Is Pi Network About to Crash? 4 Shocking Reasons It Could Drop 45%!

Jakarta, Pintu News – Pi Network’s recent price decline is losing its strength, but technically and fundamentally, there are indications that the price will fall again and may reach a low point like in April.

Technically, the current pattern shows a bearish pennant formation (falling flag pattern).

On the fundamental side, there are concerns that it is a ghost chain, and its centralized nature makes it unlikely that major exchanges will list it in the near future.

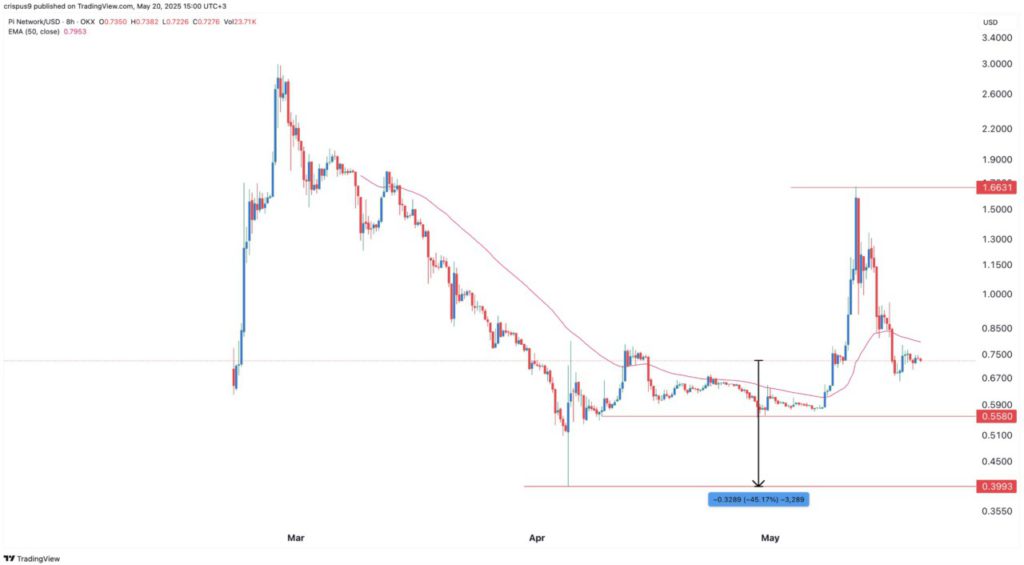

Technical Analysis of Pi Network Price: Bearish Pennant Pattern Formed

As reported by Coingape (20/5), an eight-hour chart shows that Pi Network’s price has been on a decline since May 12, having previously spiked to $1.6631 ahead of news regarding its ecosystem. Currently, Pi Coin has fallen below its 50-period moving average.

Read also: Pi Coin Shows Bullish Signs? 14 Million Tokens Moved to Wallet!

Most importantly, the ongoing consolidation phase is part of the bearish pennant pattern formation. This pattern consists of a vertical line resembling a flagpole and a narrowing triangle pattern.

In case of a downward breakout, the price is expected to drop towards the important support level of $0.5580 – which was the low point on April 9 and 30.

If this level is broken, the price could drop even deeper to the April low of $0.40, which would mean a drop of about 45% from the current price.

However, this negative projection will be canceled if Pi Coin manages to break the psychological level above $1.

Pi Coin’s Listing on Major Exchanges Still in doubt

Pi Network’s price also has the potential to continue to decline because the possibility of being listed on major exchanges such as Binance and Upbit is still very small, unless the developer makes major changes.

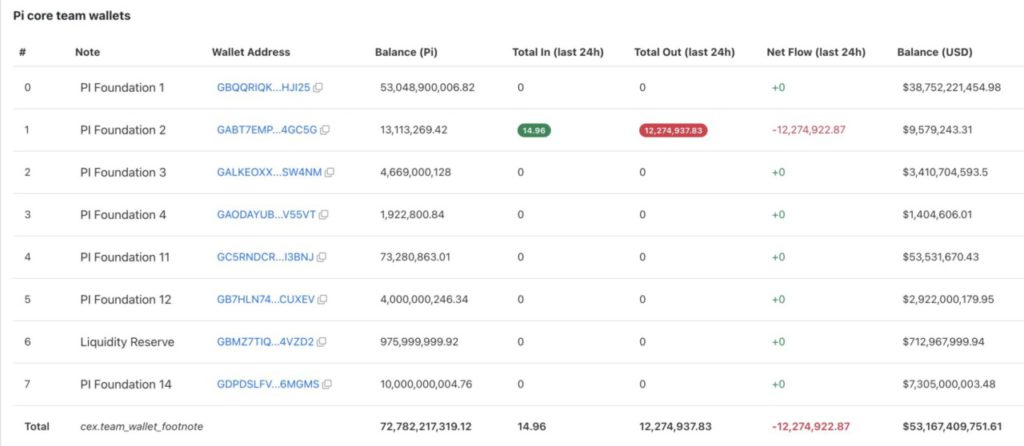

This view is based on the fact that Pi Network is a highly centralized crypto project. The less-than-transparent Pi Foundation holds the bulk of the control, with at least 72.7 billion tokens – worth more than $53 billion – spread across seven major wallets.

In addition, the foundation also holds tokens in thousands of other wallets. This situation poses a great risk to holders, given that these wallets are not publicly audited. Pi Coin’s price could also plummet if the foundation suddenly sells a large amount of its tokens, or in the event of a hack.

With this high level of centralization, most exchanges are likely to be reluctant to list Pi Coin.

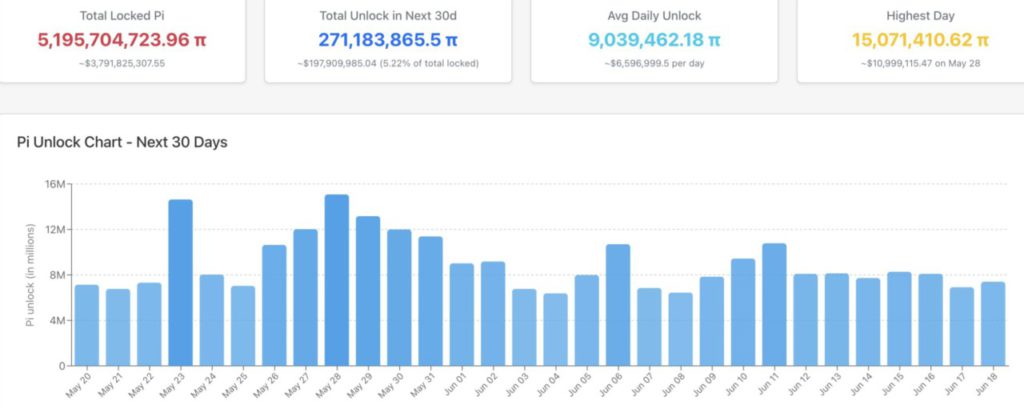

Pi Network Token Opening: Additional Threat to Price

In addition to the previous factors, the price of Pi Coin also has the potential to be depressed due to the ongoing token unlock process.

Read also: Pi Network Team Opens Job Vacancies Amid Fraud Issues & Plummeting Pi Token Prices

Based on the latest data, the network will unlock 271.18 million tokens in the next 30 days, or an average of more than 9 million tokens per day. Over the next 12 months, the number of tokens to be unlocked will reach 1.49 billion.

With Pi’s total maximum supply reaching 100 billion tokens and the current circulating supply of around 7.9 billion, there will be an increased supply of over 92 billion tokens in the future.

This increase in supply is a big risk, especially if there is no real demand to buy the tokens in the market.

Pi Network Referred to as Ghost Chain

Pi Network is also starting to be categorized as a ghost chain, which is a blockchain network that lacks development activity and has no real applications used by users.

Although the Pi mainnet was launched with around 100 apps, the majority of these apps did not show significant progress and failed to attract market attention.

In addition, although Pi Network Ventures has allocated $100 million to support the development of new projects, it is too early to judge whether these projects will be successful.

Without active and used applications, it is likely that the Pi token will lose its function as a tool that has real utility within its ecosystem.

That’s the latest information about crypto. Follow us on Google News to stay up-to-date on the world of crypto and blockchain technology.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Get a web trading experience with advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Coingape. Top 4 Reasons Pi Network Price Could Crash 45% Soon. Accessed on May 21, 2025