Crypto Crash Today (6/23): 185,000 Traders Liquidated as $647 Million Vanishes in 24 Hours!

Jakarta, Pintu News – The crypto market is currently facing volatile conditions due to rising tensions in the Middle East.

After airstrikes by the United States targeted three key nuclear sites belonging to Iran, President Donald Trump called the strikes a “success,” while warning that there would be harsher retaliation in case of provocation. The strikes came after a week of conflict between Israel and Iran that rattled global markets.

In this geopolitical context, the market capitalization of the crypto industry fell by 1.50% to $3.1 trillion. Trading volume jumped 26.23% to $136.38 billion as volatility increased significantly.

As of June 23, Bitcoin price fell 1.27% to $101,497.55, Ethereum lost 1.99% and was trading at $2,241.94, while XRP slipped 2.52% to $2.02.

In terms of market sentiment, the Fear & Greed Index fell to 37, indicating increased anxiety among investors.

Crypto Liquidations Today Surge to $647 Million

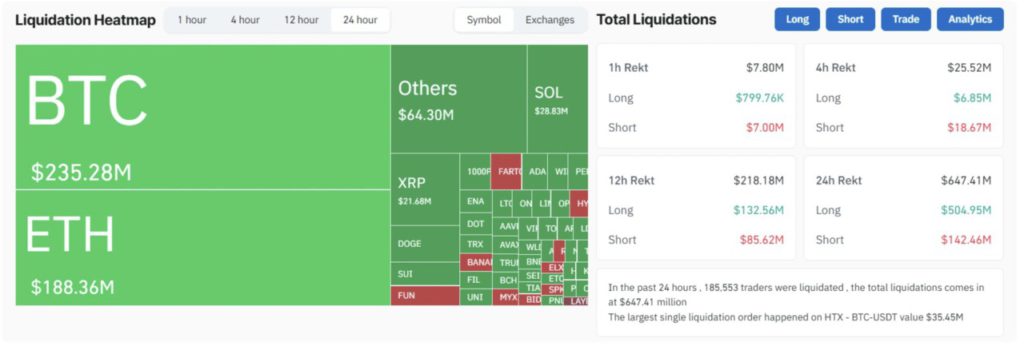

In the last 24 hours (23/6), the total crypto liquidation increased to $647.41 million, affecting more than 185,000 traders.

Read also: TRUMP Meme Coin Team Suddenly Moves $32.8 Million to Binance — Is a Major Dump Incoming?

Of this, long positions accounted for $504.95 million, indicating that traders with an optimistic(bullish) outlook were not prepared for the sudden reversal in prices. It should be noted that the largest liquidation came from BTC-USDT long positions on HTX worth $35.45 million.

The Bybit platform led in liquidation amount with a total of $252.46 million, followed by Binance at $137.57 million and Gate at $96.57 million.

The majority of liquidated positions were long positions, with the ratio reaching 95.14% on Bitmex and over 90% on Bitfinex and CoinEx. This indicates a strong tendency for the market to anticipate an upward price movement that ultimately failed to occur.

Crypto Market Capitalization Analysis

The total crypto market capitalization currently stands at $3.09 trillion, recovering slightly from the intraday low of $3.04 trillion.

Technically, the price has touched the lower Bollinger Band, which indicates an oversold condition that could potentially trigger a short-term recovery bounce.

Read also: BTC Dominance Soars to New Highs as Middle East Tensions Explode — Altcoins Crumble Under Pressure!

The RSI indicator at 38.41 also signaled the exhaustion of the bearish trend, opening up opportunities for a temporary recovery.

Nevertheless, the market is still below the 20-day SMA of $3.23 trillion, which confirms continued downward pressure.

BTC dominance is currently at a cyclical peak of 64.9%, signaling that altcoins are experiencing weak performance. ETH dominance fell to 8.7%, reflecting broader weakness among the major Layer 1s.

Although the market was impacted by external pressures, there were still assets that recorded significant gains amidst the uncertain conditions.

Some of these are Story with an intraday gain of +11.35%, Four which jumped +10.39%, and Sonic which gained +7.68%, indicating that certain microcaps still attract speculative interest.

That’s the latest information about crypto. Follow us on Google News to stay up-to-date on the world of crypto and blockchain technology.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Get a web trading experience with advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Coinpedia. Crypto Liquidations Today Wipe Out 185000 Traders and $647 Million! Accessed on June 23, 2025