ETH, BNB, DOGE Surge After Flash Crash: Crypto Market Capitalization Hits $4 Trillion!

Jakarta, Pintu News – After Friday’s massive flash crash that wiped out nearly $500 billion from the total crypto market value, the market is now showing strength again. According to a report from Cointelegraph, the overall crypto market capitalization broke the $4 trillion mark again on Sunday (October 13, 2025).

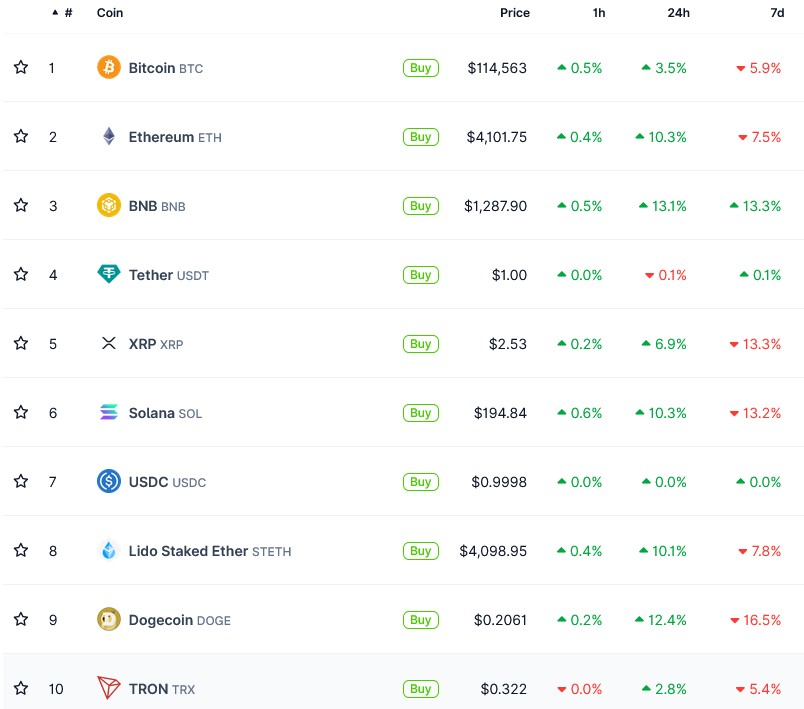

Three major assets – Ethereum , BNB, and Dogecoin – recorded significant gains:

- ETH up 10.5%

- BNB jumps 13.6%

- DOGE increased by 12.5%

Other large assets such as Solana (SOL), Cardano (ADA), and Chainlink also rose by more than 10%, according to data from CoinGecko.

Synthetix rises 100%, micro cap coins explode

The biggest headline-grabber was Synthetix which rose over 100%, even surpassing its pre-crash price and setting a record high of 2025. Other altcoins like Mantle (MNT) and Bittensor (TAO) also saw gains of over 30% in 24 hours.

What Causes Flash Crash?

Friday’s flash crash was triggered by US President Donald Trump’ s announcement of 100% tariffs on China, specifically on exports of rare earth minerals that are important in the production of semiconductor chips. This move sparked global panic, including in the crypto market.

The panic was further exacerbated as the Binance interface briefly displayed zero (0) prices for several altcoins due to an internal oracle glitch on the USDe stablecoin, accelerating the sell-off.

However, the market started to recover after Trump stated that “the US has no intention of hurting China”, which eased tensions and triggered buybacks by investors.

Also Read: 5 Coin Memes Predicted to Explode After Bitcoin Breaks $125,000

Bitcoin retests golden cross, optimism towards $200K?

Although it has not returned to its weekly high of $126,080, Bitcoin is currently trading at $115,585, still down about 4.9% since the start of the downturn.

However, crypto analyst “Mister Crypto” noted that BTC is testing the golden cross technical pattern, a bullish formation that previously preceded it:

- 2,200% increase in 2017

- 1,190% surge in 2020

He mentioned that the current technical structure is “very strong,” and if the breakout is confirmed, then Bitcoin price could explode in the coming weeks.

BitMine and Michael Saylor “Buy the Dip”

BitMine company Immersion Technologies, the largest corporate Ether (ETH) treasury holder, reportedly bought more than 128,700 ETH worth $480 million post-crash, according to data from Lookonchain.

Meanwhile, Strategy’s Michael Saylor also signaled that his firm was adding to its Bitcoin holdings. He posted a graph of Strategy’s BTC holdings on platform X with the caption: “Don’t Stop ₿elievin’.”

Conclusion: Fast Recovery, But Stay Cautious

The resurgence in ETH, BNB, and DOGE prices and the overall market rebound are indications that investor sentiment is still quite strong, even after a major shock. However, analysts also caution that volatility is not over yet and short-term profit-taking could still occur.

For beginner or long-term investors, this event can be a lesson that in the crypto world, a sharp drop can be rewarded with a quick rise, and vice versa.

Also Read: Shocking Prediction of Uniswap (UNI) Price Until 2030 According to CoinCodex!

Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Brayden Lindrea – Cointelegraph. ETH, BNB, DOGE lead as crypto market cap rebounds to $4T. Accessed October 13, 2025.