Antam Gold Price Chart Today: Latest Trends and Changes – September 4, 2025

Jakarta, Pintu News – The price of gold is often a key reference point for investors, both those focused on long-term investments and those active in trading. Changes in gold prices can provide insight into global economic conditions, inflation, and market uncertainty. Currently, Antam’s gold price shows a significant increase, attracting the attention of many people who are interested in gold investment.

As of September 4, 2025, BRANKAS Corporate’s gold purchase price was recorded at Rp1,984,600 per gram, an increase of Rp9,000 compared to the previous price of Rp1,975,600 per gram. Meanwhile, the physical gold purchase price experienced a similar increase, to IDR 2,044,000 per gram, from the previous price of IDR 2,035,000 per gram.

Antam Gold Price Chart: Significant Changes in Recent Months

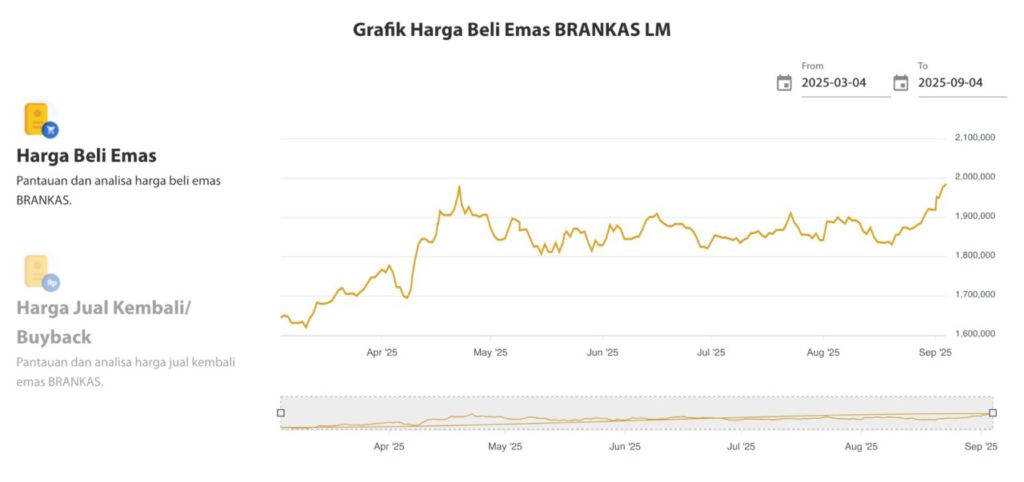

Looking at the graph of Antam’s gold buying price over the past few months, there is a significant upward trend since March 2025. This graph shows price fluctuations, with a very clear price spike in mid-2025, which is likely influenced by global economic factors and high market demand.

From the chart, it can be seen that the price of Antam gold has been rising steadily since early March until now, with prices continuing to move above Rp1,900,000 per gram, reflecting market optimism about the value of gold as a safe haven asset.

Also Read: Ondo Finance could be a crypto dark horse in Q4 2025? Here are 4 ONDO facts to know!

Factors causing the rise in gold prices

This rise in gold prices can be influenced by various economic and geopolitical factors. One of the main factors is global economic uncertainty. When stock markets experience volatility or when there are geopolitical tensions, many investors choose to turn to gold as a safer asset.

In addition, rising global inflation is also pushing up gold prices. When currency values decline due to inflation, gold is often considered an effective hedge. Hence, the demand for gold increases, leading to a rise in its price.

How Does This Gold Price Trend Affect Your Investment?

For investors, the increasing gold price trend can be a golden opportunity to make long-term investments. Although the price of Antam gold has increased, gold is still considered a relatively stable investment compared to other investment instruments, such as stocks or bonds, which are more risky.

However, it is important to keep an eye on price fluctuations that can occur at any time. Along with market developments and economic policies, the price of gold can reverse. Therefore, before making a gold purchase, be sure to monitor the price chart and consult with an investment professional.

Conclusion

Today’s Antam gold price shows a positive trend, with prices continuing to rise in line with global uncertainty and high demand. If you are planning to invest in gold, it is important to pay attention to the continuous price movements and consider the external factors that affect the gold market.

Always do your research and consider your investment goals before buying gold, whether it’s for long-term or short-term purposes. Gold remains an attractive option, despite price fluctuations that need to be watched.

Reference:

- BRANKAS Gold Price. Brankas LM. Accessed Sepetmber 4, 2025