. Enjoy an easy and secure crypto trading experience by downloading Pintu Crypto via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Click Register Pintu if you don’t have an account or click Login Pintu if you are already registered.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- AMB Crypto. Bitcoin’s road to $75k: Is crypto’s latest dip a bear trap in the making?. Accessed on April 8, 2025

- Featured Image: NFT Horizon