Bitcoin Holds Strong at $108,000 — Is a Massive Breakout Just One Move Away?

Jakarta, Pintu News – Although the Bitcoin price is holding slightly above $108,000, most of the market is watching one number: $110.000.

And although Bitcoin price has been trying to touch that elusive level without success for the past week, the current setup shows signs of materializing.

Not all systems are showing positive signals yet, but one clean breakout can change everything.

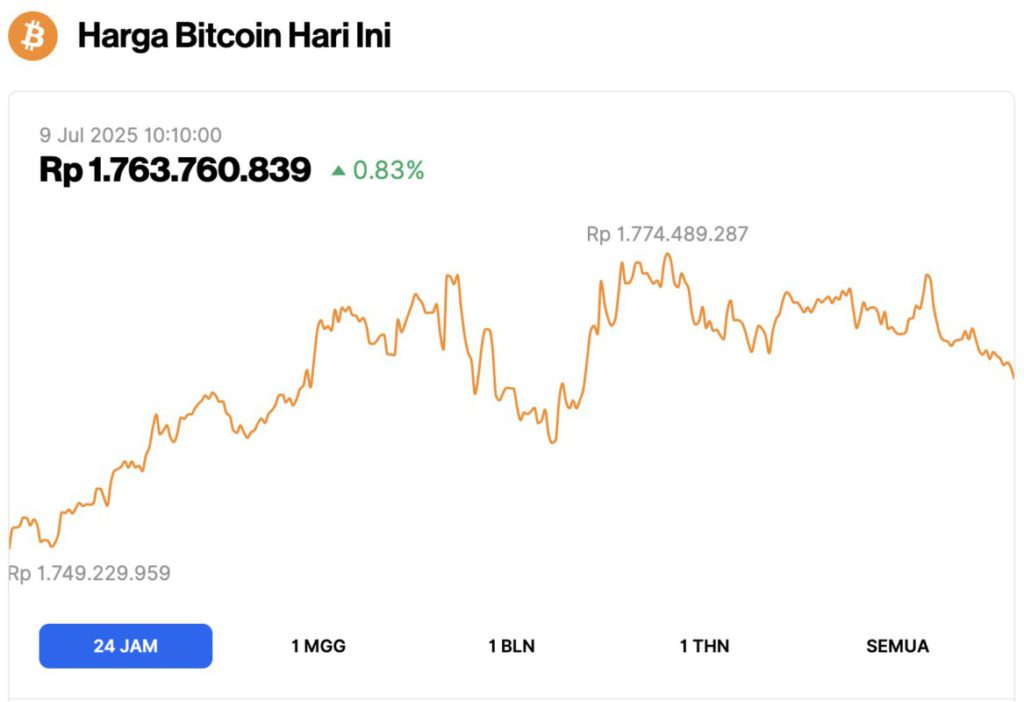

Bitcoin Price Up 0.83% in 24 Hours

On July 9, 2025, Bitcoin was priced at $108,561, which is equivalent to IDR 1,763,760,839 — marking a 0.83% gain over the past 24 hours. During this time, BTC dipped to a low of IDR 1,749,229,959 and climbed to a high of IDR 1,774,489,287.

According to CoinMarketCap, Bitcoin’s market capitalization now stands at around $2.15 trillion, with trading volume in the last 24 hours falling 10% to $41.32 billion.

Read also: Why SOL, ETH, and XRP Could Be Your Best Bets Before the Next Big Crypto Surge!

BTC Reserves Continue to Decline, which is a Bullish Signal

The most obvious bullish indicator right now is how fast Bitcoin reserves on exchanges are declining. As of July 7, only 2.4 million BTC remained on various centralized platforms-thelowest figurein more than three years.

Historically, this drop in reserves signals that investors are moving their coins to cold wallets, thus reducing the supply available for sale.

Setups like this often precede large price spikes as the number of coins in circulation tightens. When there is a sudden surge in demand, sellers have little room to react.

If this supply squeeze occurs in conjunction with a mild resistance level, even moderate trading volumes can drive large price movements.

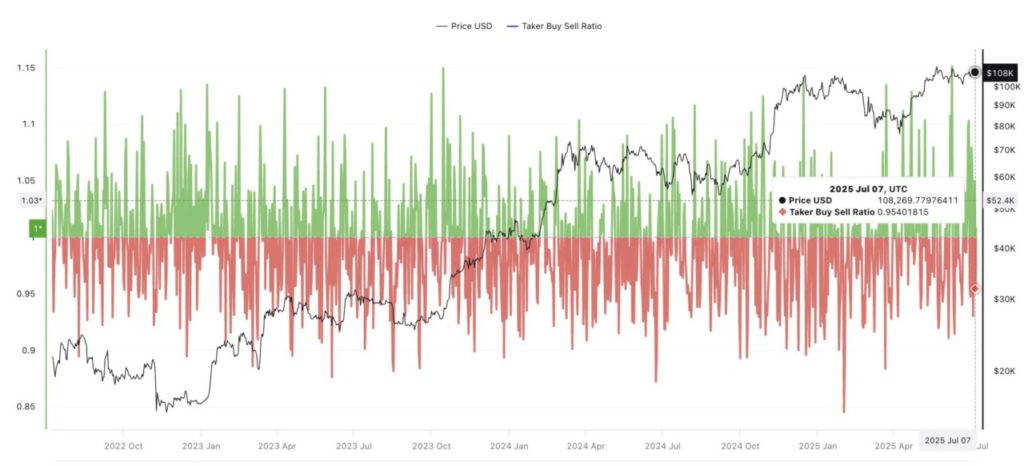

Buy-Sell Taker Ratio Still Below 1, But Getting Closer

One metric worth watching closely is the taker buy-sell ratio. This metric measures how aggressively Bitcoin buyers are taking offers compared to sellers pressing bids.

Currently, the ratio stands at 0.95, which means BTC sellers are still slightly more dominant – albeit slightly.

Once this ratio crosses 1, it usually signals that BTC buyers are starting to step in with strong conviction. Every time this has happened in the past six months, it has triggered a short-term price increase.

If in the next few days this ratio rises, it could be the final push needed to break the $110,000 wall.

Read also: Metaplanet Buys 2,205 More Bitcoins — Now Ranks Among Top 5 BTC Holders!

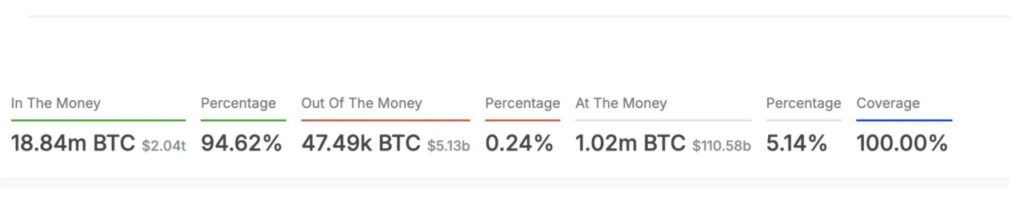

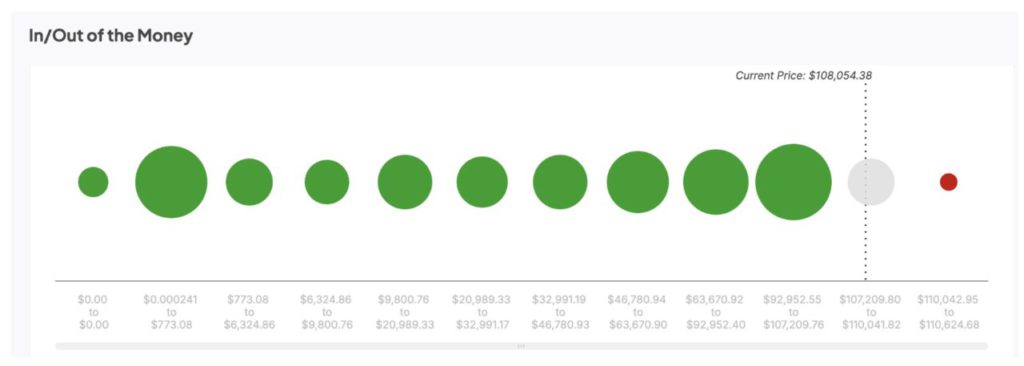

Strong Support Zone Confirmed by IOMAP Cluster

The In/Out of the Money Around Price (IOMAP) indicator maps wallet addresses that buy Bitcoin at various price levels, and shows where buying and selling pressure is most likely to occur.

Wallet clusters that are in the money (currently in profit) form support zones, while those that are out of the money (currently in loss) create resistance zones.

Based on the latest IOMAP snapshot, 94.61% of all BTC addresses are currently in profit. This is a significant cushion; historically, high profit levels tend to reduce selling pressure as holders are not rushed out of the market.

The data also shows a very strong support zone between $107,209 to $110,041, where many wallets are buying BTC. This creates a solid buy wall in case the price drops.

Meanwhile, the resistance zone between $110,042 to $110,624 is relatively thin. Only a few wallets are in this area, meaning that there is hardly any supply left that could impede the upward movement if BTC manages to break $110,000.

The combination of strong support and light resistance opens up the opportunity for an explosive move if momentum picks up again.

Bitcoin Price Levels Align with On-Chain Signals

Both the Fibonacci retracement chart and the horizontal line of resistance now confirm what the on-chain metrics have signaled: Bitcoin is just below the breakout zone.

Read also: NBA Legend Scottie Pippen Reveals His Top Crypto Picks — XRP Tops the List as Price Skyrockets!

Having traded at $108,235 on July 8, BTC is slightly above the 0.236 Fibonacci retracement level, drawn from the swing low to the most recent high. This level has been a price consolidation magnet and now forms a fairly strong short-term bottom.

On the upside, the horizontal resistance level between $110,583 and $110,779 is the last hurdle before a potential surge. What strengthens this technical picture is the perfect alignment with the on-chain IOMAP cluster.

As highlighted earlier, the In/Out of the Money indicator shows most BTC holders are in profit, with a solid wallet support between $107,209 to $110,041.

On the downside, the backup support levels remain firm at $103.584 and $101.389. However, based on current conditions, the chart confirms the on-chain story: Bitcoin is ready to climb, and a clean break above $110,779 could be the signal the market is waiting for.

However, if Bitcoin fails to defend the $107,209-$110,041 support zone and closes below $103,584, then the bullish scenario could collapse. This would indicate buyers’ exhaustion in the upper area and increase the risk of retesting the $101,389 zone.

If Bitcoin price breaks $110,000 accompanied by strong volume, the structure favors a quick move upwards. There is almost no resistance until it reaches the psychological all-time high of $111,970 reached a few weeks ago.

That’s the latest information about crypto. Follow us on Google News to stay up-to-date on the world of crypto and blockchain technology.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app through Google Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. Bitcoin Price is Circling $110,000, One Break Could Open The Floodgates. Accessed on July 9, 2025