Solana Price Prediction: Parabolic SAR Hints at Surging Demand – Is a Major Rally Brewing for SOL?

Jakarta, Pintu News – Solana prices opened at just under $135 on Monday, June 23, down 20% from the monthly peak recorded on June 12.

Despite the sharp decline, a number of key technical and network usage metrics are showing increasingly strong signs that a local rebound is forming.

Then, how is Solana’s current price movement?

Solana Price Rises 7.97% in 24 Hours

On June 24, 2025, Solana saw a strong 7.97% gain over a 24-hour period, climbing to $146.34, or approximately IDR 2,398,527. During the day, SOL traded as low as IDR 2,167,955 and reached a high of IDR 2,415,022.

At the time of writing, Solana’s market cap stands at around $77.68 billion, with trading volume rising 21% to $5.83 billion within 24 hours.

Read also: These 3 Meme Coins Are Exploding — Don’t Miss This Week’s Hottest Crypto Picks!

Solana maintains network strength despite 20% price drop

Solana’s price dropped to $130 this week, but network transaction throughput remained stable.

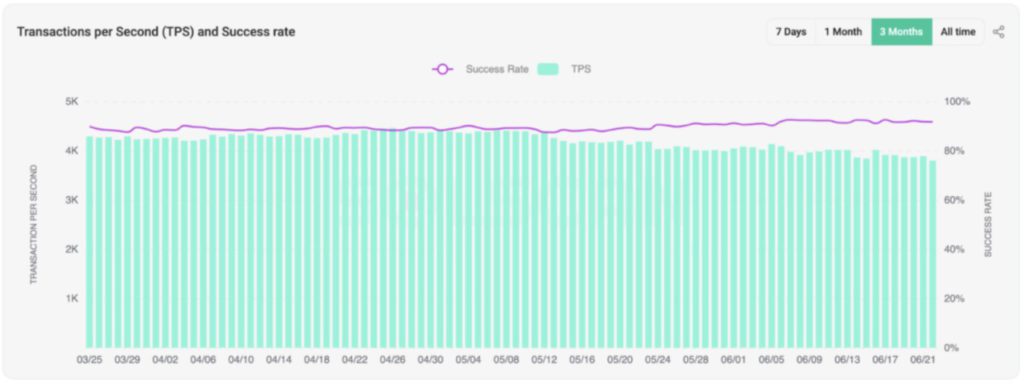

Furthermore, on-chain data from Solscan shows that Solana is currently processing 3,796transactions per second ( TPS), only down 13% from its peak on June 12 of 4,370 TPS.

This data shows that there is strong demand forblockspace on the Solana network, even though prices have fallen 20% from $163 at the start of the downturn on June 12 to $133 on Monday, June 23.

When there is a discrepancy between price and network activity like this, it is often a signal that the asset is undervalued.

With usage levels still healthy and the SOL token looking oversold when compared to its network fundamentals, a bounce to its fair value is likely if market sentiment stabilizes again.

Solana Price Prediction: Bullish Reversal Seen Above $136 Support

On the 4-hour chart (23/6), Solana’s price managed to rise back above the $136 level, where the Parabolic SAR line and the Bollinger Band midline intersected.

The Parabolic SAR dots are now below the current candlestick, which suggests that a short-term bullish trend reversal is in progress.

Read also: These 3 Altcoins Could Explode to New All-Time Highs by the End of June 2025 – Don’t Miss Out!

Parabolic SAR is a technical indicator that shows potential trend reversals through dots that are above or below price candles.

Meanwhile, Bollinger Bands consist of three moving-average lines in the center as well as upper and lower bands that expand and narrow according to price volatility. This indicator helps identify overbought or oversold conditions when the price touches the outer band.

In addition, the MACD indicator is also showing bullish signals, with the signal lines starting to move up and closer together, which is another indication that the short-term sentiment may be starting to change.

If SOL is able to maintain this momentum and close above the $140 psychological level, buying pressure(bulls) will likely push the price towards the upper Bollinger band at $147, with further targets near $155 if the overall market sentiment is favorable.

Conversely, if it fails to hold above $136, the price could retest the $130 level, which was previously a strong demand zone over the weekend.

That’s the latest information about crypto. Follow us on Google News to stay up-to-date on the world of crypto and blockchain technology.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Coinspeaker. Solana (SOL) Price Prediction: Parabolic SAR Signals Active Demand. Accessed on June 24, 2025