Introduction to DeFi in the Terra Ecosystem

Terra is a cryptocurrency with a specialized ecosystem to meet the needs of digital payments and the DeFi protocol that offers various financial services. Terra’s financial ecosystem is built on its algorithmic decentralized stablecoin, Terra USD (UST). The increasing use of UST has also fueled the growth of Terra’s DeFi ecosystem, placing it as the 2nd largest DeFi ecosystem after Ethereum, beating out other major blockchains such as Binance and Avalanche. So, what makes the Terra ecosystem so popular? Why is it growing so fast in the highly competitive DeFi industry? This article will introduce and discuss the DeFi Terra ecosystem.

Article Summary

- 💳 Terra has the vision to become the platform of choice for digital payments utilizing crypto assets, especially stablecoins.

- 🌐 Terra ecosystem is growing rapidly following the increasing adoption of UST and LUNA due to the launch of DeFi applications such as Anchor Protocol.

- 💵 Currently, Terra has the second-largest DeFi ecosystem after Ethereum. Terra has succeeded in attracting a large number of users through applications that can provide stable profits using Terra’s stablecoins such as UST.

- 🚀 Currently, Terra has a huge DeFi ecosystem that includes various types of financial services including savings (Anchor), synthetic assets (Mirror), DEX (Terra Swap), and AMM (Astroport). Moreover, the DeFi Ecosystem will continue to grow in 2022 through applications such as Mars Protocol decentralized lending and Levana’s leverage product.

The growth of DeFi in the Terra ecosystem

Terra is a cryptocurrency platform whose vision is to create a decentralized digital payment ecosystem. Terra created an ecosystem consisting of various financial service applications in the Decentralized Finance industry. In 2021, Terra’s DeFi ecosystem experienced rapid growth. This is due to several internal and external factors.

Externally, Terra secured $150 million in funding in July 2021 from various investors. The funds are then used to support and incubate several DeFi projects within the ecosystem. Internally, the implementation of the Columbus-5 update is a catalyst for the growth of the Terra ecosystem as a whole.

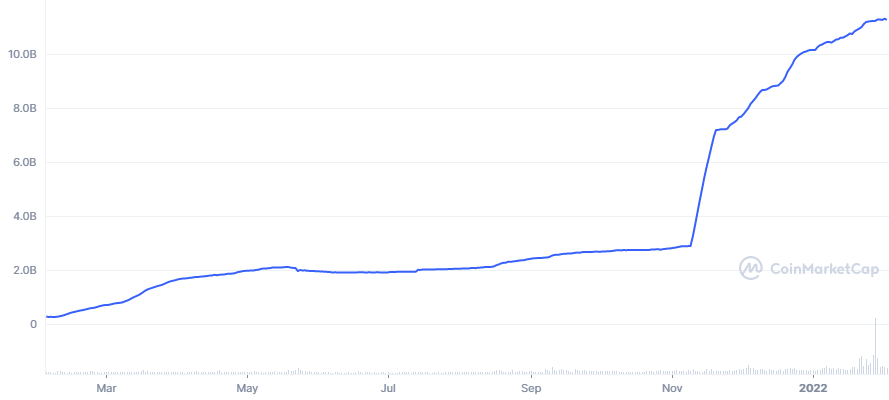

The Col-5 update makes LUNA’s staking rewards higher, reduces LUNA supply, and implements interoperability with the cosmos ecosystem via IBC. The upgrade increases the adoption of UST in 2021, as seen from the graph above. Cosmos ecosystem users can use UST when interacting with Cosmos DeFi apps like Osmosis. UST adoption has an important role to play in various parts of the Terra ecosystem.

Read more: What is Terra (LUNA)?

The role of Terra USD (UST) for the Terra ecosystem

The objective of Terra is to become the platform of choice for making digital payments utilizing crypto assets. To achieve this, Terra leverages algorithmic stablecoins that are not backed by fiat assets like centralized stablecoins (USDT and USDC). Terra’s stablecoins are decentralized and kept stable by burning the LUNA coin.

As we already know, stablecoins are an important part of the crypto world for various purposes. It also functions as an intermediary currency when buying and selling crypto assets. In addition, stablecoins are useful in various DeFi applications such as Curve because of their stable nature, unlike traditional cryptocurrencies.

This makes UST an essential part of the growth of the Terra ecosystem. You could say that the Terra ecosystem depends on the use of its stablecoins. All elements in the Terra ecosystem are built to support the use of UST, including LUNA which needed to be burned when creating a new UST. For users, UST can be a promising stablecoins, especially in the Terra DeFi ecosystem or commonly called “TeFi” (Terra Finance) by the community.

Several promising DeFi protocols in the Terra ecosystem

Anchor Protocol

The Anchor Protocol is an application that provides decentralized savings services by utilizing the UST stablecoin. The protocol was launched in March 2021. Anchor is Terra’s flagship app with the largest TVL in the ecosystem. One of the things that makes Anchor popular is that it gives depositors a fairly high-interest rate of around 18%-20% called the “Anchor rate”. Furthermore, you only need to deposit your UST into Anchor deposits without any specific lock-down period.

There are 2 services in the Anchor protocol which are savings and loan services. Anchor pays interest to depositors who keep their funds from borrowers who pay interest relevant to the amount they borrow. In addition, anyone borrowing from Anchor must include collateral in the form of a crypto asset in case they fail to pay back their money.

If you want to get stable and relatively safe interest rates, becoming a depositor at Anchor can give you a fairly profitable income. However, if you are a risk-taker, DataDrivenInvestor has a strategy to double your profits at in anchors. You can convert your LUNA into bLUNA and then borrow additional UST using bLUNA to increase your deposit at Anchor.

Read more: What is Decentralized finance?

Mirror Finance

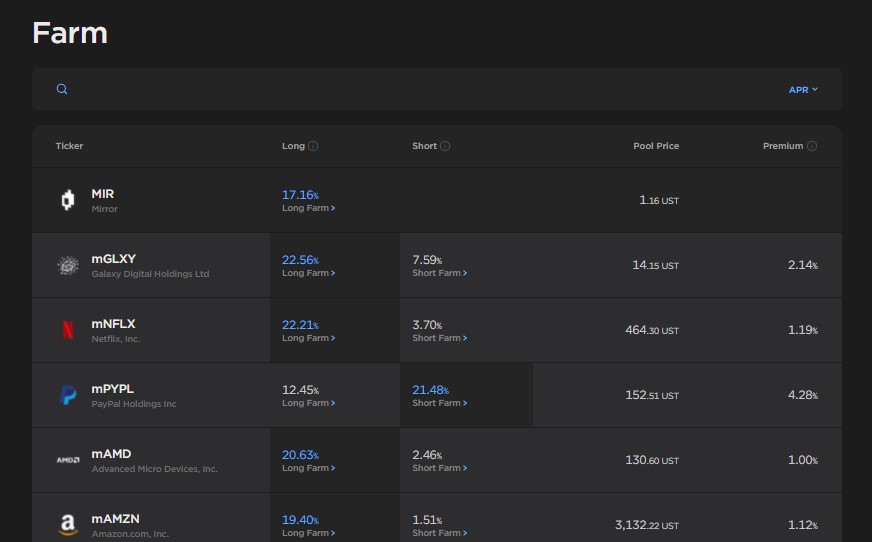

Mirror Finance is a DeFi protocol that allows you to buy real-world stock assets in the form of mAssets (Mirrored Assets) such as mGOOGL, mNFLX, and mAMAZON. The protocol gives you access to the world of stocks and the ability to buy them in a decentralized way using cryptocurrencies. In addition, orders within Mirror Finance time are immediately executed as it utilizes a pooled liquidity system.

However, you need to over-collateralize by 150% when you want to buy mAssets on Mirror Finance. So, you have to guarantee a crypto asset of 150% the amount of mAsset you want to buy. For example, you have to deposit a guarantee of 15 UST to buy 10 mNFLX (assuming 1 mNFLX = 1 UST). It is a normal practice in order to keep the peg of mAsset price in line with the original stock price in the event of a price decrease.

In addition, you can use the mAsset to become a liquidity provider (LP) or a ‘long farm’ in the Mirror protocol. To do this, you also need to deposit an equal amount of UST that matches the value of the mAsset you are saving. Becoming a liquidity provider in Mirror Finance can earn you around 20% interest, depending on your mAssets.

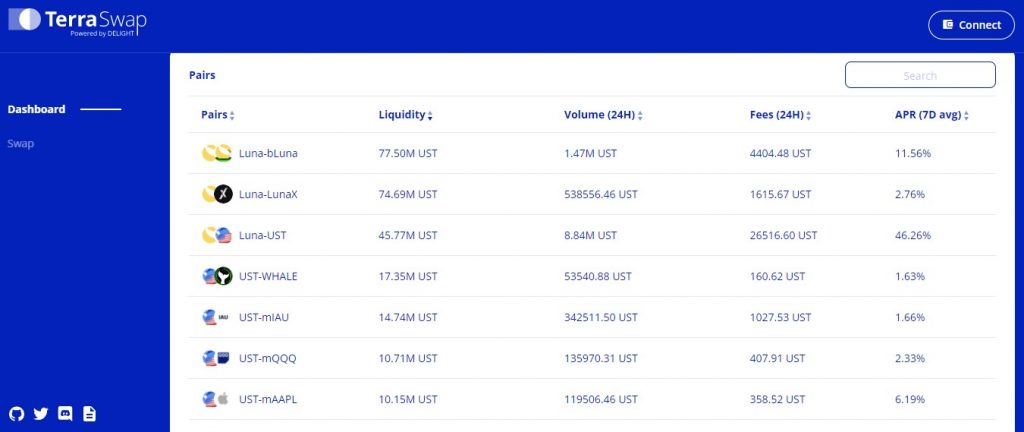

Terra Swap

Terra Swap is a decentralized exchange protocol (DEX) for the Terra ecosystem token that also functions as an automated market maker (AMM) similar to Uniswap. In Terra Swap, you can exchange LUNA or UST tokens into other Terra ecosystem tokens such as ANC and MIR. According to DeFiLlama, Terra Swap has the largest TVL in the Terra ecosystem ($8.34bn dollars). You can also become a liquidity provider (LP) in the various liquidity pools available on Terra Swap. These pools can deliver huge APRs up to 46%.

In addition, Terra Swap also plays a role in providing liquidity pools for several mAssets in Mirror Finance. So, you can use Terra Swap to generate additional profits from the tokens you get from Mirror and Anchor.

Several DApps for the Terra ecosystem in 2022

Astroport

Astroport is a DEX that combines Curve’s AMM algorithm and Uniswap to create an application that acts as a source of liquidity for the entire DeFi ecosystem in Terra. The application can facilitate the liquidity pool for various Terra ecosystem tokens as well as cross-chain assets such as USDC and wETH (wormhole ETH). Currently, the main function of Astroport is already up and running. Astroport’s developers are trying to integrate various other features such as staking and improving the UI of the application. Like Curve, Astroport can be a catalyst to channel funds to the Terra ecosystem.

Astroport Litepaper: Astroport Litepaper. Astroport is the central space station.

Mars Protocol

Mars Protocol is a decentralized loan application that uses algorithms to determine interest similar to AAVE and Compound. However, unlike the two protocols, Mars innovates and uses dynamic interest rates, a model that changes loan interest according to market conditions. This makes the protocol more efficient against volatile market conditions. Currently, Mars Protocol is still in the development stage where its smart-contract code is still audited and its user interface is in progress.

Mars Protocol Litepaper 2.0: Mars Protocol Litepaper 2.0

Levana Protocol

Levana, which stands for leverage any asset, is a protocol that wants to bring leverage products into the DeFi Terra ecosystem. The protocol uses the Levana Leverage Index (LLI) token which allows users to open leverage positions in various assets. Levana limits the leverage position to 2x because the Levana algorithm borrows funds using the Mars Protocol. The first LLI to be launched is LUNA 2x, which can later be purchased through the Terra Swap and Astroport platforms. Levana can prevent the impact of liquidation by using an algorithm that incentivizes other users to balance the pool of funds called the leverage capsule so that no liquidation occurs.

In addition, Levana also utilizes NFT elements and various gamification methods on its platform to form a loyal user community. Currently, Levana is developing its community using NFT and simple games to attract users. This is to create hype in anticipation of its launch which will happen in 2022.

Levana Litepaper Protocol: Levana Litepaper and Introducing Levana Protocol

Why are DeFi apps in the Terra ecosystem so popular?

- 🫂 Ease of use: The process of using various DeFi apps on Terra is very simple as it only requires Terra’s digital wallet which is Terra Station. You just need to move your LUNA into Terra Station. After that, you can easily use all DeFi apps on the Terra ecosystem.

- ️ 🖼️ User-friendly UI: Terra Station and DeFi Terra apps have a simple UI that makes them easy to interact with and use.

- 💸 Promising stable interest: Applications such as Anchor Protocol provide a stable income interest of 18%-20% and reward you in the form of UST that has a stable value.

- 🌕 Deflationary price of LUNA: The LUNA coin has a deflationary nature with the token constantly being burned as UST adoption increases. In theory, this shrinking supply makes the LUNA coin even more valuable in the long term.

Disclaimer: Using DeFi carries considerable risk due to the potential for hacking and fraud that can occur. Always be careful in choosing the application that you want to use. This article is not financial advice.

Buying LUNA

You can start using Terra’s DeFi ecosystem by buying LUNA in the Pintu app. Through Pintu, you can buy LUNA and other cryptocurrencies in an all-in-one convenient application.

Pintu is also compatible with popular wallets such as Metamask to facilitate your transactions. Download the Pintu app on Play Store and App Store! Your security is guaranteed because Pintu is regulated and supervised by Bappebti and Kominfo.

You can learn more about cryptocurrencies through the various Pintu Academy articles that we update every week!

References:

- Duncan Reucassel and Genevieve Yeoh, Mapping The Moon: An Overview of Terra’s Ecosystem, Delphi Digital, diakses pada 28 January 2022.

- Genevieve Yeoh and Jeremy Ong, Terra’s TVL Growth, Lido’s LUNA Benefits, DEX Valuations, Delphi Digital, diakses pada 28 January 2022.

- Stefan Stankovic, A Beginner’s Guide to Terra’s DeFi Ecosystem, Crypto Briefing, diakses pada 31 January 2022.

- Emerick Mary, Terra Ecosystem Overview, Figment, accessed on 2 February 2022.

- Cointelegraph Consulting: A look at Terra’s ecosystem, Coin Telegraph, accessed on 2 February 2022.

- Cointelegraph Consulting: Terra’s bullish case after Columbus-5 upgrade, Coin Telegraph, accessed on 2 February 2022.

- Zhiyuan Sun, Anchor protocol’s reserves head toward depletion due to lack of borrowing demand, accessed on 2 February 2022.

Share

Related Article

See Assets in This Article

DEFI Price (24 Hours)

Market Capitalization

-

Global Volume (24 Hours)

-

Circulating Supply

-