Ethereum Supply on Exchange Lowest Since 2017, Ready to Explode to €44 Million?

Jakarta, Pintu News – Ethereum is currently in a crucial consolidation phase, having recorded an impressive rally since early April 2025. From a low of around $1,600 (IDR 26 million), the ETH price surged more than 100% to around $2,700 (IDR 44 million). However, macroeconomic uncertainty and technical resistance are holding ETH back from breaking higher in the short term.

Supply on the Exchange Shrinks Sharply: Strong Signal of Investor Confidence

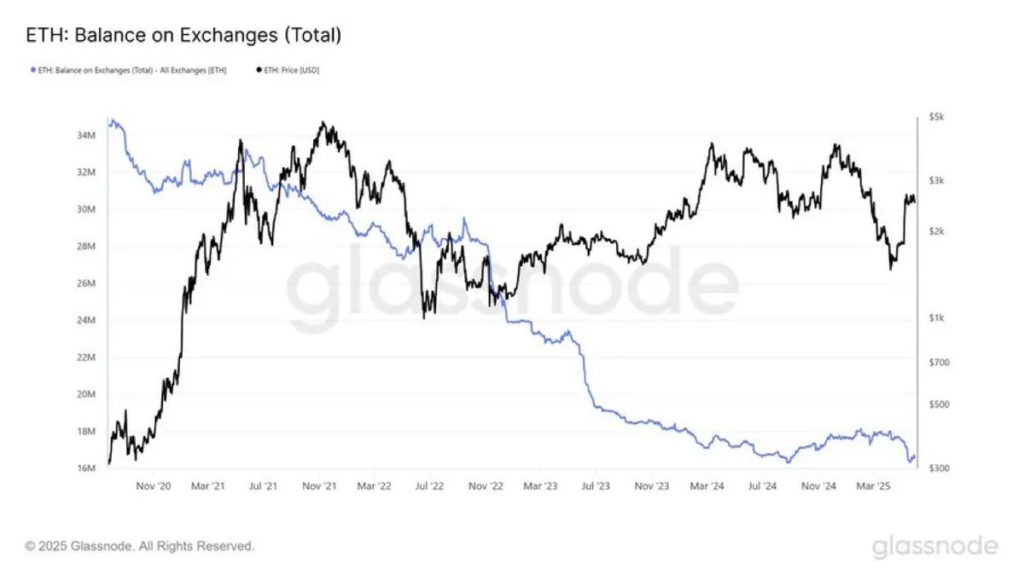

Data from blockchain analytics platform Glassnode shows that Ethereum supply on centralized exchanges is now at a seven-year low. This decline typically signals that investors are moving their assets to self-custody, as a form of long-term confidence in the price’s upside potential.

The drop in supply on exchanges also indicates weakening selling pressure. This is important in the context of a crypto market that is highly sensitive to the balance of supply and demand. When there is less ETH on exchanges, the potential for a “supply shock” increases – which could trigger a price spike if demand suddenly picks up again.

Also Read: Pi Network (PI) Token is Ready to Flood! What Happens If the Price Falls Below IDR6,500?

ETH Stays in Critical Consolidation Zone, Breakout Awaits Confirmation

Ethereum price is currently consolidating around $2,484. Despite trying to break through the $2,700 resistance (IDR 44 million), the price has gradually corrected again. This decline is characterized by the formation of a pattern of lower highs, indicating weakening momentum in the short term.

However, the sell-off was moderate. Trading volume is also declining, signaling that the bearish pressure is not entirely convincing. If ETH is able to maintain the support area above $2,450 (IDR39.9 million) and break back through the $2,550-$2,700 level (IDR41.6 million-IDR44 million), then the chances of a breakout are very high.

Technical Analysis and Market Sentiment

Technically, ETH is now below the 34-day Exponential Moving Average (EMA), but is still holding above the 100-day Simple Moving Average (SMA) at $2,559. This suggests that the price structure hasn’t really changed in a bearish direction. If this SMA level can be maintained, ETH could soon bounce and form a new wave of gains.

Market sentiment remains generally positive, especially with the declining supply trend in the exchanges. Analysts such as Quinten Francois state that this could be the trigger for a major rally, as has happened in previous bull cycles.

Conclusion

The decrease in the supply of Ethereum on exchanges is an important signal for crypto market participants. The combination of bullish on-chain indicators and steady price consolidation opens up strong breakout opportunities in the near future. However, traders still need to pay attention to technical levels and volume before making an entry decision.

Also Read: XRP is in Freefall! Is This a Sign of a Big Storm in the Crypto World?

That’s the latest information about crypto. Follow us on Google News for the latest crypto and blockchain technology updates. Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- NewsBTC. Ethereum Supply On Exchanges Hits 7-Year Low – Breakout Loading?. Accessed June 3, 2025.

- Featured Image: Generated by AI