Ethereum Open Interest Reaches Record High, Signaling Institutional Confidence!

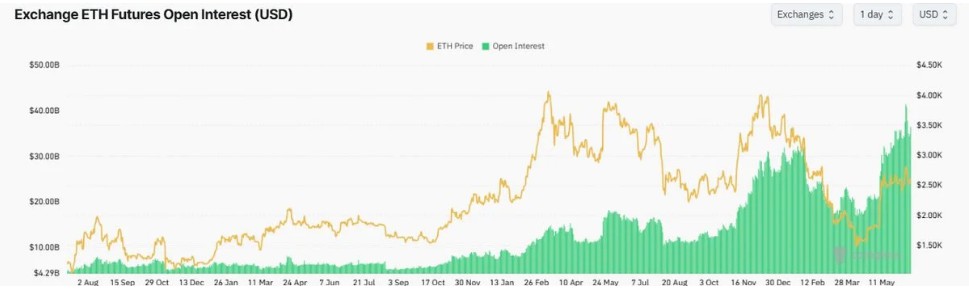

Jakarta, Pintu News – Ethereum was back in the spotlight on June 16 when open interest for futures contracts hit an annual peak of $36.56 billion. Ethereum (ETH) price managed to surge past $2,600, approaching a key resistance level that has held for several months. Traders started entering new positions, indicating the potential for a big move in the near future.

Futures Open Interest Reaches Annual Peak

Data from CoinGlass shows a sharp spike in open interest for Ethereum (ETH) futures contracts, reaching $36.56 billion on Monday. This figure is the highest since last year, signaling that many traders are using borrowed funds to speculate on the next direction of the Ethereum (ETH) price.

This surge not only shows high interest, but also increases liquidity in the market, which can affect price volatility. With more and more funds involved, any price movement, however small, can trigger forced liquidation, which in turn increases market volatility.

Also Read: Bitcoin (BTC) Hits a New Low, What’s the Impact on the Market? (6/18/25)

Price Test at Multi-Year Resistance

In one session, Ethereum (ETH) rose by about 4.5%. Based on technical analysis, the rise brought Ethereum (ETH) close to a descending trend line that investors have been watching for more than a year. This line is just above the 50-week moving average, while the 200-week moving average is just below it.

If Ethereum (ETH) can break and hold above this level, there might be more room for price increases. However, the low trading volume may indicate that the bulls need more support before they can take full control of the market.

ETF Flows Show Steady Support

The US spot foundation linked to Ethereum (ETH) saw a small outflow of $2.18 million on the same day, marking the first net withdrawal in 19 days. However, weekly inflows still totaled $528.12 million, pushing total assets under management in this ETF over $10 billion.

The expansion of institutional support for Ethereum (ETH) continues to grow. Large asset managers such as BlackRock and Fidelity are starting to issue tokenized treasury products and stablecoin-backed funds directly tied to Ethereum (ETH).

Conclusion

With increasing open interest and strong institutional support, Ethereum (ETH) is on the verge of a potential significant price move. While there are some factors to be wary of, such as low trading volumes, current market dynamics suggest that Ethereum (ETH) may be ready for its next big move.

Also Read: Global Tensions Heat Up, Crypto Takes a Hit: What Really Happened? (6/18/25)

That’s the latest information about crypto. Follow us on Google News for the latest crypto and blockchain technology updates. Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- NewsBTC. Record High Ethereum Open Interest Signals Institutional Confidence. Accessed on June 18, 2025

- Featured Image: Decrypt