Global Tensions Rising: Crypto Traders Watch Fed Rate July 2025

Jakarta, Pintu News – Global markets are facing major challenges due to rising geopolitical tensions. Military attacks and conflicts on an international scale not only shake up capital market sentiment, but also directly affect the prices of digital assets such as cryptocurrencies.

Traders and analysts are now focusing on the possibility of an interest rate cut by the Federal Reserve (Fed) in July 2025. This could be an important catalyst, especially for the crypto market which has been known to be highly sensitive to changes in interest rates and macroeconomic sentiment.

The Impact of Geopolitical Tensions on the Crypto Market

A series of military incidents, ranging from airstrikes to threats of retaliation between major countries, prompted tremendous uncertainty in financial markets. Traditional assets such as stocks and bonds experienced sharp corrections, while commodities such as gold surged as they were perceived as safe assets. However, on the other hand, volatility has also penetrated the crypto world. The value of Bitcoin and Ethereum fell sharply before stabilizing, while some cryptocurrencies such as Ripple and Solana (SOL) were also hit by selling pressure.

Many investors and traders are starting to reorganize their portfolios. A large amount of capital is moving into digital assets as a form of diversification, although risks remain high. Crypto and cryptocurrencies are increasingly seen as an alternative hedging tool, even though their movements can be very sharp in the current geopolitical situation.

Also Read: Robert Kiyosaki Suggests Buying Bitcoin Before the Global Monetary Collapse

New Focus: Potential Fed Rate Cut

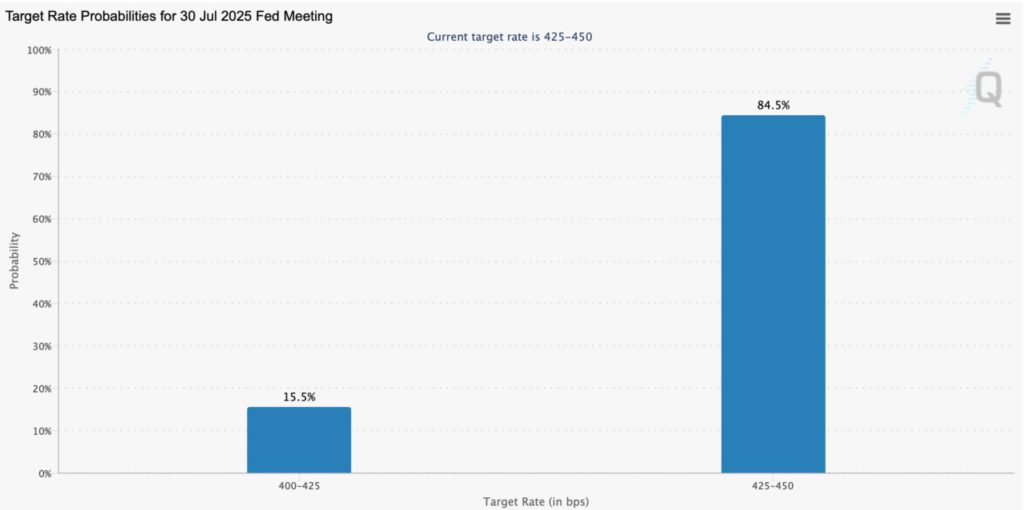

Amid the global turmoil, market participants’ attention is now focused on the US Federal Reserve’s move. Many analysts and market participants predict that the Fed is likely to cut its benchmark interest rate at its July 2025 meeting. This move is expected to calm financial markets, given inflationary pressures and economic uncertainty due to international conflicts. If interest rates fall, liquidity flowing into the market is likely to increase – potentially providing a breath of fresh air for crypto and cryptocurrencies.

Some traders are monitoring the latest macroeconomic data, such as inflation and US economic growth. They hope that dovish signals from the Fed will support a recovery in the price of Bitcoin (BTC) and other major digital assets. The predicted 25 basis points (0.25%) cut is expected to strengthen the crypto market, where new investment funds could flow in as the attractiveness of US dollar assets declines.

Crypto Trader Response and Market Reaction

Global crypto traders are taking anticipatory positions ahead of the Fed’s decision. Some chose to hold funds in stablecoins such as Tether or USD Coin while waiting for clarity on the direction of monetary policy. Meanwhile, some market participants started accumulating in Bitcoin (BTC), Ethereum (ETH), and selected altcoins in the hope of a price surge after the interest rate announcement.

Changes in the Fed’s stance in the past have shown a significant impact on crypto exchange rates. When interest rates are lower, investments in cryptocurrencies tend to increase as investors seek higher returns outside of traditional instruments. Therefore, the Fed’s move in July 2025 is predicted to be a pivotal moment for the entire crypto ecosystem, both institutional and retail investors.

Conclusion

Geopolitical uncertainty and speculation surrounding the Fed’s interest rate cuts are prompting traders and investors to be more vigilant in crafting investment strategies. The crypto market remains dynamic, with the price of Bitcoin (BTC) and other major cryptocurrencies moving with global sentiment and central bank policies. Education, diversification, and monitoring macro data are key to dealing with volatility in the second half of 2025.

Also Read: Important Warning from Binance CZ: Beware of Hacker Attacks!

That’s the latest information about crypto. Follow us on Google News for the latest crypto and blockchain technology updates. Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- News.Bitcoin.com. From Bombers to Basis Points: Traders Eye Fed Rate Cut in July Amid Rising Tensions. Accessed June 23, 2025.

- Featured Image: Generated by AI