4 Memecoin Trading Strategy

Memecoins are the king of the current bull market cycle. In the past year, we have had numerous success stories such as WIF, BONK, MOODENG, etc. Every week, new memecoins reach $100 million market cap and every now and then some even reach a one billion market cap . With this frenzy, thousands of investors and traders have embraced memecoin trading. So, how do you ensure success in memecoin trading? We will discuss 5 strategies for trading memecoins.

Article Summary

- 🐕 Memecoins’ Popularity and Risks: Memecoins dominate the current bull market with massive gains, but extreme volatility and low success rates make trading highly risky.

- ⚠️ Solana’s Role in Memecoin Trends: Solana is the leading platform for memecoin launches, but only a tiny fraction of tokens achieve sustainable market caps, highlighting the difficulty of success.

- 👀 Community and Memetic Potential: Successful memecoins rely on strong narratives, attention-driving catalysts, and dedicated communities that fuel market-driven valuations.

- 🔎 Core Strategies for Trading: Key approaches include using Fibonacci retracements for entry points, buying in accumulation zones, tracking momentum shifts (higher highs/lows), and leveraging support/resistance flips after breakouts.

Memecoin Trading: The Success Stories of 2024

Trading memecoins is far harder compared to your typical altcoins. Memecoins are on the edge of the volatility spectrum, where a 100% gain can be erased within hours and even minutes. On the flip side, memecoins can rise by 2,000% in 2 days (CHILLGUY above). So, memecoin trading isn’t for everyone, and most of the time it takes a combination of luck and experience.

Additionally, the VC-oriented and low-float tokenomics of most projects prompt most retail investors to stay away from utility projects and towards memecoins. Memecoins are regarded as fair, community-oriented projects where price and valuation are market-driven.

However, as many people would say, memecoin trading is hard. Experienced veterans utilize tools such as trading bots, token screeners, and smart wallet monitors. Many people jokingly refer to the memecoins sector as ‘the trenches’ because traders fiercely compete with each other as if in a war.

Why trading memecoin is Hard

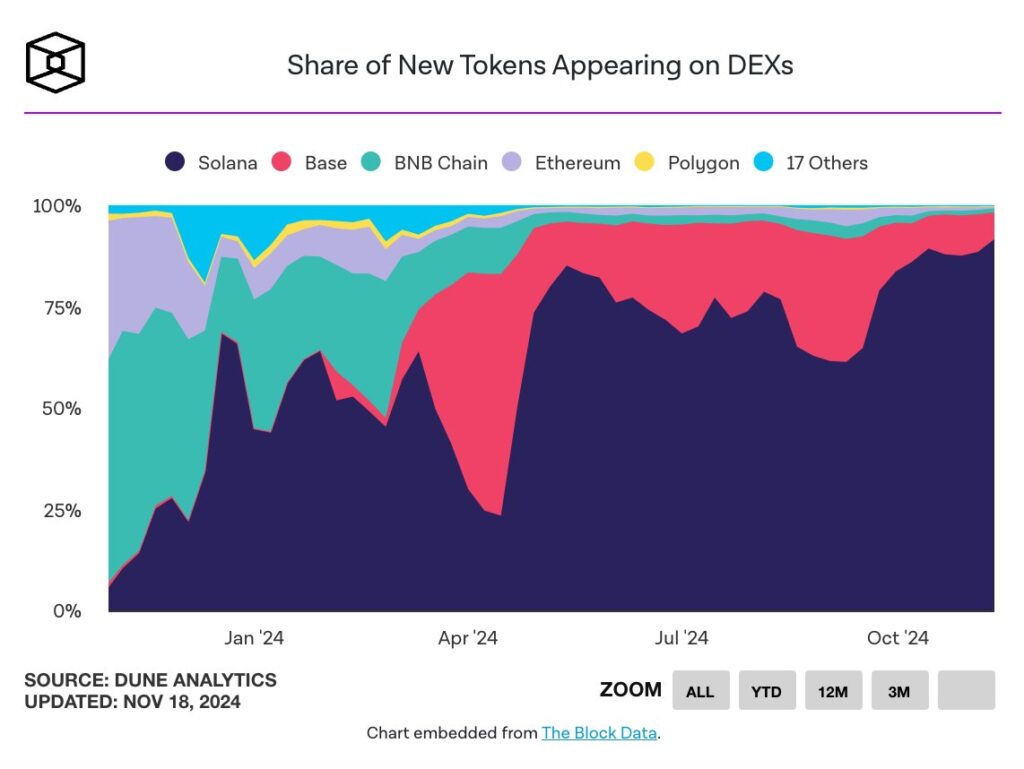

Solana dominates the memecoin sector, as 89% of new token launches come from Solana. Last week, 181,000 new tokens appeared on DEXs. Platforms like Moonshot and Pumpdotfun enable anyone to launch their token.

However, only 1.5% of tokens launched to Raydium and even less (0.0045%) maintain a market cap above $1 million. This is evidence that shows being successful at trading memecoin is extremely hard. The success stories of the ‘Bonk guy’ and ‘WIF millionaire’ are the exception, not the norm. However, some strategies can dramatically improve your chance of spotting the right memecoins.

4 Strategy for Trading and Investing in Memecoins

The first problem of memecoin trading is picking the right one. As previously stated, almost 98% of memecoins will die out within several weeks or months. The trend in ‘the trenches’ moves so fast that most people are left holding their dead coins. So, you need to pick memecoins with good memetic potential, strong attention catalysts, and a ‘cult-like’ community.

Additionally, in the memecoin trenches, buying at the right price is paramount. Buying at the right price can be the difference between a 500% profit or experiencing the first -80% pullback. Understanding momentum, volumes, and patterns will be the differentiator for traders and investors.

1. Fibonacci Retracement

The Fibonacci retracement/extension is one of the most useful trading tools for marking support and resistance. As you can see above, Fibonacci marks important support and resistance levels during crash/pullback. It also facilitates a level-to-level framework for trading.

Several important aspects of trading using Fibonacci:

- The 0.236 and 0.34 are the first two strong supports. If the price holds here, it will likely rebound and attempt at a new all-time high.

- The Fibonacci golden pocket (0.618-0.65) is the best entry point after a large dump.

- The 0.786 is the last strong support in a correction. Almost all memecoins will reach this level. This is the best entry for strong memecoins but also the riskiest because you need to be sure the memecoin will make a comeback.

- Do not blindly buy at each level. Watch for volumes, actions of top holders, and sell pressure.

2. Buying in an Accumulation Zone

An accumulation zone is a price range that forms after a massive dump. An asset in the accumulation zone is building up a base for the next leg up. In memecoins, you can also see that holders are usually changing hands and increasing. Old holders are selling and new holders are coming in.

As with WIF above, the accumulation zone lasted 49 days before it broke out. Another interesting note is the breakout followed by retest. This is one of the most common breakout pattern. Your best option with the accumulation zone is to buy the bottom of the zone or buy on retest.

3. Buying on Momentum Shifts

A momentum shift usually happens on market leaders of a new narrative. After constant price discoveries, momentum shifts to the downside, and the asset experiences its first 60%, 70%, or 80% drawdown. A strong asset usually doesn’t have a long drawn-out accumulation zone, especially in a good market condition.

There are two scenarios after a dump: the asset establishes a solid accumulation zone or its momentum shifts quickly. Asset leaders don’t usually accumulate for a long time in good market conditions.

As the first AI memecoins, GOAT showed immediate strength after experiencing its first major crash. However, within one day it has already broken above and established its first higher low (HL). After that, it continued creating higher lows and higher highs (HH) until it broke through its previous ATH. Besides momentum shifts through HH and HL, watch out for other common patterns such as a double bottom.

4. Buying on Support/Resistance Flip

The classic support and resistance flip is one of the most effective strategies for buying memecoins and altcoins. Support resistance flip happens when an asset breaks out and then does a retest to flip the previous resistance into a new support. CATANA above does a retest into a long-term resistance and flips it into a strong support.

The resistance zone that turned into support also coincides with the Fibonacci golden pocket 0.618 (around 0.019-0.022). Once an asset crash and flips its previously strong resistance into a support, it is a strong buy signal. However, people are often times very fearful to buy at these levels. Getting good at recognizing and taking actions on this signal require experience.

Conclusion

Memecoins are one of the popular categories of the 2024 bull market. While memecoins offer enormous profit potential, their volatility and low success rate make trading them highly challenging. Utilizing tools like Fibonacci retracement, accumulation zones, tracking momentum shifts, and leveraging support/resistance flips can significantly improve success rates. However, success in memecoin trading also requires understanding market dynamics, cultivating experience, and often, a bit of luck. For most traders, cautious optimism and disciplined strategies are key.

References

- Stacy Mur, “The State of Memecoins”, Substack, accessed on 19 November 2024.

- @Cumberlandlabs, “From Rugs to Riches: An Analysis of Memecoin Market Structure”, X, accessed on 21 November 2024.

- @Defiminty, “How to find good entries for memecoins”, X, accessed on 21 November 2024.

- @Coingurruu, ”The Ultimate Memecoin Trading Guide”, X, accessed on 22 November 2024.

Share

Related Article

See Assets in This Article

GOAT Price (24 Hours)

Market Capitalization

-

Global Volume (24 Hours)

-

Circulating Supply

-