Crypto Fear & Greed Index Turns Cautious — Calm Before the Crypto Storm?

Jakarta, Pintu News – The crypto market on June 18, 2025 is grappling with a wave of uncertainty.

The overall market capitalization briefly fell by 1.83% to $3.28 trillion, while trading volume plummeted by 7.63% to $123.25 billion.

Crypto Fear & Greed Index At 48

According to Coinpedia, crypto market movements show that investor confidence seems to be shaken. Furthermore, the Crypto Fear & Greed Index on June 18 stood at 48, indicating a “Neutral” sentiment – signaling that investors are still wavering between being cautious or remaining confident.

Read also: Bitcoin (BTC) Headed to $150,000? Analysts Predict BTC Surge to Be Linked to Global Liquidity!

This change in sentiment was influenced by various macroeconomic and geopolitical factors. Trump’s threat of new tariffs, rising tensions in the Israeli-Iranian conflict, as well as renewed debate over a stablecoin regulation bill in the US added pressure to an already fragile market.

In terms of market dominance, Bitcoin now holds 64%, while Ethereum holds 9.3%. Meanwhile, the Altcoin Season Index only registered 23 out of 100, confirming that altcoins are still far from dominating the market direction.

Liquidation Surges as Leverage Traders are Under Pressure

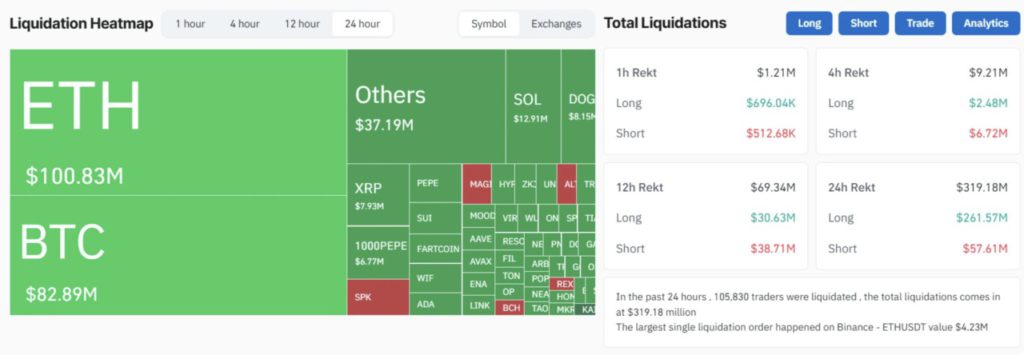

According to data from CoinGlass, in the last 24 hours (18/6), more than 105,830 traders were liquidated, with a total of $319.18 million worth of positions wiped out.

ETH traders were the most affected, with liquidations totaling $100.83 million, followed by BTC at $82.89 million. This indicates a major shift in trader sentiment, possibly triggered by surprising market movements and increased volatility.

The largest individual liquidation was recorded for the ETH/USDT pair on Binance, with a value of $4.23 million.

These figures highlight the high risk of using large leverage in volatile market conditions, and point to a growing mismatch between traders’ expectations and the actual direction of the market.

Fear & Greed Index Reflects Market Uncertainty

The Fear & Greed Index has fallen from the “Greed” zone earlier this month, and is now at a neutral score of 48. This decline is in line with the Bitcoin price which has corrected from a high above $111,000 to a low near $105,000 in the last two weeks.

Read also: Ethereum Staking Hits a Record! More than 35 Million ETH Locked, What’s the Impact?

The index briefly dipped below the neutral threshold around June 5, coinciding with Bitcoin’s sharpest price drop, and again showed indecision in the June 13-15 period, reflecting investors’ reluctance to make clear decisions.

Despite relatively stable BTC trading volumes, market sentiment remains stuck in the neutral zone. This change in sentiment, coupled with increasing liquidation pressure, illustrates a market situation that is still waiting for a strong trigger to move more decisively in a certain direction.

That’s the latest information about crypto. Follow us on Google News to stay up-to-date on the world of crypto and blockchain technology.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Get a web trading experience with advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Coinpedia. Crypto Fear & Greed Index: Neutral But Nervous? Accessed on June 19, 2025