Bitcoin Crashes to $117K After Smashing Record High — Here’s What Triggered the Drop

Jakarta, Pintu News – Bitcoin price fell below $120,000 after hitting an all-time high of $123,091 on July 14, 2025.

BTC’s price drop comes after the latest geopolitical tensions emerged, as US President Donald Trump threatened to impose 100% tariffs on Russia within 50 days if the war with Ukraine is not stopped.

Then, how is Bitcoin currently moving?

Bitcoin Price Drops 2.53% in 24 Hours

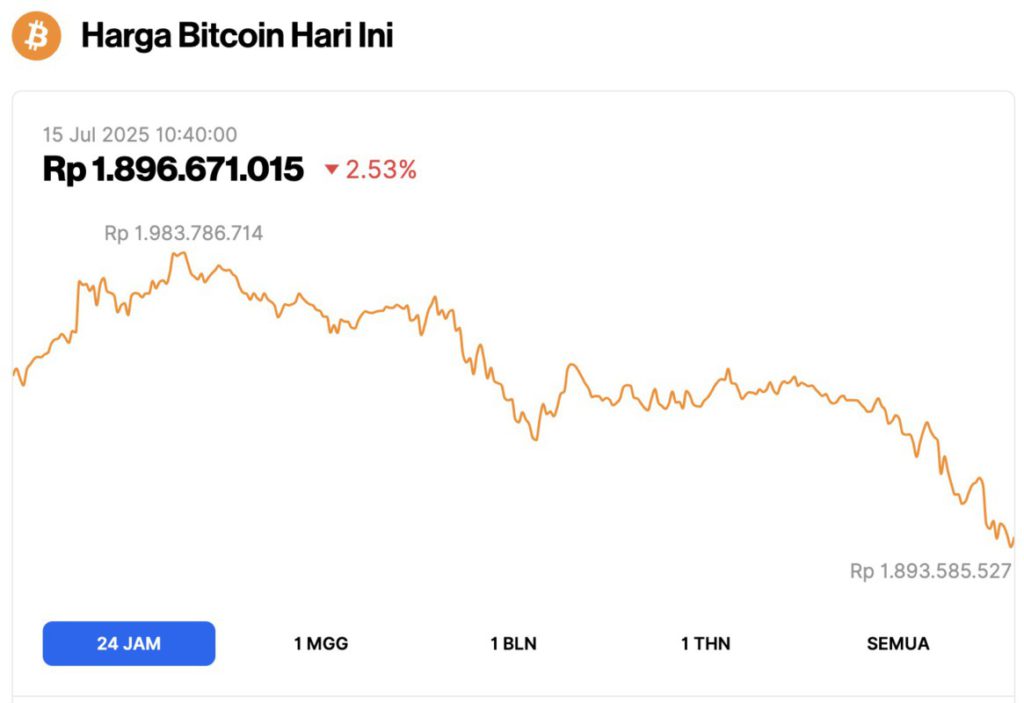

On July 15, 2025, Bitcoin was trading at $117,138, which is equivalent to IDR 1,896,671,015 — marking a 2.53% drop over the past 24 hours. During this period, BTC hit a low of IDR 1,893,585,527 and reached a high of IDR 1,983,786,714.

According to CoinMarketCap, Bitcoin’s market capitalization now stands at around $2.33 trillion, with trading volume in the last 24 hours rising 221% to $182.06 billion.

Read also: Ethereum Rebounds to $2,900 — Is a Massive Surge to $4,000 Just Around the Corner?

BTC Price Corrects after Hitting an All-Time High Record

Bitcoin price surged sharply over the weekend until Monday morning (July 14), reaching $123,091, which is the highest price in history. However, after that, the price dropped to $120,124 and continued to slide to around $119,900 according to recent reports.

Quoting the Coingape page, this correction occurred after President Trump issued a public statement threatening new tariffs against Russia and confirming an arms deal with NATO allies for Ukraine.

However, BTC’s sudden price correction has sparked concerns that Bitcoin may have reached a short-term top. A further correction or a flat move could be possible, depending on market sentiment and global political developments.

However, as the crypto week has just begun, Bitcoin price still has the potential to experience additional rallies, especially if the crypto bill is passed through the vote.

According to analysts, this bullish momentum could push the price of BTC towards a new ATH (all-time high) of $136,000.

Trump’s 100% Tariff Threat on Russia Triggers Market Reaction

In a press conference with NATO Secretary General Mark Rutte, President Trump stated that Russia will be subject to secondary tariffs of up to 100% if no ceasefire agreement is reached in Ukraine in the next 50 days.

Read also: 3 Crypto that will Rise Today (7/15/25): Ready to Set a New Record Like Bitcoin?

“We have no choice but to impose secondary tariffs… these tariffs are quite severe,” Trump said at the White House on Monday.

Trump also confirmed that a major arms deal with NATO has been finalized.

According to him, “We will deliver many weapons of various types, and they will be delivered immediately.” He emphasized that the United States will produce the weapons, while allies in Europe will finance them.

Following this announcement, Bitcoin price fell by more than $3,000, testing the support level at $119,000.

This threat comes following Trump’s announcement of additional 30% tariffs on imports from Mexico and the European Union, as well as 50% tariffs on copper and other commodities from various countries.

On-Chain Metrics Point to Profit-Taking and a Possible Local Top

According to data from CryptoQuant.com, there was a sharp spike in exchange netflows after Bitcoin’s price hit the $123,000 mark, indicating profit-taking activity.

In a post, the company stated:

“Moves like this usually indicate a local top and could lead to a healthy correction or consolidation in the next few days.”

Meanwhile, the Crypto Fear & Greed Index rose to a level of 70, which puts it firmly in the “Greed” zone. While this reflects positive investor sentiment, high levels of greed can also be a sign ofoverbought market conditions.

According to analysts, traders often take profits when the index reaches such levels.

The derivatives market also showed increased momentum, with open interest in Bitcoin futures rising by 3.87% to $87.95 billion.

According to Coinglass, trading volume surged 146.88% to over $152 billion, signaling strong but possiblyoverextended buying pressure, which could still sustain the upward trend of BTC prices.

That’s the latest information about crypto. Follow us on Google News to stay up-to-date on the world of crypto and blockchain technology.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Coingape. BTC Price Reacts As Trump Threatens Russia With 100% Tariffs. Accessed on July 15, 2025