Grayscale Transforms Portfolios: Polkadot Out, Hedera In!

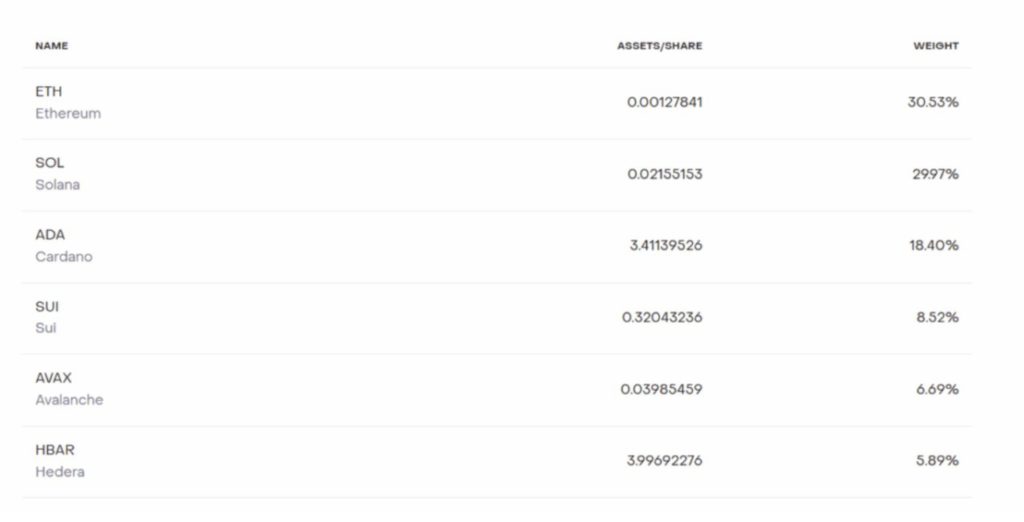

Jakarta, Pintu News – In the latest major move, Grayscale has made significant changes in their Smart Contract Platform Fund by removing Polkadot and including Hedera (HBAR). These changes are part of the regular rebalancing done every quarter by the firm.

Check out the full information in this article!

Introduction of Hedera (HBAR) into Portfolio

Hedera now holds a 5.8% weight in the fund. This decision demonstrates Grayscale’s focus on networks that offer high speed and low transaction fees. Hedera, known as one of the fastest and most energy-efficient blockchains, is an attractive option for developers looking for top-tier infrastructure.

This addition is expected to create a more scalable blockchain solution. In addition, Hedera has attracted attention for its sustainability and adaptability to various business applications. With a growing profile among institutional portfolios, Hedera is considered a strategic asset in enhancing the diversification and growth potential of Grayscale’s funds.

Read also: Heimdall v2: Speed and Security Revolution on the Polygon Network

Other Portfolio Adjustments by Grayscale

Grayscale not only added Hedera, but also introduced Ondo Finance (ONDO) to the portfolio. ONDO is now the third largest holding with a weighting of 18.22%, followed by Uniswap with 34.01% and Aave with 30.74%.

This adjustment demonstrates Grayscale’s strategy of adapting their portfolio to reflect recent developments in blockchain technology and decentralized finance. In addition, Grayscale has made adjustments to their AI fund to stay relevant to the latest technological advancements.

This move confirms Grayscale’s commitment to integrating technological innovation into their investment strategy, ensuring that they remain at the forefront of the industry.

Read also: Bitcoin Strategy 2025: Jeremie Davinci’s Secret to Big Success!

ETF Product Expansion by Grayscale

Grayscale has also filed with the SEC to launch a spot Hedera ETF. This adds to their product lineup which already includes Bitcoin and Ethereum ETFs.

With this expansion, Grayscale aims to broaden its product range by adding popular assets such as Cardano (ADA) and Ripple (XRP) to the list of ETFs they offer.

This move demonstrates Grayscale’s confidence in the potential of Hedera and other assets to attract institutional investors. With a growing portfolio, Grayscale seeks to meet the needs of diverse investors and increase their exposure to cryptocurrencies.

Conclusion

The changes made by Grayscale in their Smart Contract Platform Fund mark an important evolution in their investment strategy. By adopting Hedera and adjusting the composition of other assets, Grayscale is demonstrating their adaptation to the ever-changing market dynamics. This move not only strengthens their position in the market but also provides new opportunities for investors to get involved in the evolving blockchain technology.

That’s the latest information about crypto. Follow us on Google News to stay up-to-date on the world of crypto and blockchain technology.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- Crypto Times. Grayscale Drops Polkadot, Adds Hedera to Smart Contract Fund. Accessed on July 10, 2025

- Featured Image: Cryptoslate