BTC Staking: The Future of Bitcoin DeFi?

In the past 2 years, the Bitcoin ecosystem has undergone significant developments. Ordinals became the catalysts for further developments into infusing additional utilities into BTC. Ordinals then evolve into Runes. More recently, DeFi entered the picture with staking protocols launching on Bitcoin. This led to speculations of fully-fledged DeFi on Bitcoin. So, is DeFi on Bitcoin finally a reality? How does Bitcoin DeFi work? We’ll discuss it in detail.

Article Summary

- Evolution of Bitcoin DeFi: The Bitcoin ecosystem has seen rapid growth with the introduction of DeFi elements, evolving from Ordinals to Runes and now full-scale DeFi protocols using Bitcoin L2s.

- Key Players: Babylon Finance and Solv Protocol are leading the way in BTC staking, enabling Bitcoin to act as a yield-bearing asset and enhancing interoperability with other blockchains.

- Advantages of Bitcoin DeFi: Bitcoin’s unmatched security, liquidity, and untapped potential make it an ideal candidate for DeFi projects, offering unique opportunities compared to other blockchains.

- Challenges and Future Outlook: Despite promising growth, Bitcoin DeFi is still in its early stages, and these protocols’ long-term resilience and security have yet to be fully tested.

What is Bitcoin DeFi or BitcoinFi?

BTCFi, BitcoinFi, or just Bitcoin DeFi is a term for expanding DeFi into Bitcoin. Developers have been trying to develop DeFi on Bitcoin for the past few years. This finally came to fruition in the past few years as DeFi on Bitcoin started to pop up in the form of L2s and protocols.

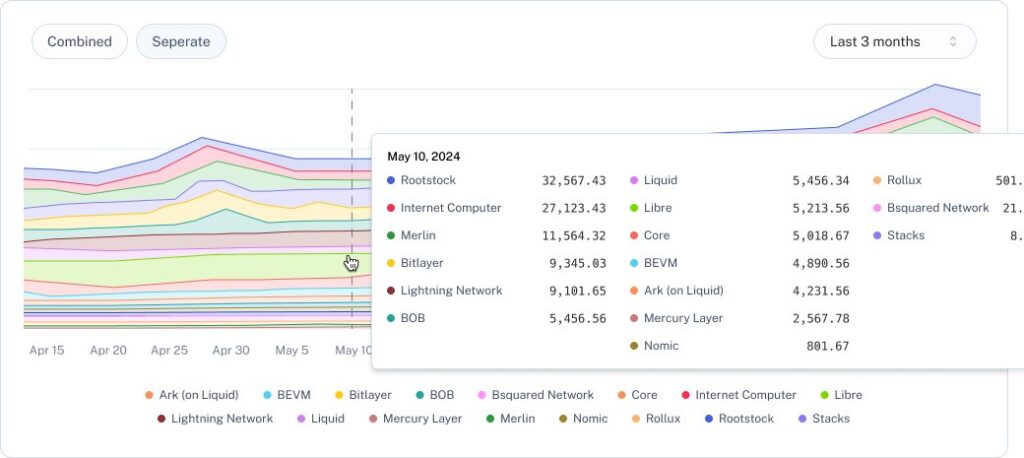

Right now, the easiest way to use DeFi on Bitcoin is to interact with Bitcoin L2s such as Rootstock, Stacks, and Merlin Chain. Franklin Templeton said that Bitcoin TVL reached $2,9 billion in Q1 2024. Regardless, development in the Bitcoin ecosystem has grown in the last few years.

Full stack Bitcoin L2 like Merlin and Stacks already has a suite of DeFi products such as lending and DEX. On the apps side, protocols like Sovyrn are already live on several Bitcoin L2s—with $63 million in TVL—to provide lending and trading for several assets. Sovryn explained that Bitcoin DeFi is just taking its first steps.

Despite the limited tools, several Bitcoin DeFi projects were launched with a resounding success. One of the most hyped projects is Babylon Finance with its innovative Bitcoin restaking protocol. The developers at Babylon figured out a way to utilize BTC to secure other PoS blockchains, essentially making BTC a yield-bearing asset.

What Makes DeFi on Bitcoin Better Than on Other L1s?

- Security: As the oldest blockchain, Bitcoin has unparalleled and almost impenetrable security. This is ideal for DeFi, especially when we talk about institutional funds.

- Liquidity: Bitcoin is the most liquid cryptocurrency in the industry. It is the easiest crypto asset to find anywhere in the world. With billions of daily trading volumes, liquidity is not a problem for BTC.

- Untapped Opportunity: Millions of BTC are currently sitting idle in centralized and decentralized wallets. Compared to assets like SOL or ETH, BTC is very unproductive as holders cannot utilize their assets. Projects are

How Does DeFi on Bitcoin Work?

DeFi on Bitcoin works very differently than on PoS blockchains such as Ethereum or Solana. Ethereum and Solana have Turin-complete programming languages capable of complex computation. On the other hand, Bitcoin was created as a medium of exchange so it never needed complex functions. The Bitcoin network can only perform minimal calculations.

So, creating DeFi on Bitcoin always involves off-chain elements as no protocols can build DeFi products fully on-chain yet. This is why Bitcoin L2s are needed when it comes to Bitcoin DeFi. What differentiates between all the L2s is how they connect to the Bitcoin network.

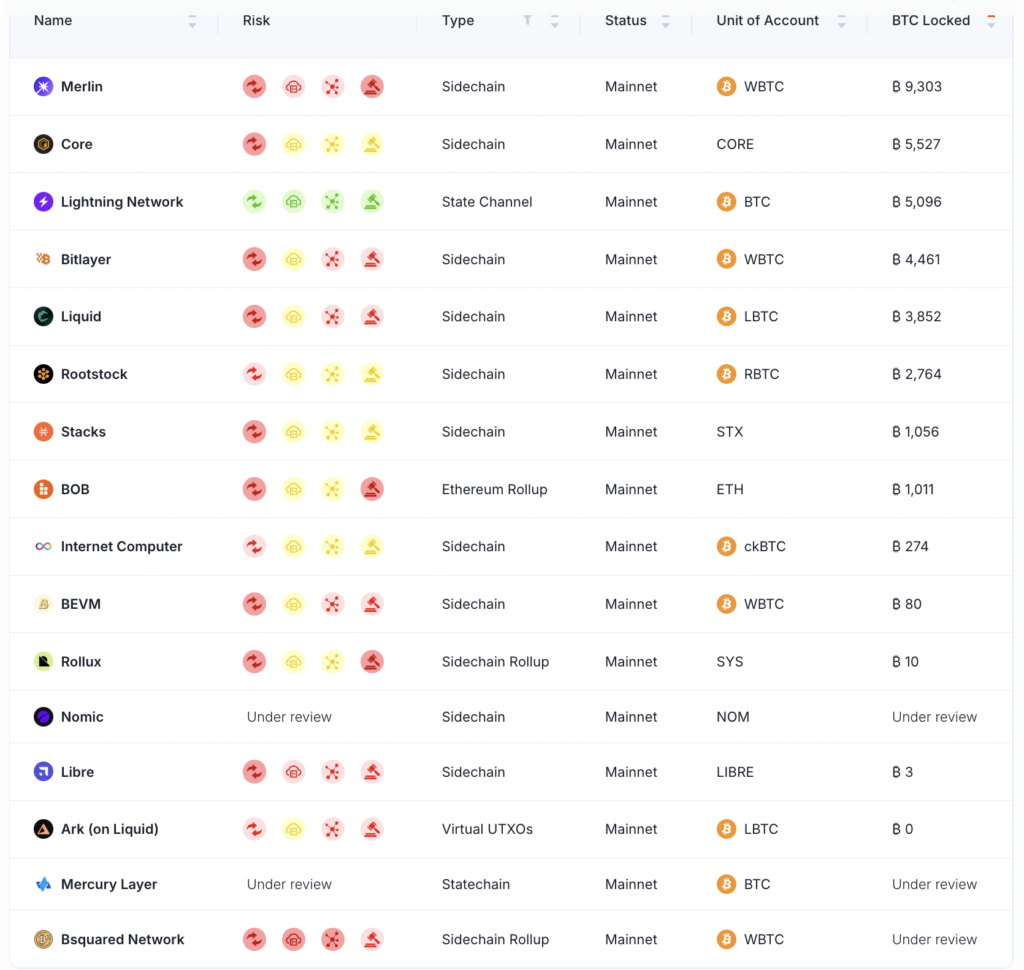

Ideally, the L2s have real-time syncs with Bitcoin blocks and have a decentralized bridge. Bitcoin layers are the L2Beat of Bitcoin and provide various information on the current state of the Bitcoin L2 ecosystem. As seen above, when it comes to security and decentralization most L2s are still lacking. Most Bitcoin L2s utilize centralized bridges with custody and don’t truly inherit Bitcoin’s security.

Exploring Bitcoin DeFi Projects

1. Babylon: Enabling BTC Staking

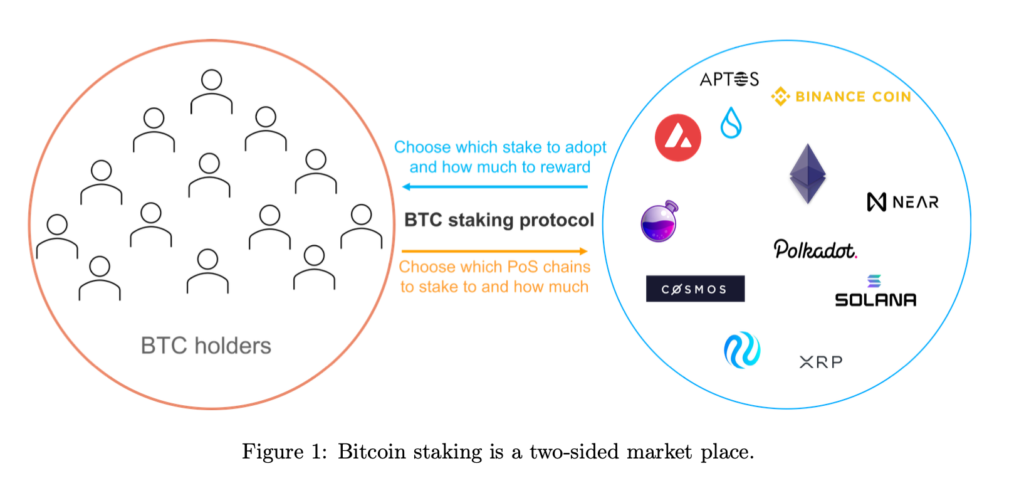

Babylon is an innovative Bitcoin staking protocol. Babylon Finance enables self-custodial staking for BTC holders by sending a staking contract on the Bitcoin network. Then, the locked BTC will be used as a stake to validate PoS chains such as Ethereum or Solana—enabling restaking for BTC similar to Eigenlayer on Ethereum. Babylon turns BTC into a productive yield-bearing asset.

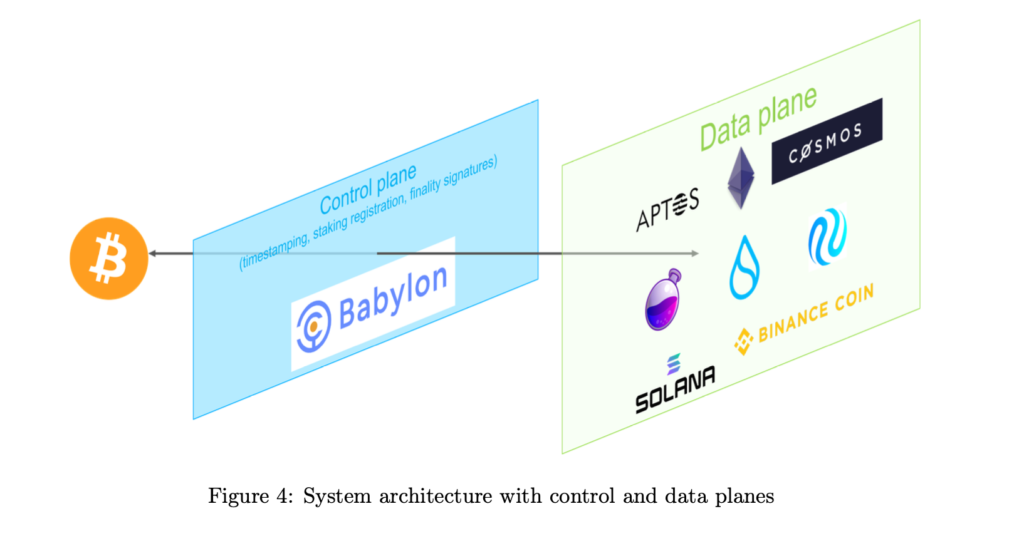

Babylon enables BTC staking through three crucial components: staking contracts on Bitcoin, automated slashing, and Bitcoin timestamping protocol. The staking contract on Bitcoin is a set of specialized UTXO transactions designed to emulate staking. For slashing, Babylon creates Extractable One-time Signatures (EOTS) to automatically slash a staker’s BTC by sending it to a burn address. Lastly, Babylon will create a Bitcoin timestamping protocol to enable real-time sync with Bitcoin’s blocks.

To house the two critical components of Bitcoin timestamping and automated slashing, Babylon will launch its own PoS chain using Cosmos SDK. So, the Babylon chain will act as the control plane that connects validated PoS chains and the Bitcoin network.

Babylon Finance has said that it will launch its protocol in three phases. The first phase will lock a limited amount of BTC in Babylon’s staking contract. This was done on 22 August, with a 1,000 BTC staking cap filled within one day. The next two phases will involve the launching of the Babylon chain, activating BTC staking for PoS chains and enabling a multi-staking mechanism.

Babylon’s BTC staking is a modular protocol compatible with all PoS chains using a BFT consensus mechanism, especially Cosmos-based PoS chains.

2. Solv Protocol: Unifying BTC Liquidity

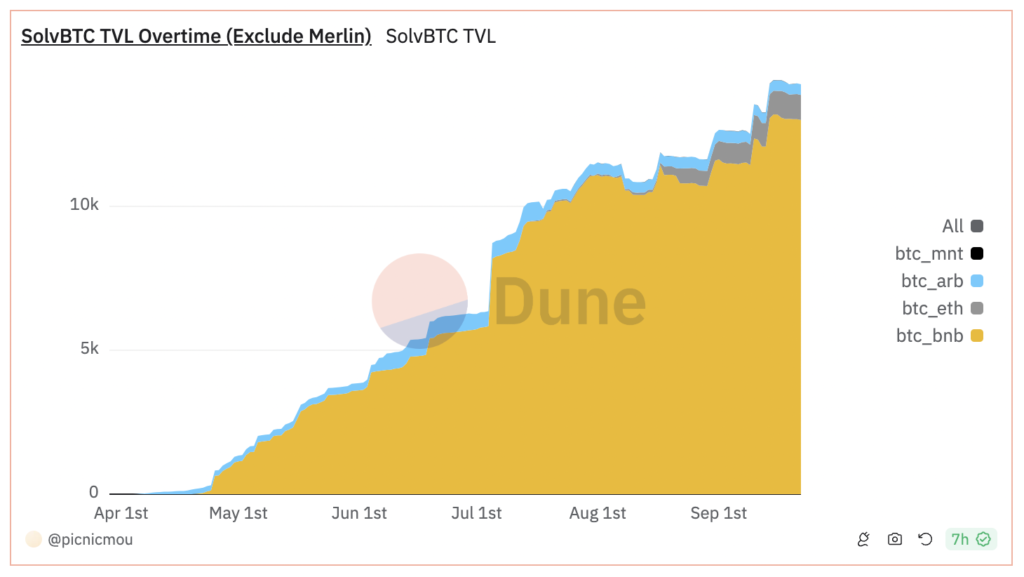

Solv is a BitcoinFi protocol aiming to create a decentralized Bitcoin reserve through SolvBTC. The protocol creates a staking app similar to Babylon but with a vastly different strategy and architecture. The protocol utilizes its liquid-staked BTC in SolvBTC for DeFi activities across multiple PoS chains. Currently, SolvBTC is active on Ethereum, Avalanche, Mantle, BOB, Merlin, Arbitrum, and BNB.

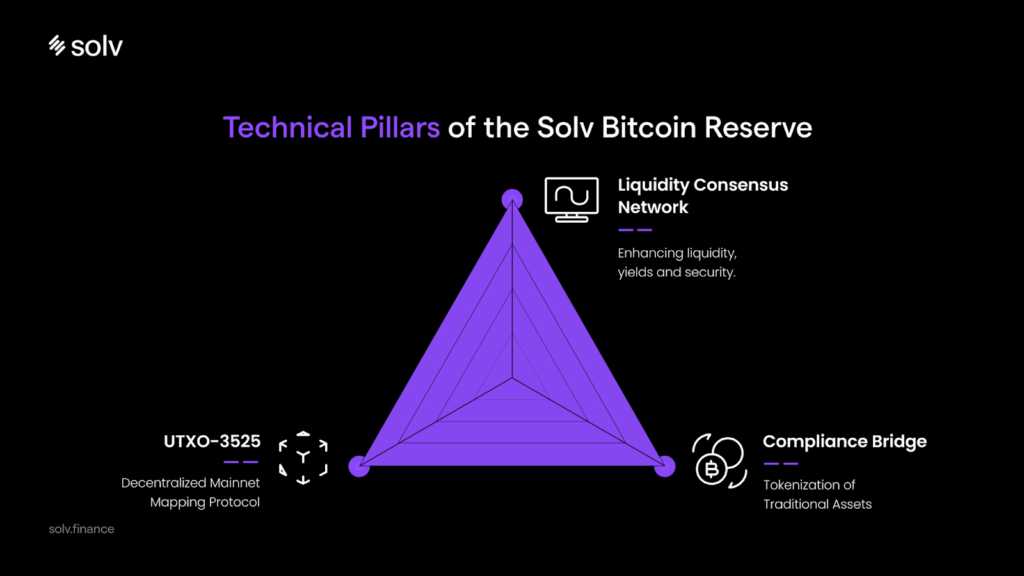

Solv was built on three technological pillars: Liquidity Consensus Network (LCN), Compliance Bridge, and UTXO-3525. So, these pillars ensure the smooth cross-chain movement of SolvBTC and a transparent, compliant reserve of BTC for TradFi (Traditional Finance) investors.

Solv has been building partnerships left and right with various protocols building on Bitcoin and other chains. On Bitcoin, Solv has partnered with other Bitcoin staking and liquid staking protocols such as Babylon, Satlayer, Mezo, and Lombard. On EVM chains, Solv has partnerships with Ethena, GMX, Fuel, Avalon, and Karak. The total TVL of Solv Protocol is $1,1 billion (as of 29 August 2024).

Solv Protocol positioned itself as a unique Bitcoin staking protocol that caters to institutional and crypto investors. It doesn’t aim to be fully decentralized and secure like Babylon but instead aims to be as compatible as possible with multiple protocols and chains. Solv inherits its security and decentralization from a diversified basket of assets backing SolvBTC. With a TVL of $1 billion within a few months, Solv has already become the go-to protocol for BTC yield.

BTC Staking as the Future of Bitcoin DeFi

The quest for DeFi on Bitcoin seems to be edging closer and closer. Staking enables additional utilities for BTC through composability and interoperability with various chains. Solv and Babylon are some of the most popular staking protocols on Bitcoin. Both enable BTC to be a yield-bearing asset while still maintaining decentralized security.

Additionally, more protocols and Bitcoin L2s are adopting staking to tap into the Bitcoin DeFi market. Satlayer and Lombard are two additional protocols building on top of Babylon’s innovative staking model. Lombard creates a Bitcoin LRT called LBTC that can be utilized across many DeFi protocols. Meanwhile, Satlayers is similar to Eigenlayer which provides BTC security for other chains or protocols—called BVS or Bitcoin Validated Service.

Furthermore, traders and investors can monitor the BTC staking sectors to look for airdrop opportunities and be early to potential sector leaders. For example, you can farm multiple rewards for protocols like Lombard, Satlayer, and Babylon. Currently, these three protocols are intertwined so interacting with one will get you a reward from all three.

However, many of these protocols are still in the early stages. Babylon has yet to launch its staking and restaking model fully. So, in the long term, we don’t know if BTC staking has the resiliency and security to support a full-fledged DeFi on Bitcoin.

Conclusion

In recent years, the Bitcoin ecosystem has experienced significant advancements, particularly with the introduction of DeFi projects that enhance Bitcoin’s utility. Innovations like Ordinals, Runes, and various Bitcoin L2s have paved the way for Bitcoin DeFi. Now, a new wave of innovations begins with protocols such as Babylon allowing BTC holders to participate in yield-generating activities. While these protocols demonstrate the potential for proper DeFi on Bitcoin, they are still very early in development.

References

- Sovyrn, “Bitcoin DeFi: A Guide to Decentralized Finance”, accessed on 16 September 2024.

- Babylon, “Babylon Labs – Forkless Rollups with Bitcoin Staking”, accessed on 16 September 2024.

- Solv, “Introduction to Solv Protocol”, Solv Documentation, accessed on 17 September 2024.

- Solv Protocol, “Solv’s Grand Vision: To Be A Decentralized Bitcoin Reserve,” Medium, accessed on 17 September 2024.

- Picnicmou, “Solv Protocol: Bitcoin Staking,” Dune Analytics, accessed on 17 September 2024.

- @Matrixthesun, “The most anticipated launch of 2024 is upon us! The BTC DeFi space is set to be revolutionized by the mainnet launch of @babylonlabs_io,” X, accessed on 18 September 2024.

- @Defimedivh, “In the last bull, there were 1000x opportunities A good way to spot these gems early is to follow the big-money,” X, accessed on 18 September 2024.

- Lombard, “Introducing Lombard & LBTC,” accessed on 19 September 2024.

- Arndxt, “The Next Big Bet – Satlayer’s $8M Pre-Seed Round and Babylon’s Mainnet Launch Set the Stage”, Threading on The Edge Substack, accessed on 19 September 2024.

Share