Bitcoin Adoption as a Reserve Asset: A New Trend in Digital Finance

The Bitcoin treasury strategy refers to the practice of companies, institutions, and even governments holding large amounts of Bitcoin as part of their cash reserves, strategic assets, or long-term investment portfolios.

This strategy began gaining popularity in 2020, when MicroStrategy made the bold move of adopting Bitcoin (BTC) as a primary asset in its corporate treasury. That decision later inspired other major corporations, including Tesla, Block (Square), and GameStop, to allocate Bitcoin within their own treasuries.

Interestingly, this trend has not been limited to public companies. Several governments have also started to view Bitcoin as a strategic reserve asset. El Salvador became the first country to officially adopt Bitcoin as legal tender while also adding it to its national reserves.

Article Summary

- 💡 What Is a Bitcoin Treasury – A strategy adopted by companies, institutions, and governments to hold Bitcoin (BTC) as part of their cash reserves or long-term investments. Popularized after MicroStrategy’s adoption in 2020.

- 🌍 Global Corporate Adoption – As of 2025, companies collectively hold 979,333 BTC (4.66% of total supply). MicroStrategy remains the largest holder with 629,376 BTC.

- 🏛️ Countries with the Largest Bitcoin Holdings – U.S. (±200,000 BTC), China (±190,000 BTC), Bhutan (±12,500 BTC), U.K. (±61,000 BTC), El Salvador (±6,000 BTC), and Iran (thousands of BTC).

- 📑 Regulation & Taxation – EU’s MiCA framework & U.S. SEC approval of spot Bitcoin ETFs. FASB updated accounting rules (Dec 2023) to fair value accounting, providing greater transparency for corporate balance sheets.

- 🇮🇩 Adoption in Indonesia – By Q1 2025, crypto investors reached 14.16 million (3rd globally), with monthly transactions at Rp35.61 trillion. The government is exploring Bitcoin as part of its national reserves.

Global Companies Adopting Bitcoin as Treasury

According to the latest data from CoinMarketCap, companies currently hold a total of 979,333 BTC. This amount represents 4.66% of Bitcoin’s maximum supply of 21 million BTC.

Here are the top 10 companies with the largest Bitcoin holdings:

| Company | Bitcoin Holdings |

|---|---|

| MicroStrategy | 629,376 |

| MARA Holdings, Inc. | 50,639 |

| XXI | 43,514 |

| Bitcoin Standard Treasury Company | 30,021 |

| Bullish | 24,000 |

| Riot Platforms, Inc. | 19,287 |

| Metaplanet | 18,888 |

| Trump Media & Technology Group Corp. | 15,000 |

| CleanSpark, Inc. | 12,703 |

| Coinbase Global, Inc. | 11,776 |

Why Companies Choose Bitcoin as a Reserve Asset

The Bitcoin corporate treasury strategy is gaining momentum because it provides greater flexibility for corporate finance and operations. The key reasons include:

- Global liquidity and flexibility

Bitcoin can be traded anytime, anywhere. For multinational companies, holding Bitcoin helps simplify cross-border transactions and provides faster access to liquidity. - Hedge against inflation

With its fixed supply of only 21 million coins, Bitcoin is considered more resistant to inflation compared to fiat currencies that can be printed indefinitely. BTC’s strong performance over the past decade reinforces this view. - Asset diversification & growth potential

Allocating funds into Bitcoin allows companies to diversify beyond traditional assets like bonds or cash. Many investors and corporations now see BTC as a long-term investment, similar to gold or stocks. - Attracting traditional investors

By including Bitcoin in their balance sheets, companies can attract institutional investors who cannot directly purchase crypto. Instruments like convertible bonds or Bitcoin-linked stocks give traditional investors indirect exposure to cryptocurrency in a regulated way.

Risks of Holding Bitcoin in Corporate Treasury

While the number of companies holding Bitcoin continues to grow, it is important to assess the risks objectively:

- Price volatility

Bitcoin’s sharp price swings can affect corporate financial statements and liquidity. A sudden drop in BTC’s price could weaken a company’s financial position depending on its strategy. - Distraction from core business

Overemphasis on Bitcoin may divert management’s focus away from the company’s main operations, potentially harming its long-term strategic direction.

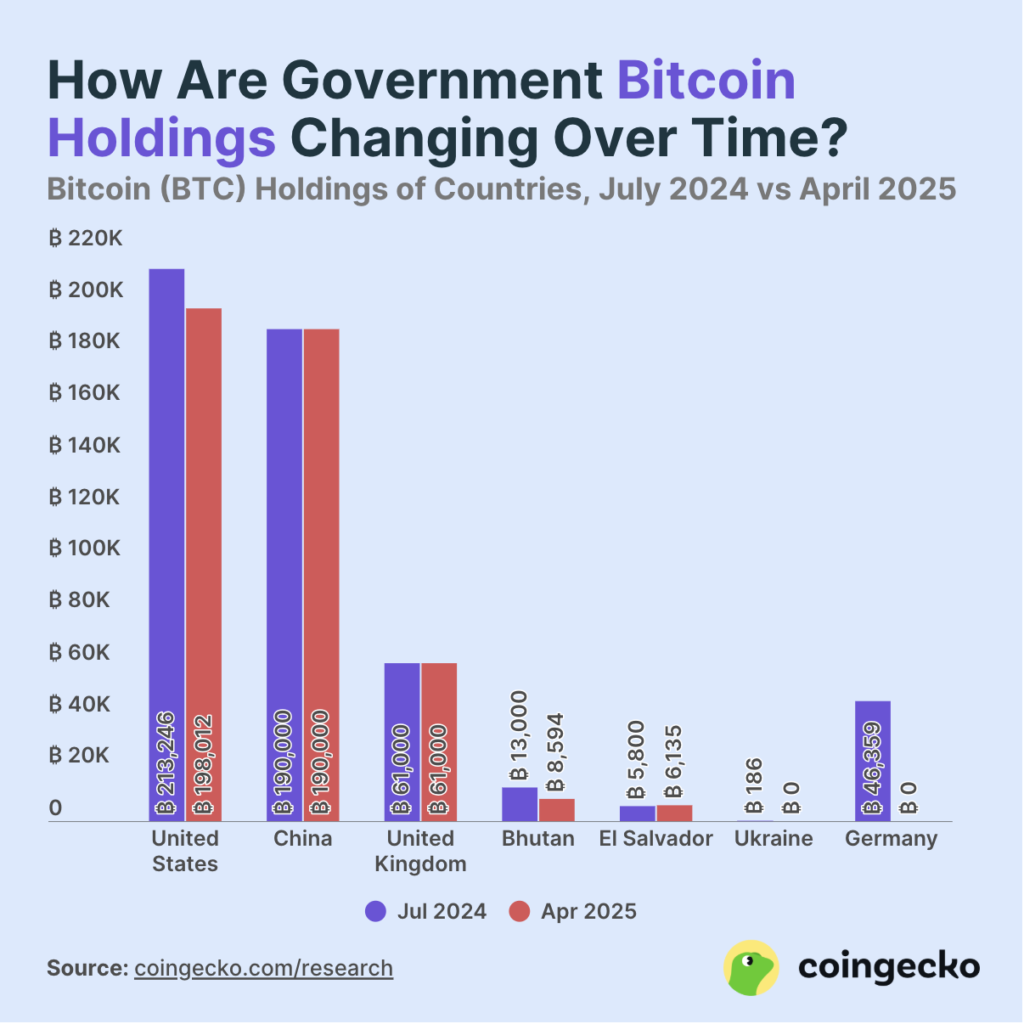

Top 6 Countries Holding Bitcoin in 2025

Bitcoin adoption as a reserve asset is no longer limited to companies but has also extended to nation-states. According to a Coingecko study (April 2025), governments collectively hold around 463,000 BTC, or 2.3% of total supply.

| Country | Estimated Holdings | Source of BTC | Key Notes |

|---|---|---|---|

| United States | ±200,000 BTC | Seized assets (Silk Road, ransomware, etc.) | Formed Strategic Bitcoin Reserve in March 2025 |

| China | ±190,000 BTC | Seized from PlusToken scam (2019) | Held in cold storage despite crypto ban |

| Bhutan | ±12,500 BTC | Renewable energy mining (hydropower) | 30–40% of GDP, managed by Druk Holding & Investments |

| United Kingdom | ±61,000 BTC | Seized in money laundering cases (2021) | Managed by Metropolitan Police & CPS, considered for reserves |

| El Salvador | ±6,000 BTC | Direct government purchases | “1 BTC per day” program, despite legal tender status revoked |

| Iran | Thousands (est.) | Licensed mining, sold to Central Bank | Controlled up to 4–7% of global hash rate at peak |

Bitcoin vs. Traditional Reserve Assets

Gold and oil have long served as the backbone of national reserves, providing monetary stability and energy security. However, Bitcoin (BTC), with its capped supply and decentralized nature, is beginning to challenge traditional paradigms.

Each asset—gold, oil, and Bitcoin—has unique characteristics in terms of value, liquidity, volatility, storage cost, and strategic role in the global economy.

| Aspect | Gold | Oil | Bitcoin (BTC) |

|---|---|---|---|

| U.S. Reserves Value | 8,133 tons (Rp12,842T) | 372M barrels (Rp455T) | 200,000 BTC (Rp258T) |

| Liquidity | Very high, > Rp3,200T/day | Linked to industry & geopolitics | High, Rp487–Rp812T/day |

| Volatility | Low–moderate | High, OPEC/geopolitical impact | Very high, speculation-driven |

| Storage Costs | Expensive (vault, insurance, transport) | Very costly (SPR infrastructure) | Relatively cheap (digital custody) |

| Security Risks | Theft, authenticity issues | Depreciation, contamination | Cyberattacks, lost private keys |

| Strategic Role | Inflation hedge, monetary reserve | Energy/geopolitical stability | Inflation hedge, decentralized alternative |

| Availability | Limited but still mined | Limited & geopolitically influenced | Fixed 21M BTC |

Impact of Bitcoin Adoption on Price and the Crypto Market

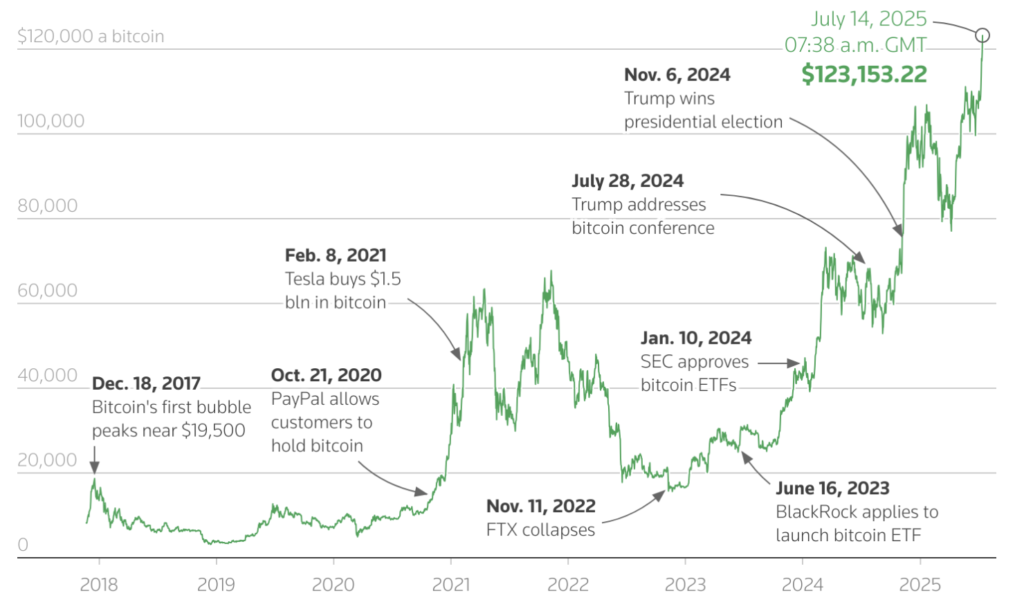

Bitcoin (BTC) adoption surged in 2025, driven by institutional investors, the approval of Bitcoin ETFs, and growing interest from governments as a strategic reserve.

On July 14, 2025, Bitcoin hit an all-time high of $123,153 (≈ Rp2 billion), marking its strongest performance yet.

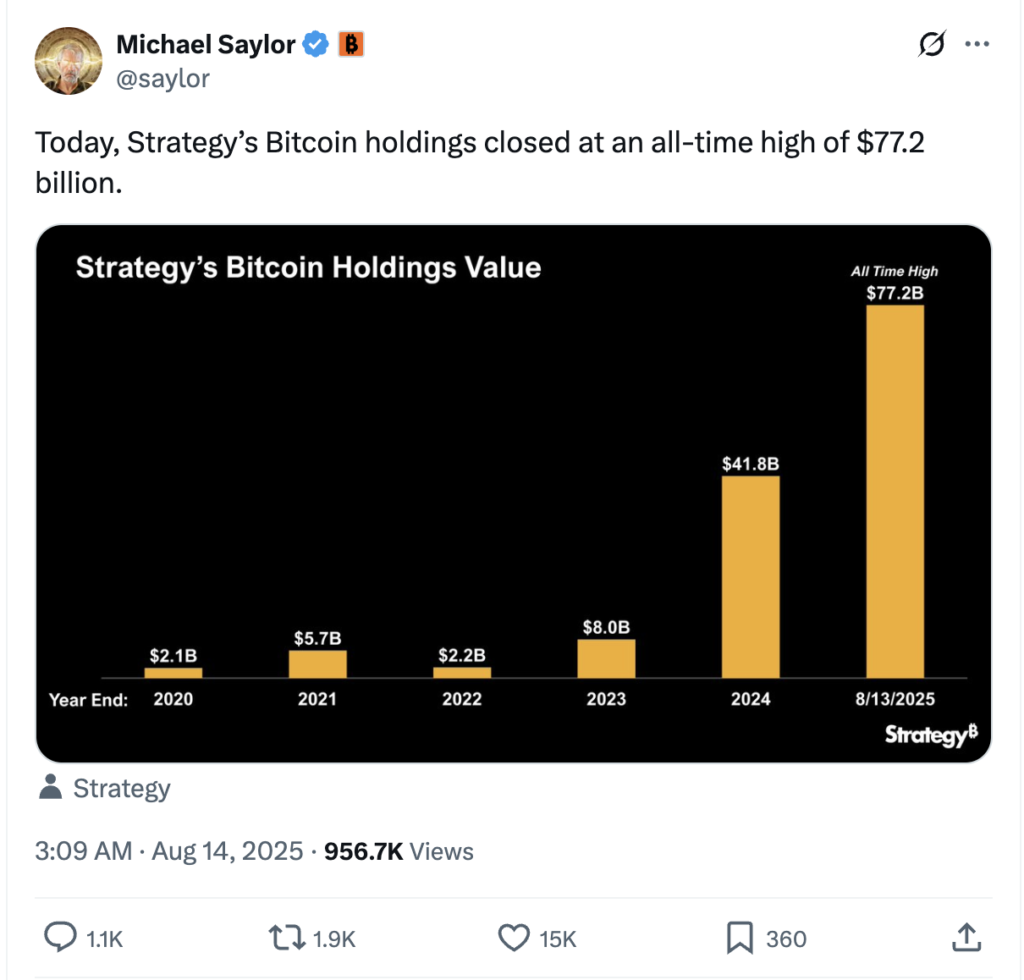

MicroStrategy’s Bitcoin Holdings Reach $77.2 Billion

MicroStrategy, under CEO Michael Saylor, remains the largest corporate Bitcoin holder with 629,376 BTC. Since August 2020, the company has consistently added to its holdings.

As BTC’s price climbed, the value of MicroStrategy’s holdings surged to a record $77.2 billion—an increase of $35.4 billion from its previous record of $41.8 billion in 2024.

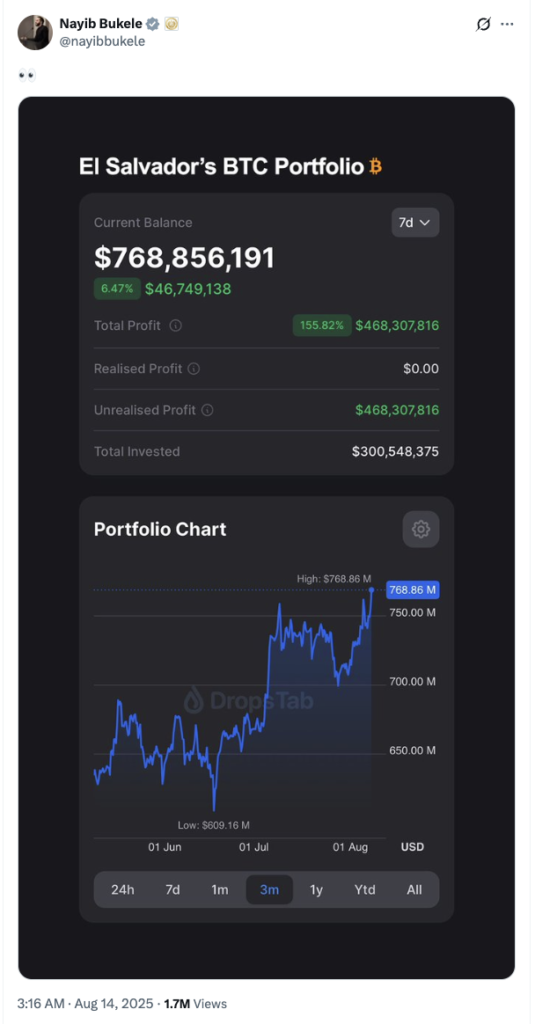

El Salvador’s Bitcoin Holdings Reach $768 Million

El Salvador’s bold Bitcoin strategy has also paid off. President Nayib Bukele announced unrealized profits of $468.3 million from the country’s Bitcoin reserves.

With an initial investment of $300.5 million, El Salvador’s holdings are now worth $768.8 million. The country celebrated this milestone, calling it proof that its national Bitcoin strategy has “borne fruit.”

Regulation and Taxation on Corporate Bitcoin Treasury

Evolving crypto regulations worldwide have boosted confidence among investors and corporations adopting Bitcoin (BTC) as treasury reserves. Clearer frameworks, such as the EU’s MiCA regulation and the U.S. SEC’s approval of spot Bitcoin ETFs in January 2024, provide legal certainty and market transparency.

Additionally, in December 2023, the Financial Accounting Standards Board (FASB) changed accounting standards for digital assets. Under fair value accounting, Bitcoin can now be recorded at current market value.

Previously, companies could only record impairment losses without acknowledging gains. The new rule gives a more accurate view of Bitcoin’s real value on balance sheets, improving financial transparency.

Bitcoin Adoption Trends in Indonesia and Globally

In Q1 2025, Indonesia had 14.16 million crypto investors, ranking 3rd globally in digital asset adoption. Monthly crypto transactions reached Rp35.61 trillion. This growth reflects rising adoption, projected to reach 16.98% of the population by 2026.

Corporate involvement is also accelerating. In 2025, corporate Bitcoin accumulation outpaced inflows from retail investors and ETFs, making corporations a key driver of adoption.

Indonesia Exploring Bitcoin as National Reserves

The Indonesian government is exploring Bitcoin as part of its national reserves. The Bitcoin Indonesia community was invited to present its proposal at the Vice President’s office.

They highlighted potential strategies such as Bitcoin mining powered by renewable resources (hydroelectric and geothermal). The initiative could boost economic growth and create new jobs, as seen in other nations adopting Bitcoin nationally.

Expert Predictions on Global Crypto Adoption

A Chainalysis report (Oct 2024) highlighted regional differences in crypto adoption due to economic conditions, regulations, and infrastructure. Forbes noted that clearer regulations will be critical in pushing global adoption to the next level.

Coinbase CLO Paul Grewal expressed optimism on X that comprehensive U.S. crypto regulations could emerge soon through collaboration between Congress and the White House.

Similarly, Blockchain Association CEO and former CFTC Commissioner Summer Mersinger stressed the urgent need for consistent and well-structured digital asset regulations.

Meanwhile, Alex Gladstein from the Human Rights Foundation emphasized Bitcoin’s collaborative and decentralized nature. He argued that Bitcoin could expand financial access, strengthen economic resilience, and support human rights globally.

Conclusion

Bitcoin adoption as a reserve asset is rapidly expanding, embraced not only by corporations like MicroStrategy and Tesla but also by governments such as El Salvador, the U.S., and China.

With its limited supply, global liquidity, and role as an inflation hedge, Bitcoin is increasingly seen as a strategic alternative to gold and oil.

Although risks remain due to volatility and regulatory challenges, the 2025 trend highlights Bitcoin’s growing relevance in global finance, making it a strong candidate for long-term corporate and national strategies.

💡 Disclaimer: All Pintu Academy articles are for educational purposes only and should not be considered financial advice.

References:

- Bitcoin Magazine. Bitcoin Price Breaks $123,000, Bullish Momentum Targets $125,000. Accessed August 25, 2025.

- Binance Academy. What Is a Bitcoin Treasury Strategy?. Accessed August 25, 2025.

- Business Indonesia. Crypto Investor Reaches 14 Million in Indonesia, Ranks Third in Global Crypto Adoption. Accessed August 25, 2025.

- Cointelegraph. US Bitcoin reserve vs. gold and oil reserves: How do they compare?. Accessed August 25, 2025.

- Coingecko. Governments Now Hold 2.3% of All Bitcoin. Accessed August 25, 2025.

- Forbes. What Is Crypto Adoption, And Is It Increasing? Examining Global Growth In 2025. Accessed August 25, 2025.

- Ledger. Bitcoin Treasury. Accessed August 25, 2025.

- Trust. Why is MicroStrategy Buying Bitcoin?. Accessed August 25, 2025.

Share

Table of contents

Related Article

See Assets in This Article

BTC Price (24 Hours)

Market Capitalization

-

Global Volume (24 Hours)

-

Circulating Supply

-