Market Analysis Jun 9th, 2025: Bitcoin Holds Strong Above $100K Despite Trump-Musk Tensions

The crypto market was stirred by a public feud between U.S. President Donald Trump and Elon Musk, who exchanged jabs on Trump’s Truth platform and Elon’s X. While the market experienced a brief correction, Bitcoin has remained strong, holding steady above $100,000 signaling a bullish outlook. Check out the full analysis from the Pintu’s Trader Team.

Market Analysis Summary

- 😍 Analyst forecasts suggest a potential upward trajectory in June, with predictions estimating BTC could reach as high as $137,600 by mid-month.

- 💬 The latest speech by Federal Reserve Chair Jerome Powell emphasized the central bank’s commitment to its dual mandate of promoting maximum employment and stable prices.

- 📈 The latest U.S. personal income data for April 2025 showed a solid increase of $210.1 billion, or 0.8% on a monthly basis.

- 📉 In April 2025, the U.S. goods trade deficit narrowed sharply to $87.6 billion, a significant drop of $74.6 billion or 46% from the record high of $162.3 billion recorded in March.

- 💵 The latest data for the U.S. PCE Price Index, released in late May 2025, showed that the index rose by 0.1% month-over-month in April.

Macroeconomic Analysis

Fed Chair Speech

The latest speech by Federal Reserve Chair Jerome Powell, delivered on June 2, 2025, at the 75th Anniversary Conference of the Fed’s International Finance Division, emphasized the central bank’s commitment to its dual mandate of promoting maximum employment and stable prices. Powell highlighted the importance of careful, objective, and non-political analysis in guiding monetary policy decisions, underscoring the Fed’s independence amid political pressures. He acknowledged the current period of heightened uncertainty driven by geopolitical risks, inflation, trade policy, and economic volatility, and praised the International Finance Division’s role in developing new analytical tools to measure and respond to these challenges.

Powell reflected on the Fed’s ongoing efforts to monitor systemic risks and maintain financial stability both domestically and globally. He noted that the Fed benefits from robust relationships with global counterparts and detailed preparatory work by staff, which enable the central bank to respond effectively to international economic developments. The Chair also paid tribute to former Vice Chair Stanley Fischer, recognizing his contributions to international economics and mentorship within the Fed.

Addressing recent political tensions, Powell reiterated that monetary policy decisions would be based solely on incoming economic data and the evolving outlook, not political considerations. This statement came amid reports of pressure from the White House for the Fed to cut interest rates sooner. Powell emphasized that the Fed’s approach remains data-driven, with any adjustments to policy contingent on economic conditions related to growth, employment, and inflation.

Overall, Powell’s remarks conveyed a cautious but steady stance, acknowledging economic uncertainties while affirming the Fed’s readiness to adapt policy as needed. The speech highlighted the central bank’s focus on balancing inflation control with support for labor market strength, maintaining vigilance over risks, and leveraging international cooperation to fulfill its mandate in a complex global environment.

Other Economic Indicators

- Personal Income & Personal Spending: The latest U.S. personal income data for April 2025 showed a solid increase of $210.1 billion, or 0.8% on a monthly basis, driven primarily by higher government social benefits and wage gains. Disposable personal income (DPI), which is income after taxes, also rose by 0.8%, indicating that consumers had more money available to spend. This rise in income was accompanied by a moderate increase in personal consumption expenditures (PCE), which grew by $47.8 billion or 0.2%, reflecting continued but cautious consumer spending.

- Goods Trade Balance: In April 2025, the U.S. goods trade deficit narrowed sharply to $87.6 billion, a significant drop of $74.6 billion or 46% from the record high of $162.3 billion recorded in March. This dramatic reduction was primarily due to a steep decline in imports, which fell by $68.4 billion to $276.1 billion. The plunge in imports followed a surge in March when many businesses front-loaded shipments to avoid anticipated tariffs. Meanwhile, exports increased by $6.3 billion to $188.5 billion, marking a modest but important rise that helped reduce the overall deficit.

- Core PCE Index: The latest data for the U.S. Core Personal Consumption Expenditures (PCE) Price Index, released in late May 2025, showed that the index rose by 0.1% month-over-month in April, matching market expectations. On an annual basis, the core PCE price index—which excludes volatile food and energy prices—grew by 2.5%, down slightly from 2.7% in March. This marks the slowest year-over-year increase since March 2021, indicating a moderation in underlying inflation pressures within the economy.

- Michigan Consumer Sentiment: The latest University of Michigan Consumer Sentiment Index for May 2025 remained unchanged at 52.2, matching the April reading and ending a four-month streak of declines. Although sentiment had initially dipped to a preliminary reading of 50.8 earlier in the month, it rebounded in the latter half of May following the temporary pause on some tariffs on Chinese goods.

- Manufacturing Index: The latest S&P Global US Manufacturing PMI for May 2025 showed an improvement to 52.0, up from 50.2 in the previous two months, signaling solid overall growth in the manufacturing sector. This was the best reading since February 2025 and was driven largely by a record rise in input inventories as manufacturers and their clients front-ran expected tariff-related price increases and supply chain disruptions.

- JOLTS Job Opening: The latest U.S. Job Openings and Labor Turnover Survey (JOLTS) report for April 2025 showed that job openings unexpectedly rose to approximately 7.39 million, up by about 191,000 from March’s 7.2 million and surpassing market expectations of around 7.1 million.

- ADP Employment Change: The latest ADP National Employment Report for May 2025 revealed a significant slowdown in private sector job growth, with only 37,000 jobs added—the lowest monthly increase since March 2023 and well below economists’ expectations of 110,000 jobs.

BTC Price Analysis

Over the past week, BTC experienced relatively stable price action, trading in a narrow range around the $100,000 to $106,000 level. On June 6, 2025, BTC closed at approximately $100,811.

Despite the recent feud between Donald Trump and Elon Musk that briefly caused BTC’s price to dip, Bitcoin remains optimistic and is showing potential to consolidate after a strong rally earlier this month. Market sentiment appears to be waiting for fresh catalysts, with traders watching for regulatory developments and macroeconomic indicators. Some price forecasts suggest a potential upward trajectory in June, with predictions estimating BTC could reach as high as $137,600 by mid-month, though with a possible short-term floor near $105,700.

Trading volumes have remained robust, indicating sustained investor interest. On June 4, the volume was around 43.7 billion USD, reflecting active participation in the market. This level of liquidity supports price stability and suggests that both buyers and sellers are engaged near current price levels. The futures market also shows mild bearish pressure, with BTC futures for June 2025 down slightly by about 1% around $105,795, indicating some cautious positioning ahead of upcoming economic data releases.

In summary, BTC’s price action over the past week has been characterized by consolidation near the $105,000 mark following a strong rally. The market is digesting recent gains while awaiting new developments that could drive the next directional move. Predictions remain bullish for the medium term, but short-term volatility may persist as traders balance optimism with caution amid global economic uncertainties.

Altcoin Analysis

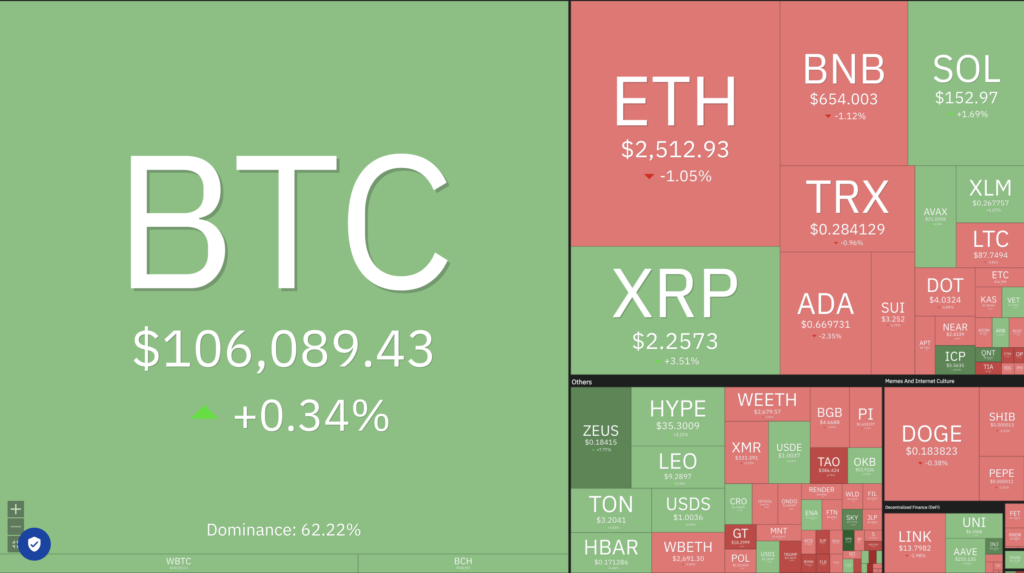

Over the past week, the broader cryptocurrency market showed mixed but generally positive price action amid cautious investor sentiment. The total crypto market capitalization fluctuated around $3.3 trillion, with some reports noting a slight dip of about 1.9% on June 4, 2025, while others indicated a modest 0.3% gain, reflecting short-term volatility as traders balanced optimism with uncertainty. Trading volumes remained robust, around $90 billion daily, signaling active participation across major tokens.

Among the leading altcoins, ETH outperformed many peers, rising over 7% in the past week to trade near $2,570. This rally was supported by growing interest in ETH’s Layer-2 scaling solutions and anticipation of upcoming protocol upgrades, which aim to improve transaction speed and reduce fees. BNB also gained strongly, up around 5%, influenced by positive developments in Binance’s ecosystem and technical breakout patterns. SOL led gains with a notable 10% jump, driven by increased developer activity and network usage.

Other notable performers included XRP, which rose about 1.5% amid growing institutional interest and expectations of favorable regulatory outcomes. ADA and DOGE also posted gains of 6-7%, reflecting renewed retail enthusiasm and broader market confidence. USDT and USDC remained steady near $1, maintaining their critical role in market liquidity and trading pairs.

Market sentiment remains cautiously optimistic, supported by institutional inflows, ETF approvals, and expanding adoption of blockchain technology. However, traders remain watchful of macroeconomic factors such as interest rate decisions, geopolitical tensions, and regulatory developments that could influence volatility. Overall, the crypto market is consolidating recent gains, with selective strength in high-quality projects and continued rotation among leading tokens.

In summary, the past week’s crypto market action has been characterized by moderate gains in major altcoins alongside BTC’s consolidation near $105,000. Volume and liquidity remain healthy, while investor focus shifts toward fundamental developments and upcoming catalysts. This environment suggests a maturing market balancing growth potential with risk management amid evolving global economic conditions.

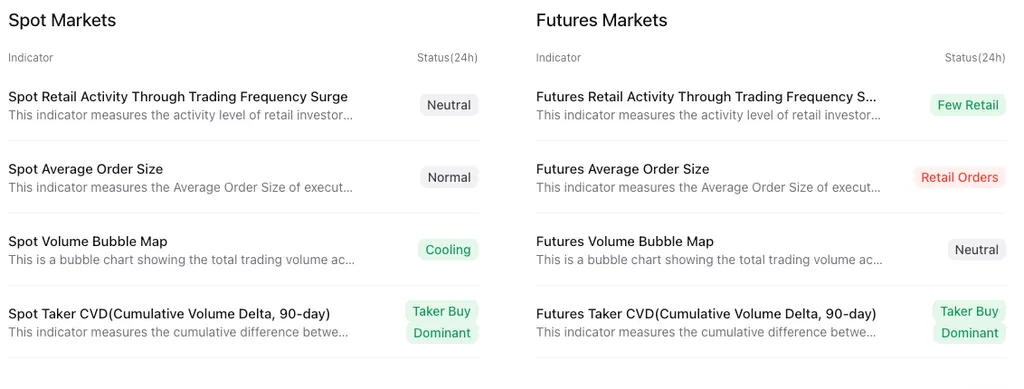

On-Chain Analysis

News About Altcoins

- Tokenized RWA Market Booms as Corporate Bitcoin Treasuries Surpass 800K BTC. Binance Research reports a 260% surge in the tokenized real-world asset (RWA) market this year, growing from $8.6 billion to over $23 billion, led by private credit (58%) and U.S. Treasuries (34%). Major drivers include BlackRock’s BUIDL Treasury fund, now valued at $2.9 billion and integrated into DeFi via sBUIDL, and the rise of Tradable on ZKSync Era with over $2 billion in tokenized assets. Additionally, tokenized funds on Solana are expanding access through DeFi platforms like Kamino. Meanwhile, corporate Bitcoin treasuries have grown from 312K to 809K BTC over the past year, with 116 companies—including Trump Media, GameStop, and PSG—publicly holding BTC. MicroStrategy leads with 72% of the total. While altcoin adoption exists, it poses structural risks, especially amid market stress. Bitwise projects corporate BTC holdings could exceed 1 million by 2026.

News from the Crypto World in the Past Week

- Bitcoin Community Urges Elon Musk to Go All-In on BTC to Counter Trump. The Bitcoin community, including analyst Will Clemente and JAN3 CEO Samson Mow, is calling on Elon Musk to adopt a Bitcoin treasury strategy amid his escalating feud with former U.S. President Donald Trump. Mow suggested that Tesla resume accepting Bitcoin payments and that SpaceX offer BTC discounts, warning Musk that his fiat assets could be frozen. The move is seen as a way to “force a hard money standard” and surpass Trump, who despite signing a Strategic Bitcoin Reserve executive order, has not bought more BTC. The feud intensified after public clashes over tax policy and global tariffs.

Cryptocurrencies Market Price Over the Past Week

Cryptocurrencies With the Best Performance

- SPX6900 (SPX) +21.00%

- Internet Computer +12.80%

- Quant +11.59%

- Injective +9.61%

Cryptocurrencies With the Worst Performance

- DeXe (DEXE) -31.19%

- Stacks -13.10%

- Jupiter (JUP) -12.62%

- Virtuals Protocol (VIRTUAL) -10.88%

References

- Ciaran Lyons, ‘Full porting Bitcoin’ could be Musk’s Trump card in feud: Bitcoiners, cointelegraph, accessed on 7 June 2025.

- Leo Jakobson, Tokenized Real-World Assets Surge 260% in 2025, thedefiant, accessed on 7 June 2025.

Share

Related Article

See Assets in This Article

BTC Price (24 Hours)

Market Capitalization

-

Global Volume (24 Hours)

-

Circulating Supply

-