BlackRock’s Role in the Crypto Industry: Exploring ETHA and the World of Crypto ETFs

In today’s ever-evolving financial landscape, BlackRock is steadily expanding its influence in the crypto space through strategic investments and innovative products that are shaping the future of digital assets.

As the world’s largest asset manager with over $9 trillion in assets under management, BlackRock is not only a dominant player in traditional markets but is also becoming a force in the cryptocurrency sector.

One of its biggest contributions is the launch of several crypto-related products, including exchange-traded funds (ETFs) such as ETHA, the iShares Ethereum Trust ETF, which is redefining how institutional investors gain exposure to digital assets.

Article Summary

- 💼 BlackRock’s Role in Crypto: The firm is strengthening its presence in the crypto industry with products like ETHA and iShares Ethereum Trust ETF, making it easier for institutional investors to access Ethereum.

- 🔒 Key Features of ETHA: ETHA gives investors direct exposure to Ethereum’s price movements without the hassle of storage or security risks. Managed by BlackRock, it ensures transparency and strict regulatory compliance.

- 🌍 ETHA’s Impact on Crypto: As an ETF, ETHA bridges traditional finance with the volatile crypto market, offering a safer gateway for institutional adoption of Ethereum.

- 🔗 BlackRock’s Crypto Partnerships: Collaborations with major projects like Coinbase and Circle extend its reach, accelerating blockchain and crypto adoption in institutional markets.

- 💡 The Future of BlackRock in Crypto: By expanding its crypto offerings and building strategic alliances, BlackRock is set to play a pivotal role in connecting traditional finance with DeFi, delivering more regulated and trusted investment opportunities.

BlackRock’s Major Role in Crypto through ETFs

For years, BlackRock cautiously approached the world of cryptocurrency. This stance shifted as the firm recognized digital assets’ potential for portfolio diversification and as a hedge against inflation.

Its involvement now spans blockchain investments, Bitcoin futures trading, and the rollout of innovative crypto ETFs. BlackRock’s entry into the crypto market brings greater legitimacy to digital assets while giving institutional investors a regulated path to participate.

Does ETHA Pay Dividends?

No, the iShares Ethereum Trust ETF does not pay dividends. This is typical for crypto-focused ETFs since digital assets like Ethereum generally don’t generate dividend income. Instead, ETHA’s value is expected to rise in line with ETH’s price appreciation.

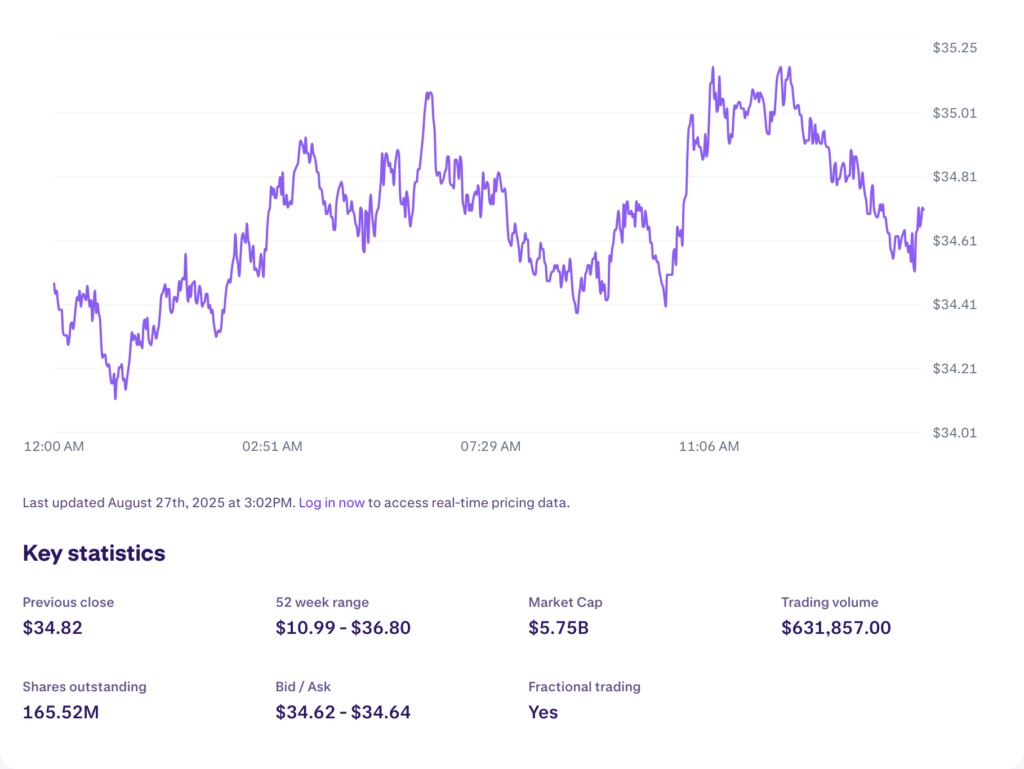

According to Kraken data (as of August 27, 2025), ETHA’s trading volume was about $631,857, with shares priced at $34.81 each. Though still relatively new, trading volume may grow as investor interest in Ethereum increases, bolstered by BlackRock’s reputation.

ETHA may be suitable for investors confident in Ethereum’s long-term potential and seeking a regulated vehicle for exposure—though crypto’s high volatility means some may prefer to wait for more favorable conditions.

Does ETHA Offer Staking Rewards?

No, ETHA does not provide staking rewards. While ETH itself can generate staking yields on the Ethereum network, ETFs like ETHA only reflect ETH’s market price and do not pass staking rewards to shareholders.

This aligns with most U.S.-based crypto ETFs, which focus solely on asset price exposure rather than additional services like staking or lending.

BlackRock’s Collaborations in Crypto

BlackRock has partnered with leading crypto firms to strengthen its market presence. Its work with Coinbase, the largest U.S. crypto exchange, gives institutional clients access to digital asset trading.

It also teamed up with Circle, the company behind the USDC stablecoin, to promote stablecoin adoption and blockchain innovation. Additionally, BlackRock launched the BlackRock USD Institutional Digital Liquidity Fund (BUIDL) in collaboration with Securitize, leveraging blockchain tokenization backed by cash and U.S. Treasury bonds to deliver daily yield directly to investors’ digital wallets.

How ETHA Differs from Other Crypto ETFs

The main difference between ETHA and other Ethereum ETFs—such as FETH (Fidelity Ethereum ETF)—lies in management and structure.

While both track ETH’s performance, FETH is managed by Fidelity, another global financial giant, and may differ in fees, regulations, and risk profile.

Investors choosing between ETHA and FETH should weigh factors like fund management style, costs, and their desired level of exposure to Ethereum.

The Future of BlackRock in Crypto

BlackRock’s move into crypto, particularly with ETHA, underscores its forward-looking strategy and recognition of blockchain’s growing role in the global economy. As more institutions express interest in cryptocurrencies, BlackRock’s products will likely serve as critical bridges between traditional finance and decentralized finance .

With BlackRock’s backing, ETHA offers investors a secure, regulated gateway into Ethereum. Still, investors should conduct due diligence and consider their risk tolerance before investing in such a volatile asset class.

In addition, BlackRock’s iShares Bitcoin Trust (IBIT) has become one of the standout spot Bitcoin ETFs since its launch in January 2024. Thanks to BlackRock’s reputation and competitive fees, IBIT has consistently recorded the highest trading volumes and inflows among Bitcoin spot ETFs, surpassing rivals from Fidelity, Ark Invest, and Grayscale.

Buy Crypto Assets on Pintu

Interested in investing in crypto assets? With Pintu, you can buy a variety of crypto assets like BTC, ETH, SOL, and more, without the hassle. Additionally, all crypto assets available on Pintu have undergone a strict vetting process, prioritizing caution and security.

Pintu’s app is also compatible with various popular digital wallets like Metamask

Disclaimer: All articles from Pintu Academy are intended for educational purposes and are not financial advice.References:

- Bitget. How Does BlackRock Work in the Crypto Industry? Accessed August 27, 2025

- The Block. BlackRock to offer crypto access to institutional clients through Coinbase deal. Accessed August 27, 2025

- Bloomberg. BlackRock, Fidelity Back Stablecoin Firm Circle in $400 Million Funding Round https://www.bloomberg.com. Accessed August 27, 2025

- Ledger Insights. BlackRock funds, Temasek, Tiger invest another $420m in FTX crypto exchange at $25 billion valuation. Accessed August 27, 2025

- rwa. BlackRock USD Institutional Digital Liquidity Fund. Accessed August 29, 2025

Share

Table of contents

Related Article

See Assets in This Article

ETH Price (24 Hours)

Market Capitalization

-

Global Volume (24 Hours)

-

Circulating Supply

-