As Iran–US Conflict Escalates, Is the Price of Gold Affected?

Jakarta, Pintu News – Geopolitical tensions between Iran and the United States have escalated again, triggering concerns in various global markets, including the gold market. As a safe haven asset, gold is often the destination of investors when the world situation is uncertain.

However, recent gold price movements have shown a trend that is not entirely in line with expectations. Then, is it true that the Iran-US conflict has a direct impact on gold prices?

What is the price of Antam Gold 1 Gram Today?

The chart above shows the price movement of 1 gram gold bars from the LM Grahadipta Gold Boutique – Jakarta over a period of 1 week, from June 16 to June 23, 2025. The last price was recorded on June 23, 2025 at 08:26:59 WIB, which amounted to Rp1,942,000, with no price change (Rp0) compared to the previous day.

The movement chart shows a fairly sharp downward trend in prices at the beginning of the week, from a high of around Rp1,960,000 on June 16, then a gradual decline until it reached a low of around Rp1,930,000 on June 20. This decline illustrates the selling pressure or declining demand in the gold market in the first few days.

However, since June 21, the price started to experience a moderate recovery and stabilized at around Rp1,942,000 until the end of the chart period. This suggests a potential consolidation in prices after the previous pressure, or perhaps an early signal of a recovery in the gold price trend.

Overall, this chart reflects the dynamics of the gold market, which was still volatile in the past week, but began to show stability towards the end of the period. Gold investors may be waiting for new catalysts that could drive further price movements.

Also read: Gold Jewelry Price Today June 23, 2025 at The Palace

How much is the selling price of 1 gram Antam gold today?

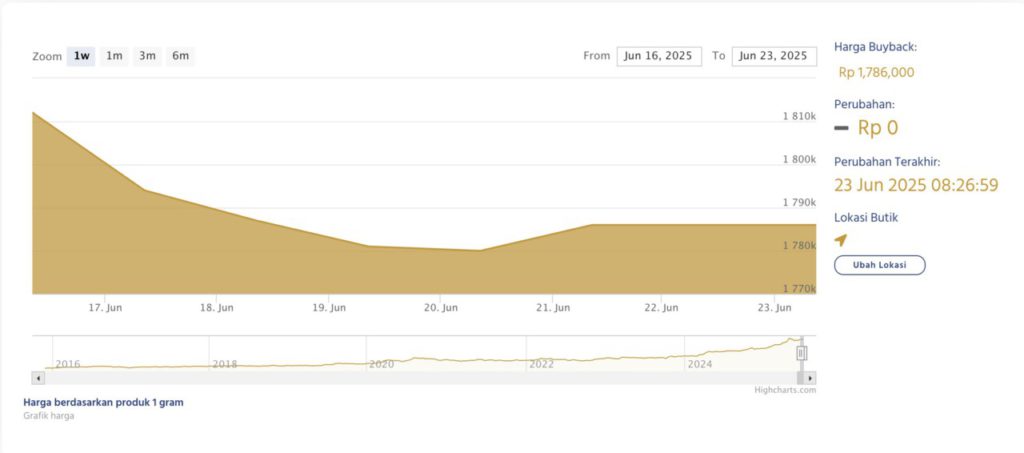

The chart above shows the movement of the 1 gram gold buyback price at the LM Gold Boutique over a one-week period, from June 16 to June 23, 2025. The last buyback price was recorded at Rp1,786,000 per gram on June 23, 2025 at 08:26:59 WIB, with no change compared to the previous day.

At the beginning of the period (June 16), the buyback price was at its highest level close to IDR1,810,000, but immediately showed a consistent downward trend for several days. The most significant decline occurred from June 17 to 19, where the price continued to weaken and reached its lowest point near Rp1,775,000 on June 20.

Starting from June 21, the chart shows a mild recovery, indicating price stabilization. The price stayed around Rp1,786,000 for three consecutive days, until the latest data on June 23. This consistency indicates that the market is starting to respond to pressure more calmly, although it has yet to show significant signs of strengthening.

Overall, the chart reflects the condition of the gold market, which experienced a correction at the beginning of the week, but began to show price stability towards the end of the period. This can be an important consideration for investors looking to resell their gold under relatively stable price conditions.

Digital Gold: When Physical Assets Meet Crypto Technology

As blockchain technology develops, gold can now be owned not only in physical form such as jewelry or bars, but also in digital form through gold-based crypto assets.

One of the most popular is Tether Gold (XAUt), a physical gold-backed ERC-20-based stablecoin, where 1 token represents 1 troy ounce of pure gold. The gold is stored in vaults in Switzerland and each token is directly linked to certified gold bullion. The system uses automated algorithms to efficiently manage the allocation of gold and Ethereum addresses.

XAUt tokens are available and traded on various crypto exchanges. XAUt is also an attractive alternative for those looking to hedge against inflation or global economic uncertainty, while remaining within the digital asset ecosystem.

That’s the latest information about crypto. Follow us on Google News to stay up-to-date on the world of crypto and blockchain technology.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Get a web trading experience with advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Antam TBK

- Featured Image: Generated by AI