XRP: Three Catalysts that Will Turn Ripple into a Global Crypto Powerhouse

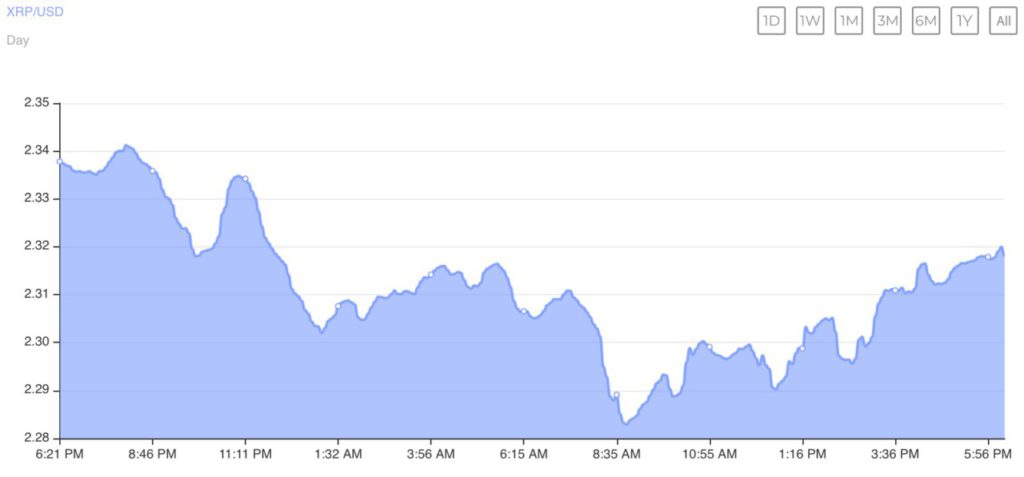

Jakarta, Pintu News – In the last analysis, Ripple showed remarkable resilience by holding above the $2.3 level and registering gains in most major trading sessions. Although investors currently appear hesitant with the Relative Strength Index (RSI) in neutral territory at 50, analysts predict that XRP could experience a significant surge and cement its position as a major player in the crypto market with a historic market capitalization.

XRP ETF Approval

Currently, there are nearly 18 XRP spot exchange-traded funds (ETFs) awaiting a decision from the US Securities and Exchange Commission (SEC). Prediction platform Polymarket suggests that there is a 79% chance that the SEC will approve an XRP ETF this year. The corresponding ETFs from Grayscale, 21Shares, Bitwise, and Canary are scheduled to receive decisions on October 18, October 19, October 20, and October 24 respectively.

This possible approval could provide a huge boost to XRP as ETFs allow institutional and retail investors to invest in crypto in a more organized and secure way. The approval will also increase XRP’s liquidity and exposure in the global market, opening up new opportunities for investors.

Also Read: Crazy Transaction! 11.75 Trillion PEPE Changed Hands in 24 Hours, What Happened?

Establishment of RLUSD

Ripple’s new stablecoin, RLUSD, has officially gained ground after the US government passed the GENIUS Act legalizing its use. With RLUSD, Ripple (XRP) can potentially strengthen its position as a leader in cross-border payments.

The use of RLUSD can facilitate more stable and reliable transactions, reducing the volatility often associated with other cryptos. It also marks an important step in Ripple’s efforts to expand its use in the mainstream financial sector, providing a stronger foundation for long-term growth.

Shaking Up SWIFT’s Dominance

Ripple (XRP) is reportedly challenging SWIFT’s dominance with its instant settlement system and lower fees. Banks adopting Ripple are said to be able to save up to 60% of “total processing fees for a $500 payment”.

These cost savings are significant, especially in an industry where profit margins are often thin. By reducing the cost and time required for cross-border transactions, XRP offers a very attractive solution for banks and other financial institutions.

Conclusion

With these three factors, XRP is expected to achieve a price surge of up to $27 and a market capitalization that could potentially reach at least $1 trillion during a bull market. This marks a new era for Ripple as a dominant force in the crypto world, changing not only market dynamics but also the way financial institutions conduct transactions.

Also Read: Monero (XMR) Surprises Market with Spectacular Rise in May 2025, How Come?

That’s the latest information about crypto. Follow us on Google News for the latest crypto and blockchain technology updates. Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- Crypto News Flash. Ripple News: 3 Critical Events That May Make XRP a Global Crypto Powerhouse. Accessed on May 27, 2025

- Featured Image: Bitcoin News