Will Ripple (XRP) Explode Past $3 This Week? Bullish Chart Pattern and Whale Moves Say Yes!

Jakarta, Pintu News – The price of Ripple seems poised to experience a parabolic surge towards $3 this week, driven by a large bullish pattern that has whales opening long positions on the altcoin.

These positive signs come after XRP experienced a significant surge of 10% in one week, which led it to reach a monthly high of $2.47.

Currently (13/5/25), Ripple is trading at $2.48 with a daily gain of 3.59%, along with the weakness of Bitcoin and most other altcoins after the trade talks between the US and China.

Even so, there are two key metrics that suggest XRP may outperform the rest of the crypto market in the next seven days.

XRP price aims for $3 this week as bullish pattern emerges

The price of XRP has the potential to rise 36% from its current position, which could push it beyond the $3 mark towards its previous high. This potential surge is reflected in the inverse head and shoulders pattern, which usually indicates a trend change from a decline to an increase.

Read also: Crypto Analyst Sounds the Alarm: Altcoin Season Has Begun — Daily 40% Gains Could Be the New Normal!

At the time of writing, XRP has managed to break the resistance level at the neckline of the bullish pattern. This suggests that XRP may be ready to continue its rise above $3 to reach $3.04.

If this target is reached and the uptrend continues, the previous all-time high of $3.40 could be the next target.

Ripple’s RSI is currently at 61, signaling that although the price of XRP has reached the resistance limit at $2.40, the bullish momentum is still strong.

Also, the MACD line continues to form new highs since crossing the zero line, which reinforces the signal that the buying pressure from the bulls is intensifying.

This bullish pattern suggests that Ripple’s price might reach the psychological target of $3 before the end of the week, as buying momentum increases. However, this upside potential is contingent on XRP’s ability to hold the support level at $2.23.

If this level fails to sustain, Ripple price could reverse to a bearish trend.

Whale Opens $5 Million Long Ripple Position with 2x Leverage

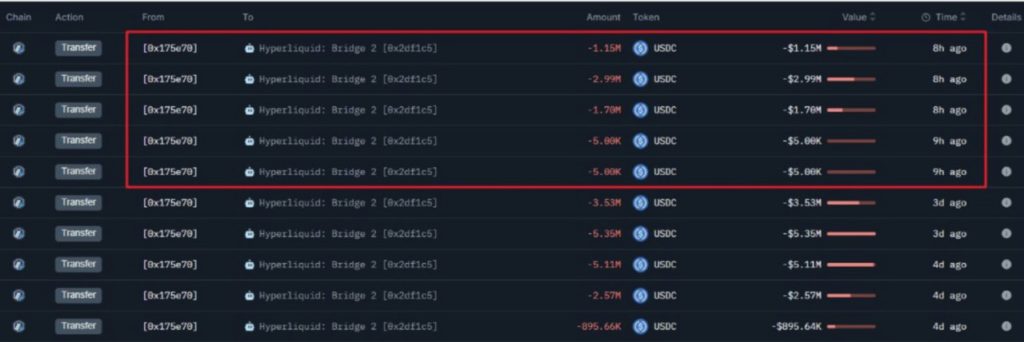

On-chain data reveals that whales are betting XRP prices will continue to rise and potentially print a new high before the end of the week.

One large address recently deposited $5.84 million worth of USDC tokens onto the HyperLiquid platform and opened a long position on XRP with 2x leverage.

Read also: Pepe Coin Explodes in Price — Is This the Start of a Massive Crypto Comeback?

These new positions indicate that the whales believe Ripple still has bullish potential to continue its weekly gains of 10% and possibly break the $3 level in the near future.

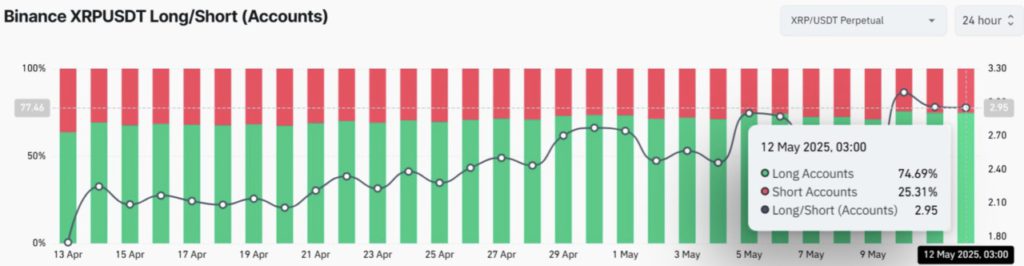

Additionally, data from Coinglass showed that the majority of traders also opened new positions on Ripple, signaling a very bullish market sentiment.

Based on the long/short ratio, about 74% of traders on the Binance exchange are long buyers, which reinforces the belief that the majority of market participants anticipate a continuation of the uptrend.

Considering the inverse head and shoulders pattern seen on the daily chart of XRP price, as well as the significant influx of long positions, there is a high probability that the token will break the $3 level and even approach the all-time high this week.

If this uptrend continues, Ripple could potentially outperform the rest of the crypto market.

That’s the latest information about crypto. Follow us on Google News to stay up-to-date on the world of crypto and blockchain technology.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Coingape. Can XRP Price Reach $3 This Week? Bullish Pattern Emerges as Whale Opens $5M Long Position. Accessed on May 13, 2025