Ethereum Holds Strong at $2,400 — Is a Surge to $3,000 Just Around the Corner?

Jakarta, Pintu News – Recently, Ethereum has been back in the spotlight in the crypto market after registering a significant price surge in recent weeks. With over 60% gains in a month and strong support from whale investors, ETH is showing signs of entering a solid bullish phase.

Massive accumulation activity and market momentum pointing towards the optimism zone is a signal that Ethereum is preparing for higher price levels. Is this the start of a long rally towards $3,000?

Let’s take a deeper dive into Ethereum’s movement and the factors driving its surge.

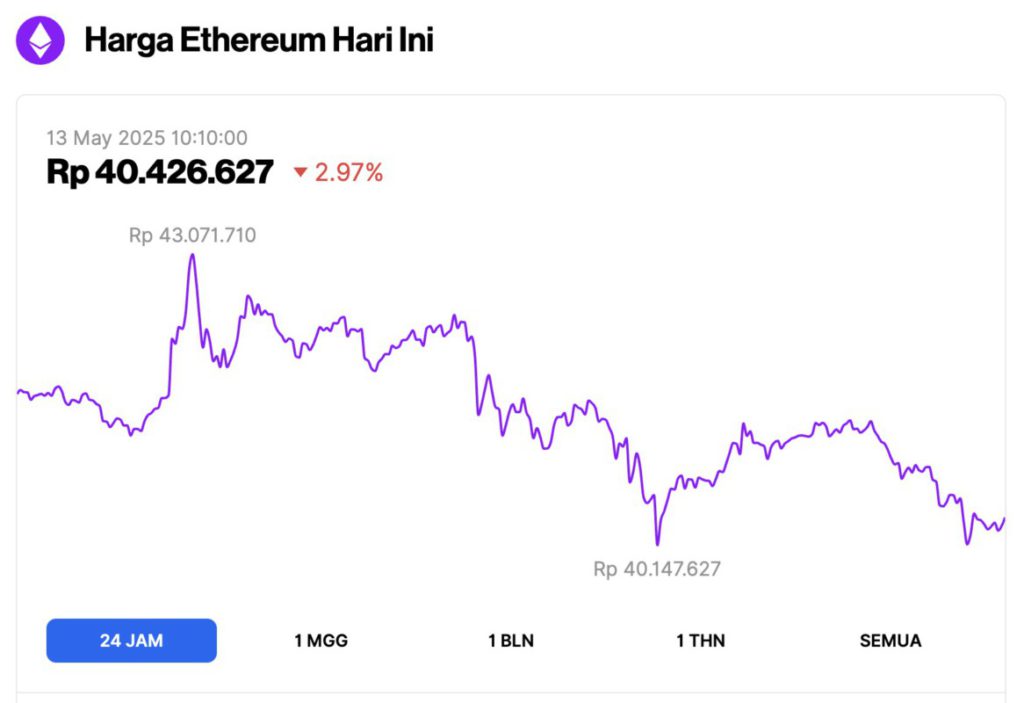

Ethereum Price Drops 2.97% in 24 Hours

As of May 13, 2025, Ethereum (ETH) was trading at approximately $2,443, or around IDR 40,426,627. This marked a 2.97% decline over the past 24 hours. Within the same timeframe, ETH reached a high of IDR 43,071,710 and dipped to a low of IDR 40,147,627.

At the time of writing, data from CoinMarketCap shows that Ethereum’s market capitalization stands at around $295.03 billion, with daily trading volume rising 31% to $32.57 billion in the last 24 hours.

Read also: Bitcoin Stalls at $102K — But a Bullish Pattern Could Send It Soaring to $150K!

ETH Whale Makes Big Profits

On-chain analytics firm Lookonchain has uncovered the activity of one “whale” that has profited immensely from Ethereum’s recent price rally.

In a post on the X platform, Lookonchain mentioned that the whale started accumulating Ethereum since February 15. When the ETH price was still around $1,600, this large investor had a loss of $21 million.

Nevertheless, he continued to buy the leading altcoin. On May 11, the same wallet address again withdrew $4.2 million worth of Ethereum from the Gate.io crypto exchange.

In total, the whale has collected 50,165 ETH, with a total value of $104.5 million, and an average purchase price of $2,084 per ETH.

Ethereum’s recent price rise managed to reverse the position from a loss of $21 million to a profit of $21.7 million for the big investor.

Has Ethereum Entered the Bullish Zone?

Ethereum has risen 41% in the last seven days and surged 64% in the last 30 days. The largest altcoin almost touched the $2,600 mark on May 11 and has been moving steadily in the range of $2,450 to $2,550.

Read also: Massive Token Unlocks This Week – Here Are 5 Moves That Could Shake the Crypto Market!

The asset is showing bullish momentum again as the crypto market in general enters the “greed” zone. As of May 12, ETH was trading at $2,615 with a market capitalization of $316 billion.

However, based on data from TradingView, Ethereum’sRelative Strength Index ( RSI) has actually shown a decline since May 9-falling from 90 to 55-despite the price continuing to rise.

This indicator shows that ETH has moved from an “overbought” state to a neutral zone despite printing the highest price in the last three months. Historically, this condition-RSI declines while prices rise-signals a mature market with a steady upward trend.

Ethereum’s next big target is to break the $3,000 level. Consistent accumulation of ETH by whales and support from positive macroeconomic conditions could push not only Ethereum, but also the entire crypto market to set new records.

That’s the latest information about crypto. Follow us on Google News to stay up-to-date on the world of crypto and blockchain technology.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Get a web trading experience with advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Coinspeaker. Ethereum Rally: Whale Flip $21M Loss into Massive Profit. Accessed on May 13, 2025