Bitcoin hits record $121,800, supported by “Goldilocks Equilibrium” of US economy and euphoria

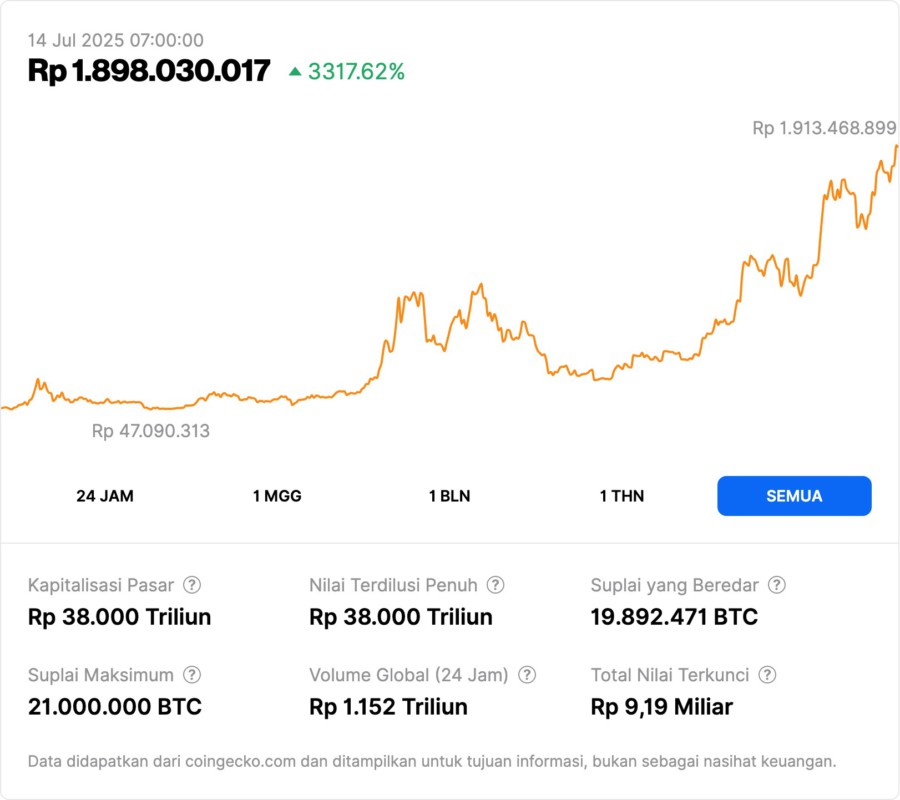

Jakarta, Pintu News – The price of Bitcoin (BTC) broke a new record high of $121,800 (equivalent to Rp1.98 billion, exchange rate 1 USD = Rp16,287) last Sunday, driven by a combination of macroeconomic factors and changes in global investor sentiment. Analysts said that the “Goldilocks” economic conditions of the United States – i.e. strong growth with contained inflation – were the main driver of the world’s largest crypto rally.

Two Macro Forces Driving Bitcoin

According to QCP Capital’s analysis, there are two main forces shaping the current macro landscape: Trump-era tariff policies and the solid US fiscal position. Many global industrialists and importers are racing to accelerate production and exports to the US before the new tariff policies take effect, creating trade credit expansion and manufacturing growth, although uncertainty remains high.

On the other hand, the Fed’s still-high interest rates triggered large Treasury interest payments to corporate and household balance sheets. This keeps consumption and investment strong, maintaining the “Goldilocks” balance – where the economy grows, inflation is contained, and financial markets remain vibrant.

Market Optimism and Institutional Inflows

Bitcoin’s rally was also triggered by investors switching to riskier assets after previously hesitating due to US trade policies. Data as of July 14 shows that Bitcoin and Ethereum spot ETFs absorbed up to $3.39 billion and $1.10 billion in new funds.

Ryan Lee, analyst at Bitget Research, said expectations of a Fed rate cut in 2025 have added to risk-on sentiment and strengthened Bitcoin’s position as an inflation hedge. In addition, purchases by treasury companies and increased institutional participation have also been positive catalysts for the price rally.

Anticipate Further Rally: $130,000 Target Hunted

As the price broke through $120,000, demand for call options for BTC at the $130,000 level surged sharply. According to vTrader advisor Steve Gregory, this surge in derivative demand indicates the market is still very bullish and many are speculating Bitcoin prices could continue to climb.

Kelvin Koh of Spartan Group concluded that as long as the US economy is stable, inflation is maintained, and the Fed’s policy direction is towards easing, the market environment remains ideal for crypto. The improving regulatory support in the US as well as the entry of large institutions also reinforces Bitcoin’s position as a major asset of the digital era.

Conclusion

Bitcoin is now not only influenced by the sentiment of the crypto community, but is truly an indicator of global macroeconomic strength. With the combination of the “Goldilocks” condition of the US economy, institutional flows, and the euphoria of the derivatives market, the opportunity for BTC prices to go higher is still very open.

Also Read: Big Drama: Coinbase and Binance Deny Each Other Over Media Leaks and Market Grab!

That’s the latest information about crypto. Follow us on Google News for the latest crypto and blockchain technology updates. Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- Decrypt. US Economy in a ‘Goldilocks-Like Equilibrium’ as Bitcoin Blasts Past $121K. Accessed July 15, 2025.