Dogecoin Surges 5% Today – Is This the Start of a Rally or Just Another Fakeout?

Jakarta, Pintu News – Dogecoin hasn’t seen much movement, and that’s the problem. Its value is down by 6% compared to last week and it hasn’t managed to break the $0.17555 level convincingly, despite several attempts.

While previous whale inflows and positive funding levels hinted at a potential breakout, the latest metrics tell a different story.

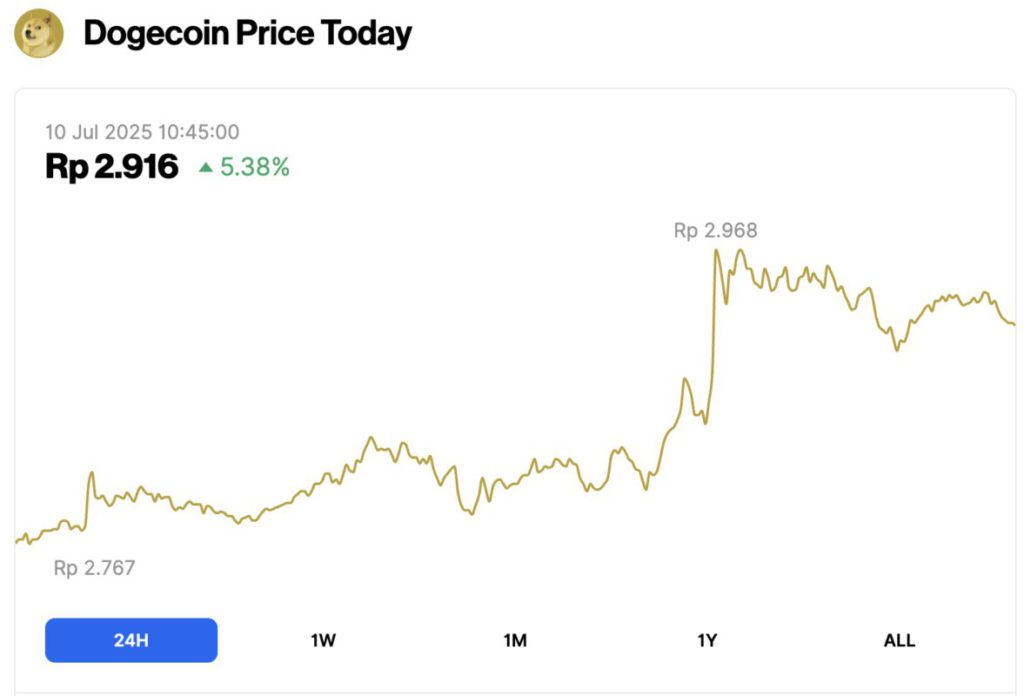

Dogecoin Price Rises 5.38% in 24 Hours

On July 10, 2025, Dogecoin saw a notable 5.38% gain over the span of 24 hours, climbing to $0.1800 — approximately IDR 2,916. During the day, DOGE traded between a low of IDR 2,767 and a high of IDR 2,968.

At the time of writing, Dogecoin’s market cap stands at around $27.02 billion, with trading volume rising 110% to $1.71 billion within 24 hours.

Read also: Ethereum Surges 6% to $2,700 — Is a Breakout to $3,000 Just Around the Corner?

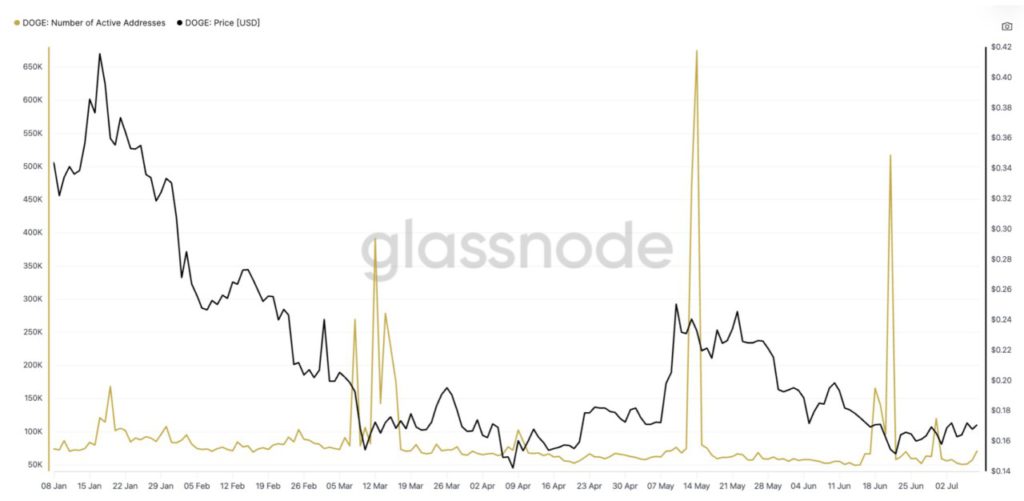

Active Address Still Doesn’t Support Movement

Despite the price increase at the end of June, the number of active Dogecoin addresses has not shown an increase. The number of wallets transacting daily-a key indicator of retail and organic demand-has remained flat with only slight spikes in some periods.

This is a red flag. It indicates that the rally attempt is not supported by new or returning users.

When the price rises without an accompanying increase in address activity, such rallies usually don’t last long. From previous Dogecoin breakout attempts, a spike in active addresses usually comes before or after a strong price movement. That’s not the case here – and it’s pretty clear.

Active Addresses refer to wallets that interact with the network on a daily basis. If the number decreases or stagnates, it usually reflects weak user participation and low transaction demand.

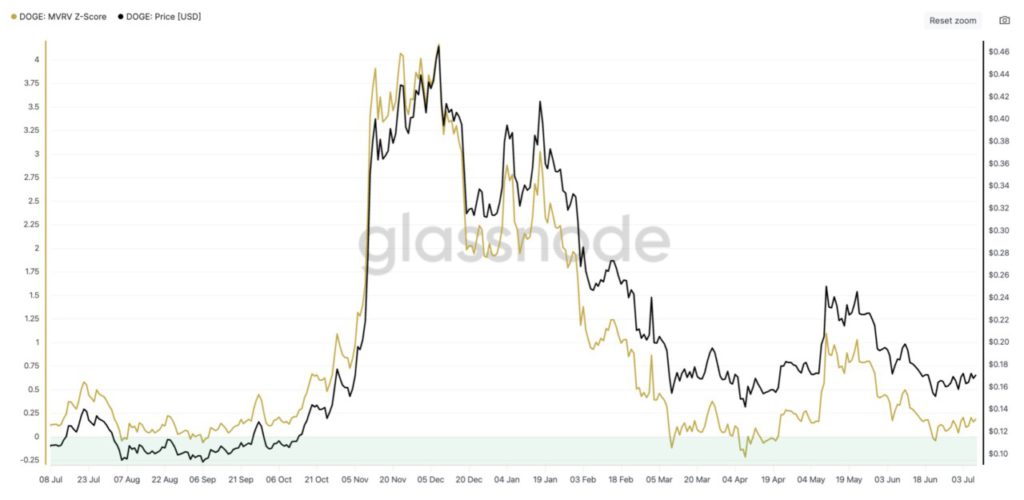

MVRV Z-Score Shows Price Below Fair Value

Dogecoin’s MVRV (Market Value to Realized Value) Z-score is still below zero, indicating that most asset holders are experiencing unrealized losses. This means that the risk of a sell-off is relatively low.

Historically, DOGE has often rallied after entering negative MVRV territory, with prices usually bottoming out as the Z-Score begins to reverse upwards. This time, however, that recovery has yet to happen.

Read also: Trending Crypto Today: 4 Meme Coins Set to Skyrocket in July 2025!

In previous cycles, when the MVRV turned negative and then went back up, it was often an early marker of a new price increase.

But DOGE’s current MVRV trend is still flat, which indicates that even though the coin is currently below its fair value, the market has not yet started a significant re-accumulation.

The MVRV Z-score compares the current market value of DOGE to the average cost basis of all holders. A negative number indicates that the average wallet is losing money, which is often a signal of undervaluation-butonly a bullish signal if followed by renewed buying pressure.

Price Structure Still Bearish, Despite Retesting the Consolidation Area

Dogecoin is still trading within a descending triangle pattern. The resistance level at $0.17555 has been tested several times. Meanwhile, the support level around $0.161 was repeatedly broken and then recovered again-a sign that the market structure is starting to weaken.

The RSI(Relative Strength Index) indicator shows a downward trend, although the DOGE price recorded higher lows-aclassic bearish divergence. This means that, although the price appears stable, its underlying strength is weakening. The flat number of active addresses further reinforces this conclusion.

RSI measures momentum. A declining RSI accompanied by a rising DOGE price signals that buyers’ control is weakening, and this is often an early signal of a potential pullback.

Therefore, even if DOGE manages to break the resistance, it is not necessarily a strong signal as a correction is still possible.

If the price drops below $0.161 again, the bearish triangle pattern remains in effect. The invalidation zone is below $0.1567-if the price breaks this point, a deeper correction could open up.

However, if the bulls manage to push the price through $0.17555, the next resistance is around $0.1832.

That’s the latest information about crypto. Follow us on Google News to stay up-to-date on the world of crypto and blockchain technology.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. Dogecoin (DOGE) Price Nears Key Resistance Again: Rally Or Another Rejection? Accessed on July 10, 2025