Solana’s Trading Volume Surges 113% Today! What does ETF Approval Mean for SOL Prices?

Jakarta, Pintu News – The price of Solana has experienced a significant spike in recent days, with trading volumes surging by 113%. This rise was largely triggered by high optimism regarding the approval of an Exchange-Traded Fund (ETF) involving Solana.

With more companies applying for Solana ETFs and the huge potential in the crypto space, this move could be a strong signal for higher Solana price movements. This article will look at why SOL trading volume has surged and what could happen next.

What’s Driving Solana’s Surge in Trading Volume?

Solana is one of the most widely used blockchains, serving as a platform for various DeFi projects and meme coins. In June 2025, Solana processed 45.77 million transactions, even more than Ethereum , indicating its growing adoption rate. This increase boosted the price and trading volume of SOL tokens.

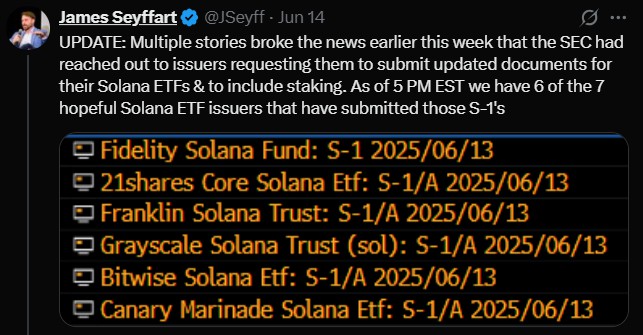

However, the main cause of the surge in trading volume is speculation surrounding the Solana ETF filing. Recently, ETF issuers updated their filings in accordance with requests from the US Securities and Exchange Commission (SEC), which has fueled expectations that the Solana ETF will be approved soon. This increased optimism attracted more investor attention, pushing Solana’s trading volume to $4.53 billion in the last 24 hours. This is a positive signal for the market, although Solana prices still face volatility challenges.

Read More: Company’s Bitcoin Accumulation Strategy Threatened, Stock Falls!

Solana ETF: Opportunity or Challenge for SOL Prices?

It is important to note that the Solana ETF is a big step for the Solana ecosystem. If approved, this ETF will allow more investors to gain exposure to Solana through a more structured and secure way. Companies such as Invesco and Galaxy Digital have listed the Invesco Galaxy Solana Trust, hoping to launch the ETF in the US. As more companies sign up for Solana ETFs, the demand for these tokens is expected to increase.

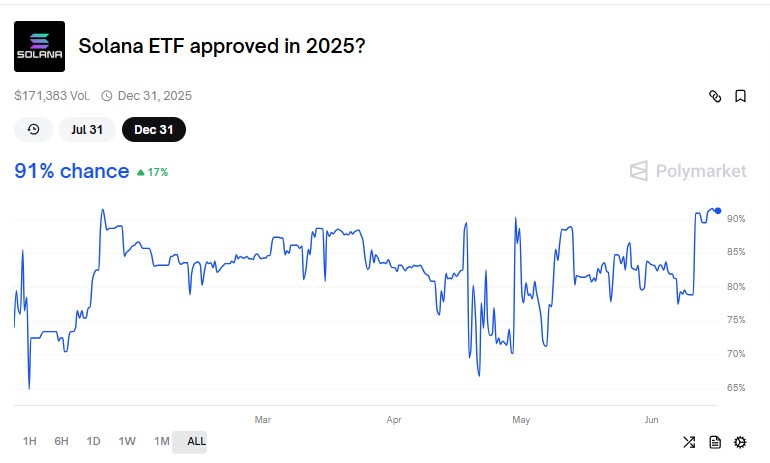

However, while the chances of ETF approval are growing, the process is still uncertain. The SEC has yet to make a final decision, and competition with other projects such as XRP and Dogecoin in terms of ETF approval could affect the possible success of the Solana ETF. Therefore, despite the high optimism, investors should be aware that there is still uncertainty surrounding Solana’s future in the crypto market.

Solana ETF’s Impact on Market Price and Sentiment

Although the price of Solana (SOL) has been on the rise, with the price currently trading at around US$157.27 (approx. IDR2,558,000), this movement does not fully reflect its long-term potential. Today’s 7.7% price increase shows the positive sentiment towards Solana, but the market is still full of uncertainty. If the Solana ETF is actually approved, the price could continue its bullish momentum, but this is highly dependent on the SEC’s decision.

Nonetheless, Solana has shown remarkable resilience amid regulatory uncertainty, and an ETF could be an important catalyst to increase adoption and prices. With trading volumes continuing to rise, Solana will probably continue to attract the attention of large and institutional investors.

Conclusion

Optimism regarding Solana’s ETF approval has pushed SOL trading volumes to the highest levels, but challenges related to regulatory uncertainty and competition with other crypto projects remain. Although the current SOL price is showing gains, the future of the price will largely depend on the SEC’s decision and further adoption by institutional investors. For investors interested in Solana, it is important to keep an eye on the latest developments regarding ETFs and market regulation.

Also Read: Metaplanet Reaches 10,000 BTC Target: What Does It Mean for the Future of Cryptocurrency?

That’s the latest information about crypto. Follow us on Google News for the latest crypto and blockchain technology updates. Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- CoinGape. Why Solana Trading Volume Skyrocketed 113% Today: ETF Approval Confirmed?. Accessed June 17, 2025.

- Featured Image: DL News