Will Solana (SOL) Trigger a Price Spike? Bullish Opportunity Revealed!

Jakarta, Pintu News – Solana is showing strength near the resistance zone, with overextended short positions and momentum starting to build. With the current favorable market conditions, the opportunity for a short squeeze seems to be growing. Will this be a turning point for Solana (SOL) to reach new heights?

Short Squeeze on the Threshold

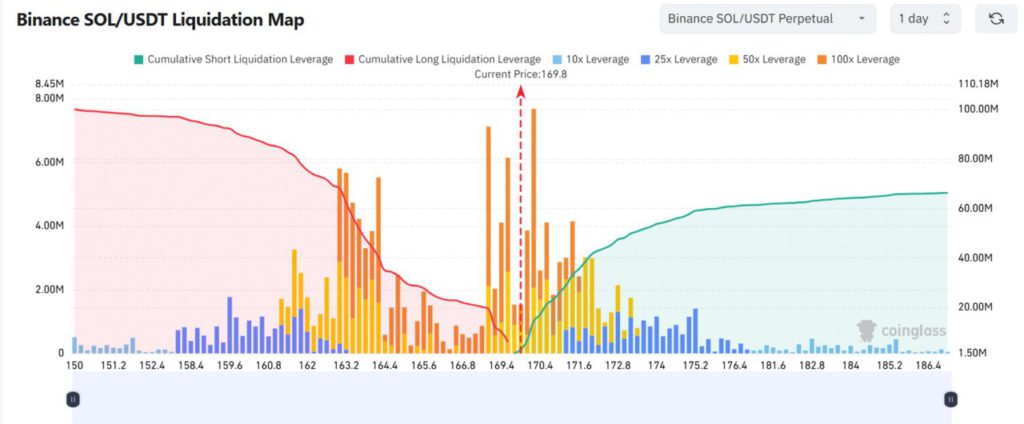

The liquidation heatmap shows that many overleveraged short positions are congregating between $170 and $176. Currently, Solana (SOL) is hovering around $171, and a decisive move past $176 could trigger massive liquidations that push the price higher. On May 18, short liquidations totaled $1.72 million, while long liquidations were almost non-existent.

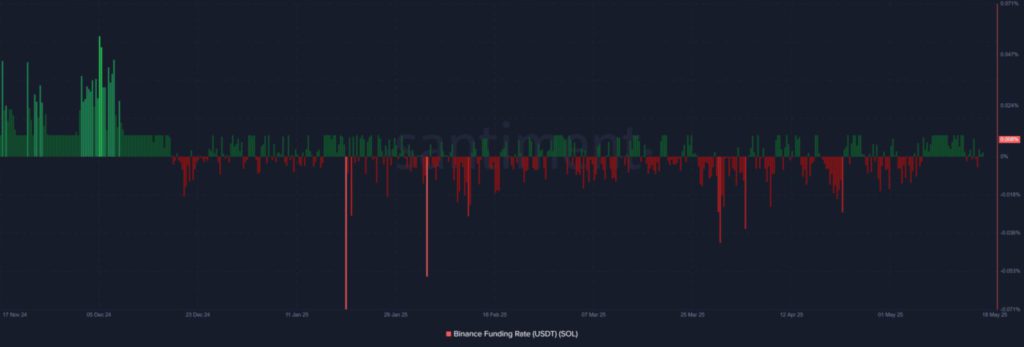

This imbalance suggests a classic scenario where if bulls can trigger upward price volatility, successive short liquidations can accelerate the price rise. The increase in the funding rate on Binance which has now turned positive by 0.008% after being in the negative zone for several weeks shows a change in sentiment.

Although the rate is still low, it signals a decrease in bearish bias and increased trader confidence in Solana’s (SOL) upside potential. Continued positive funding rates could attract more leveraged long positions, strengthening the bullish momentum.

Also Read: Bitcoin Approaches Golden Cross: Bullish Signal Amid US Debt Concerns

Retail Attention and Market Sentiment

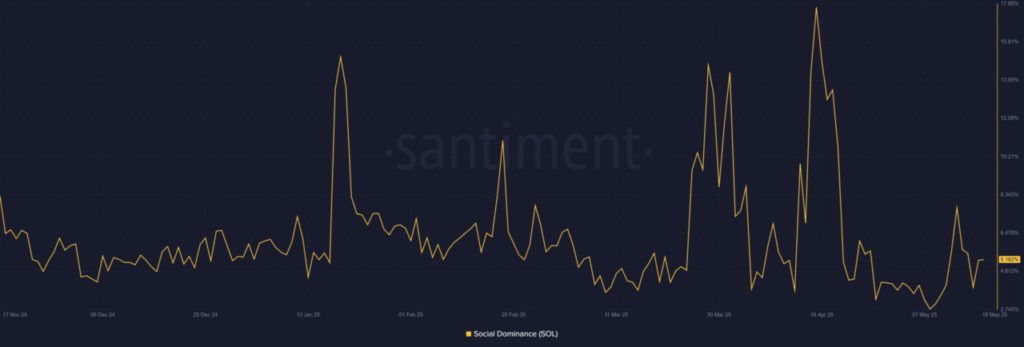

Social Dominance for Solana (SOL) has increased to 5.18%, signaling a return of retail investor interest usually seen in early bullish phases. While still below the spike that occurred in March, this increase shows an increase in community engagement.

If the price manages to break the resistance, the social traction could increase and strengthen the bullish momentum further. Also, on the technical front, Solana (SOL) remains above the 1.618 Fibonacci extension at $163.16, which is a critical support level that has held during the last volatility.

The MACD indicator is showing convergence near the zero line, which signals a possible bullish crossover in the next few days. This pattern strengthens the scenario where Solana (SOL) could reclaim $176 and head towards its next targets at $189.88 and $198.13.

Development Activity Remains Strong

Solana (SOL) is not only driven by price speculation. Development Activity remains strong with a value of 23.38, showing that builder confidence has not wavered. Although activity is slightly down from the previous peak, it continues to show confidence from builders and maintains the fundamentals of the network.

Consistent development helps strengthen long-term investor confidence and can support price rallies built on more than just speculation.

Conclusion

With liquidation pressure, rising social interest, technical strengthening and steady development activity, all metrics point to a potential breakout for Solana (SOL) as it tests a historically significant resistance range. If the bulls can break the $176-$188 zone, Solana (SOL) could begin a sustained push towards higher extension targets.

Also Read: XRP Strengthens After V-Shaped Recovery, Next Price Target IDR56,000?

That’s the latest information about crypto. Follow us on Google News for the latest crypto and blockchain technology updates. Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- AMB Crypto. Solana shorts pile up above $170, can SOL bulls force a squeeze?. Accessed on May 19, 2025

- Featured Image: Crypto Rank