Ethereum Rebounds to $2,900 — Is a Massive Surge to $4,000 Just Around the Corner?

Jakarta, Pintu News – Ethereum finally broke back through the $3,000 level after weeks of sideways consolidation, signaling a strong bullish revival.

The breakout on the daily chart, confirmed by an increase in trading volume, reinforces the presence of a technical change in favor of further price gains.

Then, how is Ethereum’s current price movement?

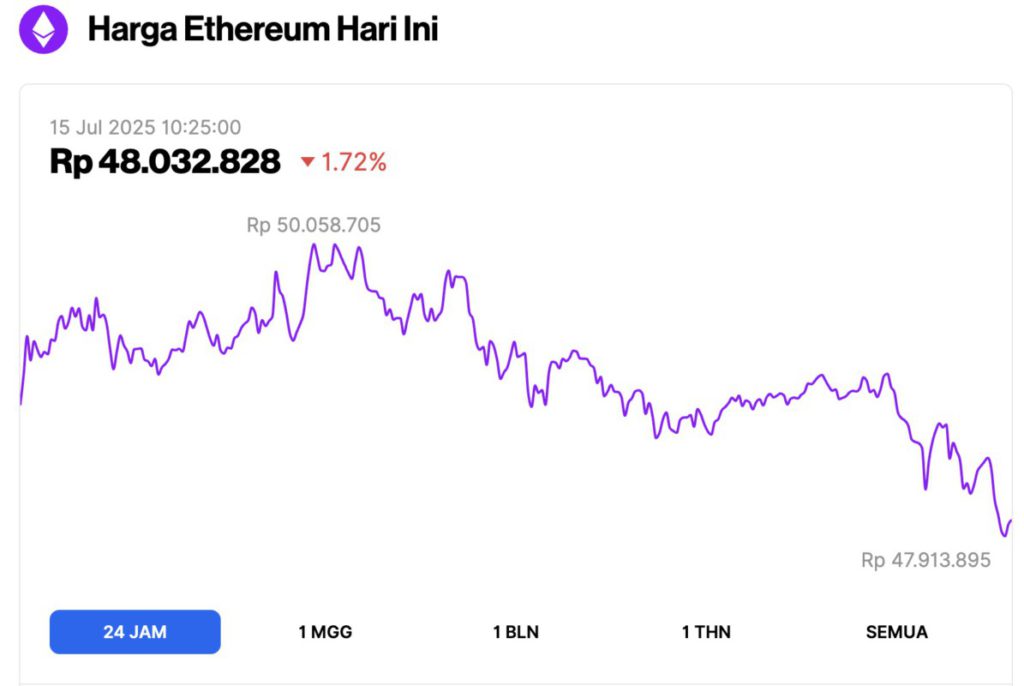

Ethereum Price Drops 1.72% in 24 Hours

As of July 15, 2025, Ethereum is trading around $2,950 (approximately IDR 48,032,828) after a slight 1.72% pullback over the past 24 hours. In that time, ETH swung between a low of IDR 47,913,895 and a high of IDR 50,058,705 — hinting at building pressure beneath the surface.

At the time of writing, data from CoinMarketCap shows that Ethereum’s market capitalization stands at around $356.13 billion, with daily trading volume rising 68% to $34.33 billion within the last 24 hours.

Read also: 3 Crypto that will Rise Today (7/15/25): Ready to Set a New Record Like Bitcoin?

Ethereum Indicates Healthy Long-Term Trend

Ethereum is currently trading above its 50, 100, and 200-day moving averages, which indicates a healthy long-term trend. These levels often serve as dynamic support zones, especially during retracements.

Crypto analysts predict that Ethereum’s breakout above $3,000 has broken the most difficult resistance level since the last sharp decline.

With the next important price gap being between $3,200 to $4,000, a quick spike to chase the gap is now possible-as long as bullish momentum remains steady across the crypto market in general.

Bull Flag Pattern Hints at Further Upside Potential

Reporting from Tron Weekly (7/14), Ethereum is currently consolidating in a bullish flag pattern after a successful breakout. This technical formation hints at a potential next rally.

Read also: 3 Big Token Unlocks to Watch This Week!

If Ethereum is able to break through the resistance of this pattern, the price of ETH could quickly shoot to $3,300, as popular analyst Lark Davis stated on social media.

A bull flag pattern often signals a trend continuation after a strong upward movement. ETH’s tight and slowly declining correction fits the characteristics of this pattern. If momentum is maintained, Ethereum has the potential to continue its rally and target $3,300 in the near future.

Davis also advises investors to try Bitunix’s platform for ETH trading because of their no-KYC policy and various bonus offers.

With lures such as a $400 deposit reward and up to $9,000 in trading credits, the site attracts investors looking to capitalize on ETH’s volatile movements amid the current bull market period.

Analysts Target ETH in the $3,300-$3,500 Range

Rekt Capital notes that Ethereum is in the process of filling the Monthly CME Gap in the area between $2,900 and $3,350. This kind of technical indication is usually followed by huge price movements.

The completion of the gap will strengthen the bullish argument and could be the trigger for further gains in Ethereum’s price trend.

According to crypto analyst Berkan, Ethereum is now on the verge of a major breakout. If the $3,000 level is successfully flipped into a strong support area, then the path to a quick rally to the $4,000 resistance zone could be wide open.

This target represents a potential upside of about 35% from the current price level.

That’s the latest information about crypto. Follow us on Google News to stay up-to-date on the world of crypto and blockchain technology.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Get a web trading experience with advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- TronWeekly. Ethereum Skyrockets Past $3,000, Bull Flag Signals $4,000 Explosion. Accessed on July 15, 2025