Bitcoin Stuck at $117K – Will It Plunge Back Below $110K?

Jakarta, Pintu News – After hitting an all-time high of $123K on July 14, Bitcoin is now down to $117K due to a drop after a massive sell-off of 20,000 BTC by a Satoshi-era whale.

Glassnode revealed that BTC investors are now quickly realizing their profits and this could be just the beginning.

Then, how is the current Bitcoin price movement?

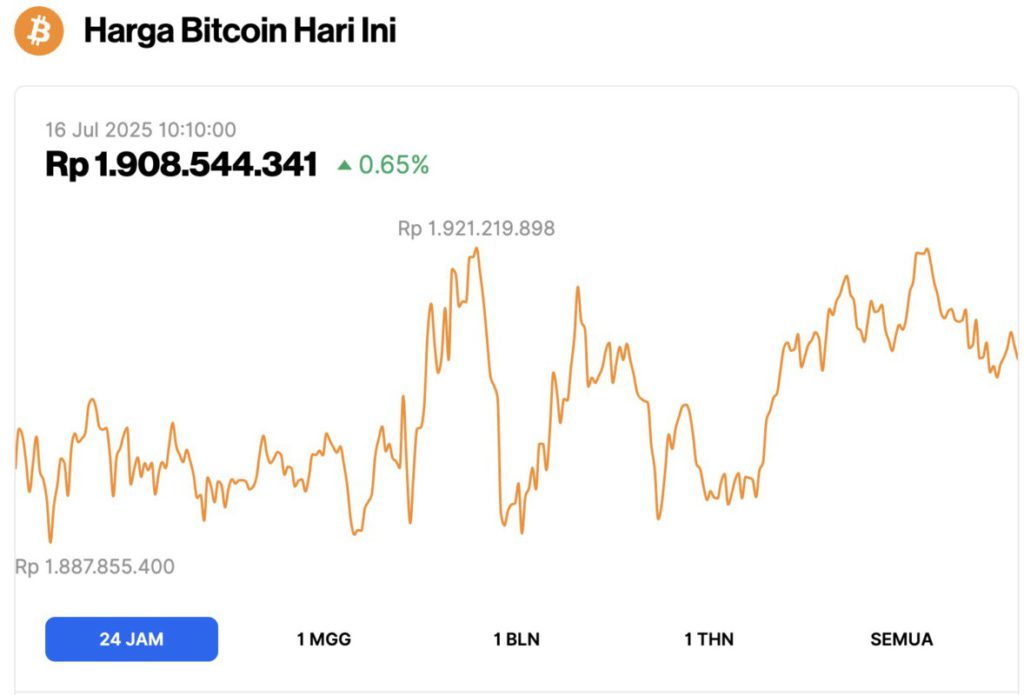

Bitcoin Price Up 0.65% in 24 Hours

On July 16, 2025, the price of Bitcoin was recorded at $117,365, which is equivalent to IDR 1,908,544,341, showing a slight increase of 0.65% over the last 24 hours. During this period, BTC reached its lowest level at IDR 1,887,855,400 and its highest price at IDR 1,921,219,898.

According to CoinMarketCap, Bitcoin’s market capitalization now stands at around $2.33 trillion, with trading volume in the last 24 hours falling 51% to $89.55 billion.

Read also: Dogecoin Soars Today (July 16): DOGE Set to Skyrocket by 130%!

Bitcoin sell-off imminent?

In a post on X, Glassnode cited on-chain metrics showing that more than $3.5 billion in realized gains have made their way into the market in the past week, mostly flowing to centralized exchanges. Large players are not only hedging, but also actively reducing their positions.

Glassnode also confirmed that 98.9% of BTC’s current circulating supply is in a profitable state as the Net Unrealized Profit to Loss (NUPL) ratio has risen to euphoric levels.

The Realized Profit to Loss ratio jumped from 3.0 to 3.6, confirming that realized profits far exceeded losses and indicating a market that is in active profit-logging mode.

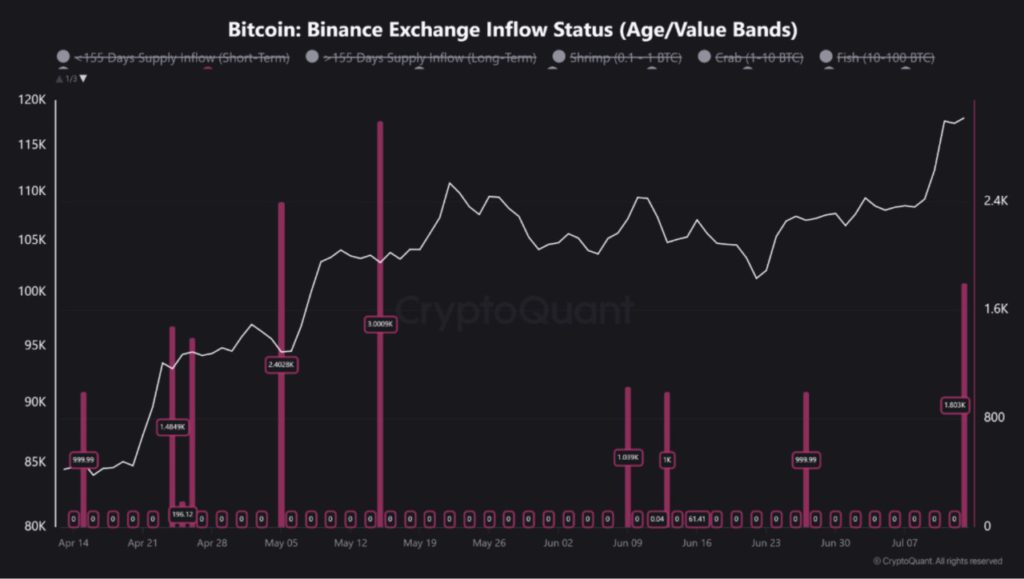

Increased Whale Activity on Binance

Additionally, analyst Crazzyblockk highlighted a sharp spike in whale activity on Binance, with more than 1,800 BTC, worth over $210 million at current prices, deposited in a single day.

Read also: Ethereum Soars to $3,100 Today: ETH Staking, Stablecoins, and TVL Skyrocket to $63 Billion!

This movement was dominated by transactions worth more than $1 million, indicating a massive coordinated change in strategy.

These coins are not new entries. These are old, well-positioned coins that are being mobilized, signaling either profit-taking or leveraged speculation.

With Binance accounting for over 25% of global spot volume, these whale-driven flows often precede sharp price movements as the whales are always timing the upcoming Binance listing.

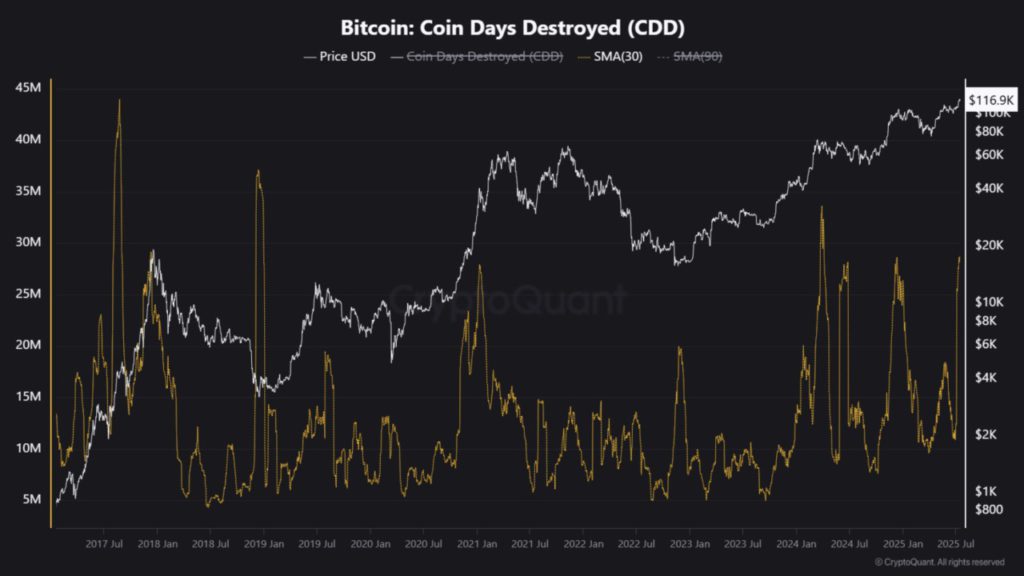

Spike in CDD and NRPL

Crypto analyst Mevsimi notes that Coin Days Destroyed (CDD) has jumped to 28 million, indicating that BTC that has been idle for a long time is now starting to move.

On the other hand, Net Realized Profit and Loss (NRPL) has surpassed $4 billion, the highest figure in months.

In contrast to June’s mix of capitulation and modest gains, this wave was dominated by aggressive profit realization, with Bitcoin strangely holding steady above $117K.

Bitcoin Price Analysis: What’s Next for BTC?

As of July 15, Bitcoin was trading at around $117,090, retreating from its ATH of $123K.

Key Fib support lies at $106,000, with a deeper downside target around $99,000. As long as BTC stays above $106K, the bullish structure is maintained.

Momentum indicators show the need for caution. The RSI is at 65.7, close to the overbought zone. MACD remains bullish but shows weakening momentum. BOP has turned negative at -0.75, and CMF is positive at 0.08, signaling mild accumulation.

If the selling pressure gets stronger, BTC might retest the $106K-$99K level. If it manages a clear breakout above $120K, the next target could reach $130K-$135K. For now, indicators point to a short-term cooling, although the larger trend remains bullish.

That’s the latest information about crypto. Follow us on Google News to stay up-to-date on the world of crypto and blockchain technology.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Get a web trading experience with advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Coinspeaker. $3.5B in Realized Profits: Will Bitcoin Drop Below $110K Again? Accessed on July 16, 2025