Bitcoin Holds Strong at $104K — Is a Skyrocketing Surge to $466K Coming Soon?

Jakarta, Pintu News – Bitcoin has remained above the $100,000 level despite recent market turmoil.

In the long term, the outlook for Bitcoin shows the potential for a major rally. If historical patterns repeat themselves, the price of this asset could rise up to four times its current position.

Before discussing further, let’s explore the current Bitcoin price movement first!

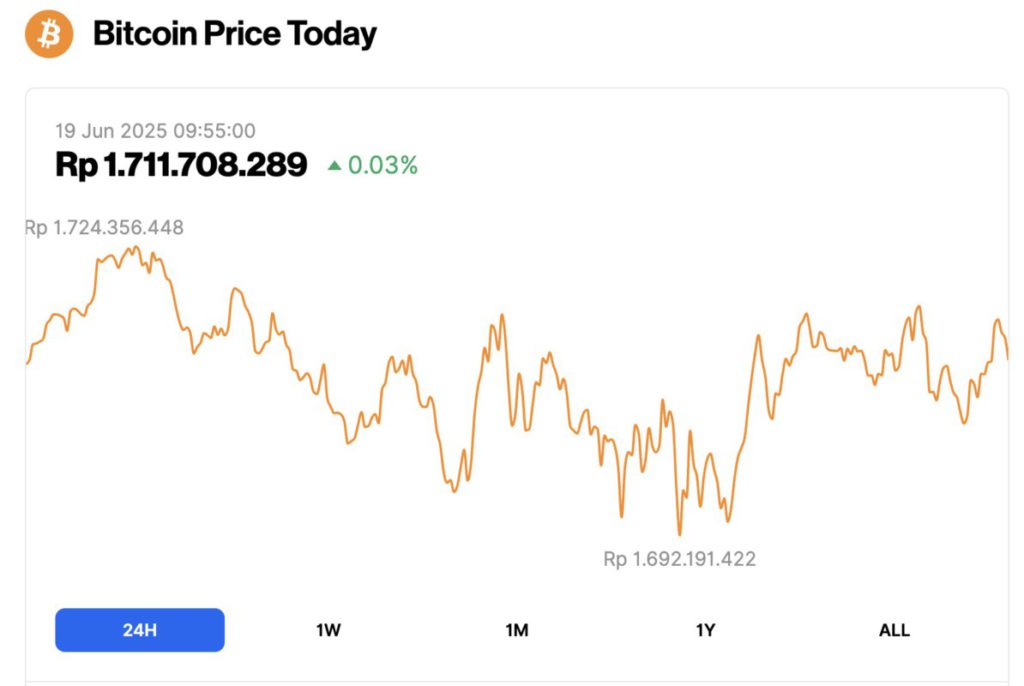

Bitcoin Price Up 0.03% in 24 Hours

As of June 19, 2025, Bitcoin was trading at $104,737, or approximately IDR 1.71 billion. The price saw a modest uptick of 0.03% over the past 24 hours. During the same period, BTC dipped to a low of IDR 1.69 billion and climbed as high as IDR 1.72 billion.

According to CoinMarketCap, Bitcoin’s market capitalization now stands at around $2.08 trillion, with trading volume in the last 24 hours falling 11% to $47.6 billion.

Read also: Bitcoin (BTC) Headed to $150,000? Analysts Predict BTC Surge to Be Linked to Global Liquidity!

Annual Trend Indicates a New Record for Bitcoin

CryptoQuant’s analysis of Bitcoin’s Yearly Percentage Trend shows that 2025 could potentially be a bullish year for the asset.

The chart, which dates back to 2011, illustrates that Bitcoin follows a recurring three-year cycle pattern: a rally phase is followed by a correction period – which is very much in line with the four-year halving cycle.

Based on this analysis, 2025 is the third year of the current cycle, and Bitcoin is expected to experience a 120% increase, with a potential price of $205,097 by the end of this phase.

This indicator works by highlighting the long-term price movements as well as the overall performance of Bitcoin to project market conditions.

However, independent analysis from the AMBCrypto page of historical price trends shows that even larger movements than this are still possible.

Halving Forecasts a Much Higher Rally

Bitcoin’s performance after the halving event in May 2020 has been used as a reference to predict market direction in the current cycle.

Interestingly, since the 2020 halving, Bitcoin price has recorded a total increase of 750% in four years, with a peak of $69,000.

If this trend continues, a similar rally of 750% could happen again. Price projections show that Bitcoin has the potential to go up to $466,257.

This analysis was done using a 9 timeframe chart and utilizing the Relative Strength Index (RSI) indicator to depict a potential rally pattern.

Read also: Ethereum Holds $2,500 as Whales Keep Buying — Is a Massive ETH Breakout Coming?

The study found that the post-halving 2020 rally only really started after Bitcoin’s RSI entered the overbought zone and continued to rise.

Overbought zones indicate that an asset may have been overbought and is at risk of a price correction. However, after this phase, prices usually settle at levels higher than where the rally started.

At the time of this report, Bitcoin’s RSI is still below the 70 level, which means it has not yet entered the overbought zone. If the RSI breaks that mark, it could trigger a strong rally that pushes Bitcoin’s price far beyond its current range.

Another Important Factor in Bitcoin’s Long-term Performance: Spot ETF Liquidity Flows

One of the key factors affecting Bitcoin’s long-term performance is the inflow and outflow of liquidity from Bitcoin Spot Exchange-Traded Funds (ETFs).

To date, the total value of assets managed by these ETFs stands at $131.16 billion.

If this number continues to rise, it shows that institutional and traditional investors are increasingly allocating funds into Bitcoin. This trend will strengthen the asset’s price performance in the market.

That’s the latest information about crypto. Follow us on Google News to stay up-to-date on the world of crypto and blockchain technology.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Get a web trading experience with advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- AMB Crypto. Bitcoin’s long-term price target – $466K after next halving? Accessed on June 19, 2025