Crypto Funds Surge: IDR 19 Trillion Into The Market As Panic Hits!

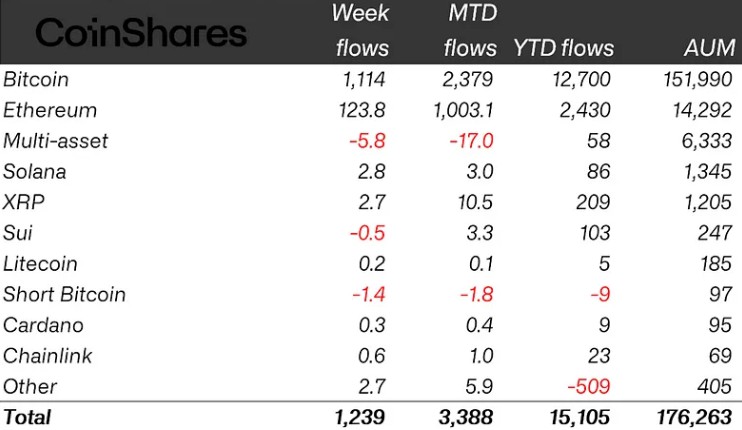

Jakarta, Pintu News – The influx of funds into the crypto market is back in the spotlight, after the latest CoinShares report revealed a massive inflow of more than USD 1.2 billion or equivalent to Rp19.7 trillion (exchange rate 1 USD = Rp16,390) in just the past week. This phenomenon occurred amidst a market atmosphere full of turmoil and panic due to various negative sentiments that hit the global economy.

However, the fantastic influx of funds into cryptocurrency investment products demonstrates investors’ confidence in the long-term potential of digital assets. This report is also an important indicator of the direction of crypto market sentiment at a time when the financial world is still in uncertainty.

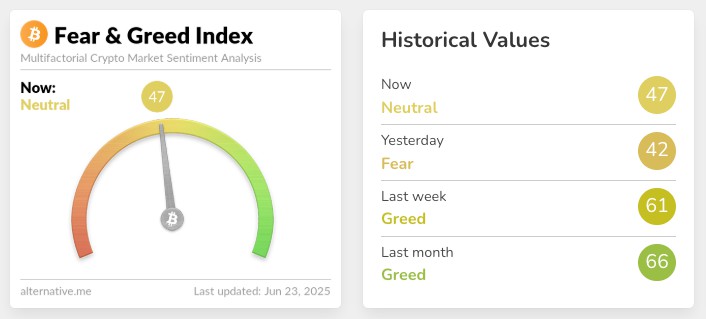

Incoming Funds Surge: Evidence of Confidence in Crypto Amid Fear

According to CoinShares data, the inflow of funds into cryptocurrency investment products such as Bitcoin , Ethereum , and Solana experienced a significant spike this week. In fact, Bitcoin (BTC) was again the favorite with the largest inflow contribution, proving its status as the digital asset that is considered the safest amid volatility. Not only institutional investors, but retail traders have also increased their exposure to crypto-based financial products.

Analysts consider this inflow phenomenon to be a signal that many investors are not simply following the current of fear in the market. Instead, they are taking advantage of the corrected prices as an opportunity to accumulate cryptocurrency assets. This indicates a strong belief in the long-term prospects of the crypto market, even though the global situation has not yet fully stabilized.

Also Read: Robert Kiyosaki Suggests Buying Bitcoin Before the Global Monetary Collapse

Impact of Global Market Panic on Crypto Assets

On the other hand, stock market turmoil and negative macroeconomic sentiment continue to put pressure on digital asset prices. Some investors were forced to reposition their portfolios by selling some of their holdings, especially amid interest rate and geopolitical concerns. However, the IDR19 trillion inflow shows that there is a large wave of market participants who are taking risks and trusting crypto’s ability to rebound faster.

Some cryptocurrencies, such as Ethereum (ETH) and Solana (SOL), have also seen increased interest, mainly due to strengthened project fundamentals. Investors have begun to use the price correction as a moment to expand their cryptocurrency holdings, hoping for a price recovery in the near future. This is what makes the dynamics of the crypto market so interesting amidst the storm of uncertainty in the world economy.

Investment Product Trends and Crypto Fund Diversification

Not only Bitcoin (BTC), but altcoin-based investment products have also seen a rise in interest, such as Solana (SOL), which continues to climb the list of this week’s most popular products. Ethereum (ETH) also remains a mainstay thanks to its growing DeFi ecosystem and updated blockchain network. In addition, institutional investors are increasingly open to diversification strategies, splitting their funds across different types of crypto assets to reduce risk.

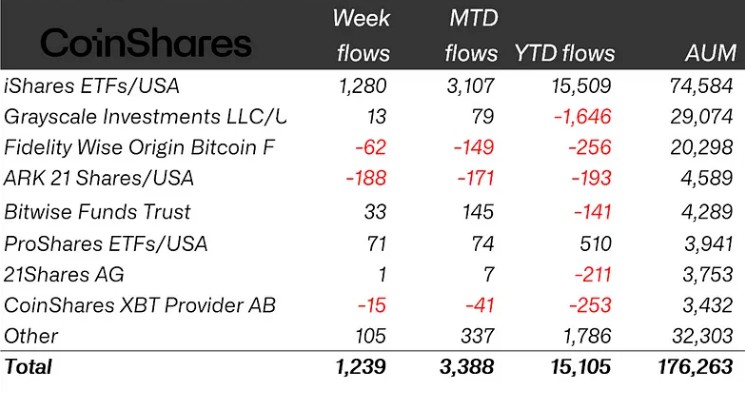

With fantastic inflows, market participants believe that the investment trend in cryptocurrency is far from over. In fact, more and more large global fund managers are starting to offer new crypto-based products, such as ETFs and index funds, in order to reach investors from various segments. Product innovation and ease of access are believed to accelerate investment growth in this sector.

Conclusion

The influx of more than USD 1.2 billion (IDR 19.7 trillion) worth of crypto investment funds into the market amid the panic is a strong signal that confidence in cryptocurrencies has not faded. This surge in inflows reflects a shift in investor strategy that is more willing to capitalize on the momentum of price corrections for accumulation. With increasing adoption and product diversification, the crypto market is believed to remain one of the most dynamic sectors in the global financial world.

Also Read: Important Warning from Binance CZ: Beware of Hacker Attacks!

That’s the latest information about crypto. Follow us on Google News for the latest crypto and blockchain technology updates. Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Cointelegraph. Crypto funds see $1.2B inflows amid panic in markets – CoinShares. Accessed June 23, 2025.

- Featured Image: Generated by AI