Ethereum (ETH): Potential Recovery After a Sharp Drop, Can it Last?

Jakarta, Pintu News – Ethereum is showing interesting investment opportunities, but it still looks weak when compared to Bitcoin . Recent analysis shows several indicators that could determine whether Ethereum (ETH) will experience a significant increase or not in the near future.

Ethereum (ETH) Recovery Key Indicators

Observation of Ethereum (ETH) shows that one of the early signals of a potential breakout is its ability to cross the 50-period Moving Average on the weekly chart. In previous instances, such as in November 2024 and October 2023, Ethereum (ETH) experienced significant rallies after successfully breaching this moving average.

Currently, Ethereum (ETH) price is still struggling below its 50-week Moving Average, suggesting that there is still resistance to overcome. A weekly session close above this average could be an early confirmation that Ethereum (ETH) is ready to enter a bullish trend. This would be an important signal for investors looking for confirmation before entering the market.

Also Read: Bitcoin Survives Global Uncertainty, Will it Continue to Rise?

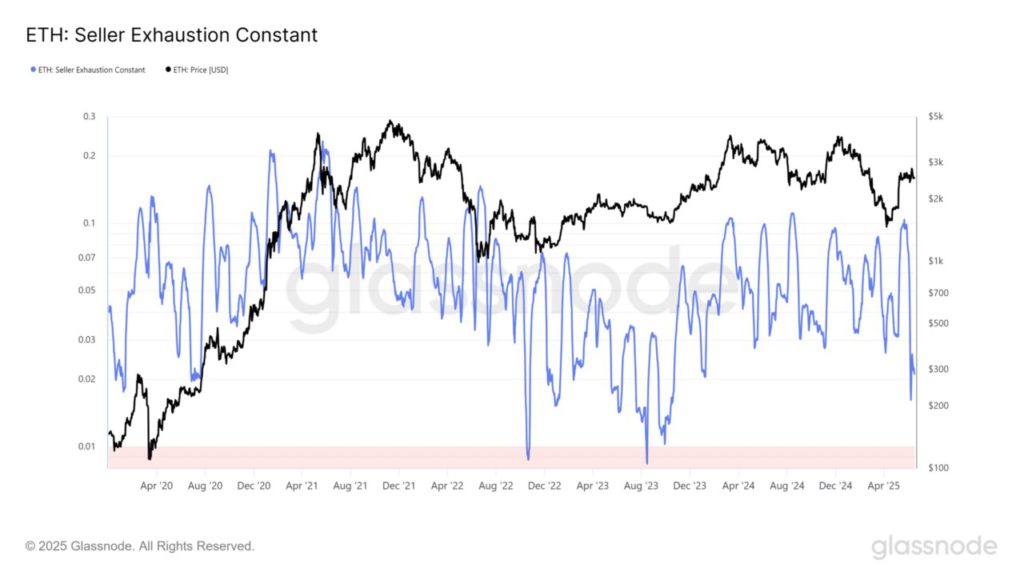

Constant Analysis of Seller Fatigue

The seller fatigue constant, which is the result of the percentage of supply in profit multiplied by the 30-day price volatility, indicates a potential low point of risk when both of these metrics are low. Currently, this constant has dropped to its lowest level since late 2024, similar to what it was in January 2024.

This indicates that Ethereum (ETH) may have reached a very likely bottom for a rebound, despite currently trading above $2,400 in a stable range. This suggests that sellers may have been exhausted, and there isn’t much selling pressure left to push the price lower. This could be an important indicator for investors looking for lower-risk entry points.

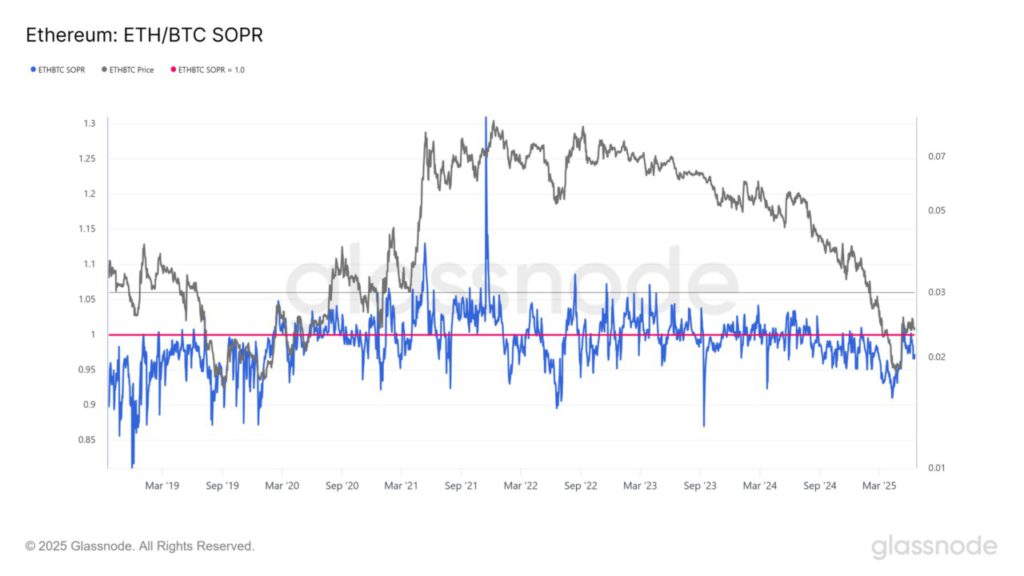

Ethereum (ETH) Performance Comparison with Bitcoin (BTC)

The SOPR (Spent Output Profit Ratio) between Ethereum (ETH) and Bitcoin (BTC) provides insight into the relative profitability of coins spent on the two networks. A value consistently below 1 indicates that investors experience greater losses or less profits on Ethereum (ETH) compared to Bitcoin (BTC).

This shows the weakness of Ethereum (ETH) in that timeframe. Despite a brief resurgence in April, SOPR data shows that Ethereum (ETH) still continues to show weakness relative to Bitcoin (BTC). This should be a concern for investors who may be considering diversifying their crypto assets.

Conclusion: Ethereum (ETH) Outlook Going Forward

With these indicators in mind, investors should remain vigilant on Ethereum (ETH) price movements and look for further confirmation before making an investment decision. Although there are some signals pointing to a potential recovery, the crypto market remains unpredictable and fraught with volatility. Decisions should be based on thorough analysis and a good understanding of market dynamics.

Also Read: Is it Time to Invest in Solana (SOL)? New ETF Fuels Speculation!

That’s the latest information about crypto. Follow us on Google News for the latest crypto and blockchain technology updates. Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- AMB Crypto. Ethereum: $500M shorts wiped out, bulls poised – Can ETH retain its stride?. Accessed on June 20, 2025

- Featured Image: Decrypt