New Breakthrough in the Crypto World: Bitcoin ETF by Trump Media & Technology Group

Jakarta, Pintu News – Trump Media & Technology Group’s (TMTG) recent announcement of the launch of a Bitcoin ETF marks a major step in the integration of cryptocurrencies with mainstream financial markets.

By filing a 19b-4 application with NYSE Arca, TMTG begins the formal review process by the U.S. Securities and Exchange Commission (SEC), which can take up to 240 days. This move shows regulators’ increased confidence in cryptocurrencies.

Bitcoin ETF Process and Potential

The filing by TMTG through NYSE Arca for the “Truth Social Bitcoin ETF” is a strategic move to make it easier for retail investors to gain exposure to Bitcoin (BTC) without having to buy and hold it directly. The review process by the SEC will involve a public comment period and possible adjustments before a final decision is rendered.

Last year, the SEC has approved 11 spot Bitcoin (BTC) ETFs, indicating a more supportive change in attitude towards cryptocurrencies. This ETF will be sponsored by Yorkville America Digital, which partnered with Truth Social to launch the fund. Foris DAX Trust Company will act as the Bitcoin (BTC) depository backing the ETF. The move is part of TMTG’s broader strategy to integrate crypto into their financial offerings.

Also Read: Shocking Prediction of Long-Term Analysis by Javon Marks: XRP Price Could Hit $21?

TMTG Investment Product Expansion and Diversification

TMTG is not stopping at just one product. In April, they collaborated with Crypto.com to build the infrastructure and custodial framework needed to launch a crypto ETF. They have also filed trademarks for a series of investment products under the “Truth.Fi” brand, including the “Truth.Fi Bitcoin Plus ETF”. This shows that TMTG is serious about expanding their portfolio of investment products in the cryptocurrency sector.

In addition, TMTG recently revealed plans to raise around $3 billion to create a Bitcoin (BTC) treasury reserve. The plan includes raising $2 billion through share sales and $1 billion through a convertible bond offering. This strategy is similar to what major tech companies have done in recent years by moving a portion of their treasury reserves to Bitcoin (BTC) as a long-term hedge.

Corporate Adoption of Bitcoin and its Impacts

Currently, 61 corporate treasuries hold about 3.2% of all the Bitcoin (BTC) that will ever exist, with exchange-listed companies holding a total of 673,897 BTC. Companies like GameStop and Japan’s Metaplanet have been quietly piling up BTC, and MicroStrategy, which has long been bullish on crypto, recently added 7,390 BTC, pushing its total to 576,230 BTC.

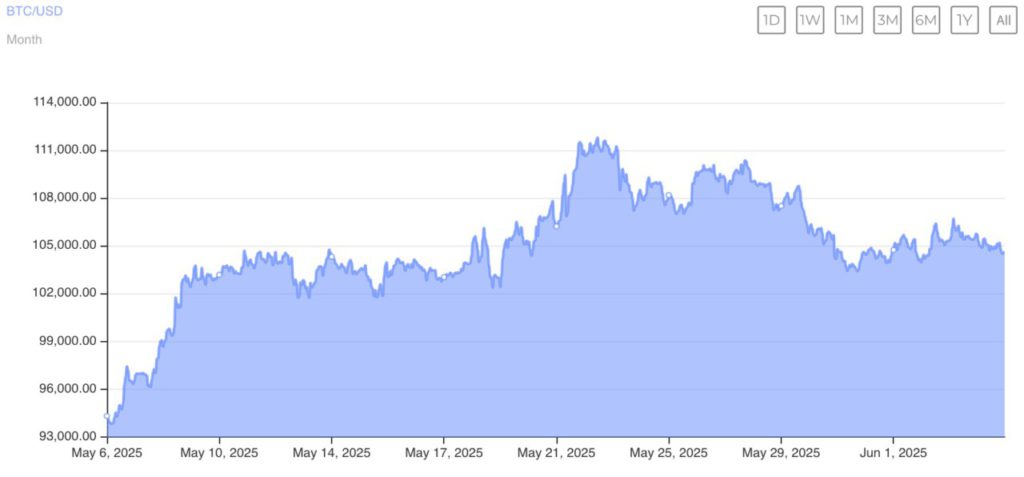

All of this happened during a bullish wave in the Bitcoin (BTC) market. The current price of BTC hovers around $104,671, up nearly 50% over the past year, despite a 3.4% decline in the last week. Trading activity is booming, Bitcoin derivatives rose 0.83% to $71.39 billion, and Bitcoin options trading volume jumped 22.33% to $3.41 billion.

Conclusion

The presence of crypto-focused investment products, especially those tied to big names, can help legitimize this space and bring more stability to the market. With the new measures taken by TMTG and the changing attitude of regulators, the future of cryptocurrencies looks increasingly integrated with the global financial system.

Also Read: Is Dogecoin (DOGE) Due for a Decline? Descending Triangle Pattern Indicates This

That’s the latest information about crypto. Follow us on Google News for the latest crypto and blockchain technology updates. Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- Crypto News Flash. Donald Trump Company Files for Spot Bitcoin ETF – Here’s What It Means for Crypto. Accessed on June 5, 2025

- Featured Image: Bitcoin News