Market Analysis Apr 21st, 2025: April & May 2025 BTC Turns Bullish, Eyeing a Return to $100K!

Bitcoin continues to fluctuate around the $85,000 range. The tariffs imposed by U.S. President Donald Trump remain the biggest driving factor behind the movements in the crypto market, and even the Federal Reserve is in no rush to make policy decisions amid the current conditions. Check out the full analysis from the Trader Pintu team.

Market Analysis Summary

- 🟢 Analysts forecast a bullish trajectory for BTC through late April and May 2025, with price targets climbing toward $100,000 and beyond

- 🔻 The latest U.S. Producer Price Index (PPI) data for March 2025 showed a 0.4% month-on-month decline, marking the first decrease since October 2023.

- 📉 The University of Michigan Consumer Sentiment Index for the United States plunged sharply to 50.8 in April 2025, down from 57.0 in March.

- 🏭 The latest NY Empire State Manufacturing Index for April 2025 rose to -8.1 from a sharply negative -20 in March, beating the forecast of -14.5.

- 📈 The latest U.S. retail sales data for March 2025 showed a robust increase of 1.4% month-on-month, surpassing expectations of a 1.2% rise and significantly improving from February’s modest 0.2% gain.

- 💬 The latest speech by Federal Reserve Chair Jerome Powell, delivered on April 16, 2025, emphasized the Fed’s cautious stance amid economic uncertainty largely driven by President Trump’s tariff policies.

Macroeconomic Analysis

Fed Speech

The latest speech by Federal Reserve Chair Jerome Powell, delivered on April 16, 2025, emphasized the Fed’s cautious stance amid economic uncertainty largely driven by President Trump’s tariff policies. Powell stated that the Fed will maintain a “wait-and-see” approach regarding interest rate changes until more comprehensive economic data becomes available. He highlighted that the tariffs represent “fundamental changes” to trade policy, creating an unprecedented environment that complicates the Fed’s dual mandate of achieving maximum employment and stable inflation. Powell warned that these tariffs could push inflation higher while simultaneously slowing economic growth and weakening the labor market, potentially causing the Fed’s objectives to diverge for the remainder of the year.

Powell acknowledged that while the U.S. economy remains in a relatively solid position with near-maximum employment and inflation slightly above the 2% target, the outlook is clouded by significant downside risks. Consumer and business sentiment has declined sharply due to trade policy uncertainty, and strong import activity in the first quarter—partly driven by companies attempting to avoid future tariffs—is expected to weigh on GDP growth. He noted that inflation expectations for the near term have risen, but longer-term expectations remain anchored, which is critical for the Fed’s confidence in managing inflation without destabilizing the economy.

Regarding financial markets, Powell dismissed the notion of a “Fed put,” signaling that the central bank will not intervene simply to support markets amid volatility caused by trade tensions. He stressed that the markets are functioning normally despite recent fluctuations. Powell also reaffirmed the Fed’s independence from political pressures, underscoring its commitment to data-driven policy decisions. Overall, his remarks painted a picture of a central bank navigating uncharted waters, balancing the risks of stagflation—a simultaneous rise in inflation and unemployment—while awaiting clearer economic signals before adjusting monetary policy.

Other Economic Indicators

- Producer Price Index (PPI): The latest U.S. Producer Price Index (PPI) data for March 2025 showed a 0.4% month-on-month decline, marking the first decrease since October 2023. This drop was somewhat unexpected, as economists had forecasted a modest increase. The headline PPI, which measures the average change in prices received by domestic producers for their output, fell from February’s level of 148.04 to 147.46. On a year-on-year basis, producer prices rose by 2.7%, a slowdown from the 3.2% increase recorded in February and below market expectations of 3.3% growth.

- Michigan Consumer Sentiment: The University of Michigan Consumer Sentiment Index for the United States plunged sharply to 50.8 in April 2025, down from 57.0 in March. This represents the lowest reading since June 2022 and marks a significant 10.9% monthly decline, well below market expectations of 54.5. The index has now fallen for four consecutive months and has lost more than 30% since December 2024. This steep drop reflects growing consumer pessimism amid concerns over trade tensions, inflation, and the overall economic outlook.

- NY Empire State Manufacturing Index: The latest NY Empire State Manufacturing Index for April 2025 rose to -8.1 from a sharply negative -20 in March, beating the forecast of -14.5. Although the index improved significantly, it still indicates a modest contraction in manufacturing activity in New York State. New orders and shipments both declined but less severely than the previous month, while inventories continued to expand. Employment remained largely unchanged, though the average workweek shortened notably. Input prices and selling prices increased at their fastest pace in over two years, reflecting rising cost pressures on manufacturers.

- Retail Sales: The latest U.S. retail sales data for March 2025 showed a robust increase of 1.4% month-on-month, surpassing expectations of a 1.2% rise and significantly improving from February’s modest 0.2% gain. This marked the strongest monthly increase since January 2023, reflecting resilient consumer spending despite concerns over economic uncertainty. On a year-over-year basis, retail sales grew by 4.6%, indicating solid growth in consumer demand over the past year. Notably, motor vehicle and parts sales surged by 5.3%, as consumers rushed to buy ahead of anticipated auto tariffs, contributing substantially to the overall increase.

BTC Price Analysis

Last week, BTC showed a recovery and consolidation around the $83,000 to $85,000 range, following a prior dip to roughly $79,600 on April 10, 2025. The price rose steadily, closing near $84,572 on April 17, 2025, reflecting a moderate gain of about 0.75% on the day. This price action indicates a cautious bullish sentiment as BTC attempts to stabilize after recent volatility. Technical indicators such as the RSI hovered near neutral levels (~52), suggesting neither overbought nor oversold conditions, which supports the potential for a measured upward move in the near term.

The broader market sentiment last week was mixed but gradually improving. Despite short-term selling pressure driven by macroeconomic concerns and regulatory uncertainties, large investors or “whales” continued accumulating BTC, signaling long-term confidence. News sentiment was cautiously optimistic, fueled by expectations of pro-crypto policies and institutional adoption. However, fears lingered around geopolitical tensions and the impact of U.S. tariffs, which have historically influenced risk appetite and crypto flows. The Fear & Greed Index remained relatively low (~30), indicating prevailing market fear but also the potential for a rebound if positive catalysts emerge.

Looking ahead, analysts forecast a bullish trajectory for BTC through late April and May 2025, with price targets climbing toward $100,000 and beyond. Predictions suggest a possible surge to over $125,000 by the end of April, driven by technical momentum and improving investor sentiment. However, volatility remains a key characteristic, with potential support levels near $77,000 acting as critical floors in case of renewed selling. The interplay of macroeconomic factors, regulatory developments, and market psychology will continue to shape BTC’s price dynamics in the coming weeks.

In summary, last week’s BTC price action reflected a tentative recovery amid cautious optimism. The market balanced between accumulation by institutional players and lingering macro risks, resulting in a consolidation phase. Sentiment was mixed but showed signs of improvement, with technical indicators supporting the possibility of further gains. Investors remain watchful of key support and resistance levels, as well as external factors like policy shifts and geopolitical events that could trigger sharp moves.

Overall, BTC’s price and sentiment last week underscore the asset’s characteristic volatility and sensitivity to broader economic and political developments. While the near-term outlook appears constructive, the market remains vulnerable to sudden shifts, making active monitoring essential for traders and investors alike.

On-Chain Analysis

- 📊 Exchange: As the exchange reserve continues to fall, it indicates lower selling pressure. Net deposits on exchanges are high compared to the 7-day average. Higher deposits can be interpreted as higher selling pressure.

- 💻 Miners: Miners’ are selling holdings in a moderate range compared to its one-year average. Miner’s revenue is in a moderate range, compared to its one-year average.

- ⛓️ On-chain: More investors are selling at a profit. In the middle of a bull market, it can indicate a market top. Long term holders’ movement in the last 7 days was lower than the average. They have a motive to hold their coins. Investors are in a anxiety phase where they are currently in a state of moderate unrealized profits.

- 🏦 Derivative: Long position traders are dominant and are willing to pay to short traders. Selling sentiment is dominant in the derivatives market. More sell orders are filled by takers. As open interest increases, it indicates more liquidity, volatility, and attention are coming into the derivative market. The increasing trend in open interest could support the current ongoing price trend.

- 🔀 Technicals: RSI indicates a neutral condition. Stochastic indicates a neutral condition where the current price is in a moderate location between the highest-lowest range of the last 2 weeks.

News About Altcoins

- OpenSea Adds Solana Token Trading and Meme Coins in OS2 Beta, Eyes NFT Comeback. As part of its OS2 platform overhaul, OpenSea has begun allowing some closed beta users to trade Solana tokens, including popular meme coins like Fartcoin (FARTCOIN) and Dogwifhat (WIF), with plans to reintroduce Solana NFT support soon. This move signals OpenSea’s shift toward becoming a broader multi-chain trading platform, expanding beyond Ethereum NFTs. CEO Devin Finzer highlighted this as part of a larger reimagining, which also includes the upcoming SEA token from the OpenSea Foundation. Despite previous struggles in the Solana ecosystem dominated by Magic Eden and Tensor, OpenSea is doubling down on its Web3 mission, advocating for regulatory clarity from the SEC—especially after the agency closed its investigation under President Trump’s more crypto-friendly administration.

News from the Crypto World in the Past Week

- Charles Schwab CEO Targets April 2026 Launch for Spot Bitcoin Trading Services. Charles Schwab Corp CEO Rick Wurster is aiming to launch spot Bitcoin trading services for Schwab clients by April 2026, following a 400% surge in traffic to the firm’s crypto website—an indicator of growing investor interest. Since taking over in 2025, Wurster has expressed Schwab’s intent to offer direct crypto services, pending regulatory clarity. He voiced optimism about a more favorable environment under President Donald Trump’s administration. Schwab has also partnered with Trump Media and Technology Group (TMTG) to launch Truth.Fi a platform blending digital assets and traditional finance as an alternative to legacy banking. While Wurster currently holds no crypto, he admitted regretting missing out on the sector’s significant gains.

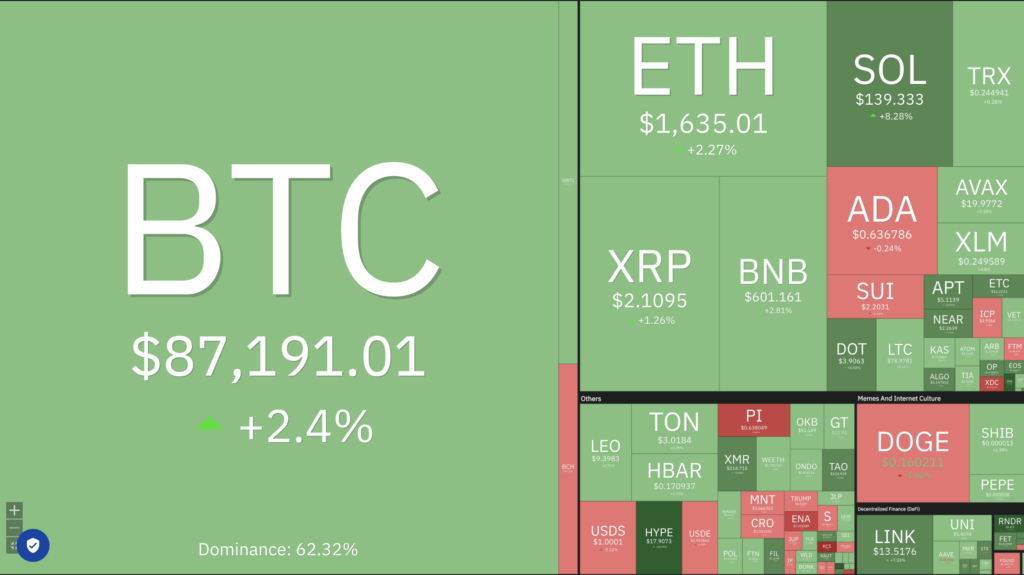

Cryptocurrencies Market Price Over the Past Week

Cryptocurrencies With the Best Performance

- Bittensor (TAO) +30.32%

- Artificial Superintelligence +20.74%

- Render +14.55%

- Immutable +14.01%

Cryptocurrencies With the Worst Performance

- Movement (MOVE) -26.66%

- XDC Network (XDC) -8.88%

- Helium (HNT) -7.04%

- Theta Network -6.82%

References

- Logan Hitchcock, OpenSea Adds Solana Trading Ahead of SEA Token Launch, decrypt, accessed on 20 April 2025.

- Vince Quill, Charles Schwab CEO eyes spot Bitcoin trading by April 2026, cointelegraph, accessed on 20 April 2025.

Share

Related Article

See Assets in This Article

0.8%

0.0%

0.0%

0.0%

0.0%

BTC Price (24 Hours)

Market Capitalization

-

Global Volume (24 Hours)

-

Circulating Supply

-