Ripple (XRP) Price Surges at the Beginning of July 2025, Check out the Causal Factors!

Jakarta, Pintu News – The cryptocurrency market is buzzing again with a significant increase in the price of Ripple . Today, Ripple (XRP) managed to break through the $2.32 resistance zone with a gain of 2.5%. The main factors driving this rise are the increased chances of Ripple (XRP) ETF approval, a surge in trading activity on the Upbit exchange, and the entry of large funds into the derivatives market. The trading volume and market capitalization of Ripple (XRP) also increased sharply.

Likelihood of Ripple (XRP) ETF Approval Increases Drastically

The odds of ETF approval for Ripple (XRP) by 2025 have increased by 19%, reaching 90% on Polymarket. This rise comes amid news that the US Securities and Exchange Commission (SEC) is planning to speed up the 19b-4 procedure that normally takes 240 days to just 75 days.

This rule change is expected to speed up the approval process, which increases market activity and gives a boost to the price of Ripple (XRP). This good news has sparked optimism among investors and traders who are now hoping that Ripple (XRP) will be among the next group to get approval. This will not only boost investor confidence but also attract more transactions in the market.

Also Read: US Tariff Delay Could Make Bitcoin Set a New Record This Week, What’s Really Happening?

CapSign Launches Ripple Equity Fund in XRPL

CapSign CEO Matthew Rosendin recently announced the launch of a new venture equity fund operating on the Sidechain EVM XRPL. The fund contains 4.7 million Ripple shares that were last sold at $125 per share on Lingto, totaling over $580 million in value. The fund is structured using a Delaware Series LLC and smart contracts, enabling token-based governance.

Investors can now vote on share sales and management decisions in real time, adding a layer of transparency and investor participation in fund management. The initiative is expected to attract more institutional investors seeking exposure in crypto assets through more traditional and structured instruments.

Ripple (XRP) Trading Volume on Upbit Reaches $1.94 Billion

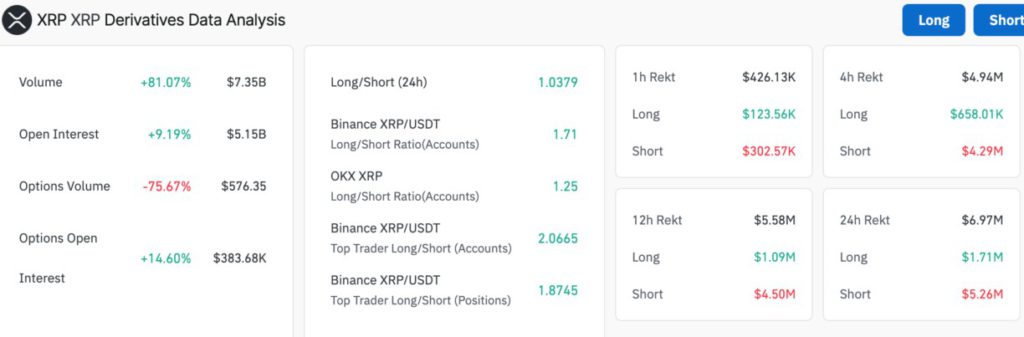

Ripple (XRP) trading volume on South Korea’s Upbit exchange reached $1.94 billion in just one hour, far surpassing the $90 million trading volume on Binance. The rise in open interest in the Ripple (XRP) derivatives market by 9.19% to $5.15 billion indicates an increase in capital going into leveraged positions.

This increase in volume and open interest often supports short-term price momentum. In addition, Ripple (XRP) managed to take back the $2.25 Fibonacci level, which adds to the technical confidence of traders and market analysts. This combination of technical and fundamental factors further strengthens Ripple (XRP)’s position in the cryptocurrency market.

Conclusion

With various positive developments taking place, Ripple (XRP) shows great potential to continue growing in the future. The approaching ETF approval, innovations in Ripple-based financial products, and increased trading activity are some of the factors that support the long-term prospects of Ripple (XRP). Investors and market watchers will continue to watch these developments with great enthusiasm.

Also Read: Russia Launches National Register of Crypto Mining Rigs: Cryptocurrency Miners Taxed?

That’s the latest information about crypto. Follow us on Google News for the latest crypto and blockchain technology updates. Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- Coingape. Why is XRP Price Rising Today?. Accessed on July 8, 2025