Market Analysis Mar 10th, 2025: Trump’s Crypto Summit Fails to Boost BTC

Bitcoin and other cryptocurrencies are still fluctuating, even after U.S. President Donald Trump hosted a Crypto Summit at the White House last week. One of the key topics discussed was a strategic reserve plan for BTC. Read the full analysis from Pintu’s Trader Team below.

Market Analysis Summary

- 🟥 Analysts suggest that BTC’s ability to maintain its current support levels will be crucial for its trajectory. If BTC can hold above $90,935 and continue to build momentum, it may target higher resistance levels.

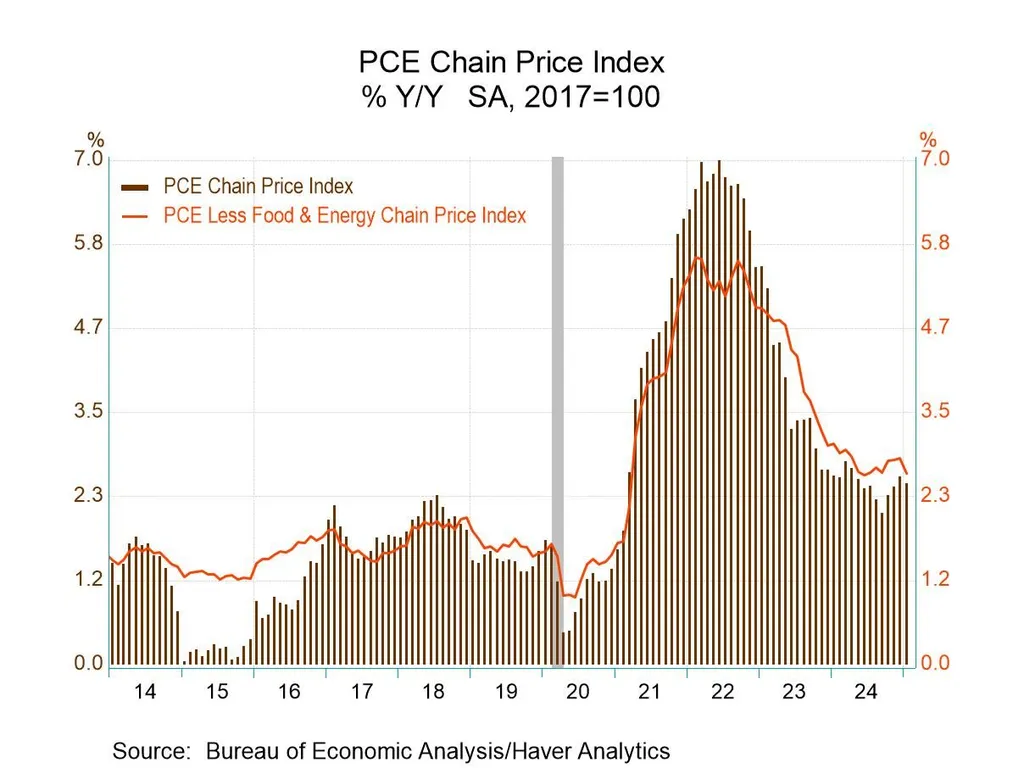

- 🏪 Core Personal Consumption Expenditures (PCE) Price Index in the United States registered an annual increase of 2.6%, down from 2.9% in December 2024.

- 📉 The U.S. goods trade deficit reached a record high of $153.3 billion in January 2025, significantly exceeding market expectations of $114.7 billion.

- 🏗️ S&P Global US Manufacturing PMI rose to 51.6, up from 51.2 in January, signaling a continued recovery in the manufacturing sector.

- 💼 The ADP National Employment Report for February 2025 indicated that private sector employment increased by 77,000 jobs, the smallest gain since July.

Macroeconomic Analysis

Core PCE Price Index

In January 2025, the Core Personal Consumption Expenditures (PCE) Price Index in the United States registered an annual increase of 2.6%, down from 2.9% in December 2024. This decline aligns with market expectations and reflects a broader trend of easing inflationary pressures within the economy. The Core PCE index, which excludes the more volatile food and energy prices, is closely monitored by the Federal Reserve as it provides insight into underlying inflation trends. The latest figure is also below the long-term average of 3.24%, indicating a cooling inflation environment compared to previous years.

Month-over-month, the Core PCE Price Index rose by 0.3% in January, a slight uptick from the 0.2% increase observed in December. This growth suggests that while inflation is moderating on an annual basis, there are still month-to-month pressures that could influence future monetary policy decisions. The Federal Reserve aims to maintain inflation around its target of 2%, and the current figures indicate that while progress is being made toward this goal, inflation remains above the desired level.

The ongoing shifts in the Core PCE Price Index are critical for economic forecasting and policy-making. Analysts expect that this trend of decreasing annual inflation may continue, with projections suggesting a potential drop to around 2.5% by the end of the current quarter. Such developments will likely influence the Federal Reserve’s approach to interest rates and other monetary policies as they seek to balance economic growth with inflation control. Overall, these results reflect a cautious optimism regarding inflation management in the U.S. economy moving forward.

Other Economic Indicators

- Goods Trade Balance: The U.S. goods trade deficit reached a record high of $153.3 billion in January 2025, significantly exceeding market expectations of $114.7 billion. This represents a sharp increase from the revised deficit of $122.0 billion in December 2024.

- Manufacturing Index: In February 2025, the S&P Global US Manufacturing PMI rose to 51.6, up from 51.2 in January, signaling a continued recovery in the manufacturing sector. This was the highest reading since June 2024. Factory output grew at the fastest pace in nearly a year, although new order growth slowed and employment gains nearly stalled, indicating cautious hiring.

- ADP Employment: The ADP National Employment Report for February 2025 indicated that private sector employment increased by 77,000 jobs, the smallest gain since July. This figure contrasts with January’s addition of 183,000 jobs and December’s 176,000. While the ADP report is often used as a predictor of government non-farm employment changes, discrepancies between the two reports can occur due to differing methodologies. The report for February sparked concerns about a potential economic slowdown.

- Global Services Index: In February 2025, the S&P Global Services PMI experienced a significant decline, falling to 49.7 from 52.9 in January. This drop marked the first contraction in the services sector activity in over two years, as the index fell below the neutral level of 50. The decline was attributed to stagnation in new orders, with businesses citing political uncertainty and spending cuts as contributing factors.

BTC Price Analysis

Over the past week, BTC has experienced notable fluctuations in its price, reflecting a mix of bullish and bearish sentiments in the market. As of March 6, 2025, BTC was trading at approximately $90,319.69, having seen a significant recovery from a low of $86,339 earlier in the week. This rebound was characterized by a series of technical indicators, including the appearance of a “golden cross” on the MACD, which typically signals a potential upward trend. However, the price action also indicated periods of volatility, with the asset testing resistance levels around $90,935 before encountering downward pressure due to a subsequent “death cross.”

Throughout this week, BTC’s price movements have been influenced by various market dynamics. After reaching an oversold condition early in the week, BTC found support and began to climb back up, driven by increased buying pressure. The RSI showed overbought conditions at several points, indicating strong interest from traders. Despite these positive signals, the market remains cautious due to external factors such as macroeconomic uncertainties and potential regulatory impacts that could affect investor sentiment.

Looking ahead, analysts suggest that BTC’s ability to maintain its current support levels will be crucial for its trajectory. If BTC can hold above $90,935 and continue to build momentum, it may target higher resistance levels, potentially reaching upwards of $92,800 or more. Conversely, failure to sustain these levels could lead to a retreat back towards lower support at $86,339. As traders closely monitor these developments, the next few days will be pivotal in determining whether Bitcoin can solidify its recovery or if it will face another downturn in the volatile cryptocurrency market.

On-Chain Analysis

- 📊 Exchange: As the exchange reserve continues to fall, it indicates lower selling pressure. Net deposits on exchanges are high compared to the 7-day average. Higher deposits can be interpreted as higher selling pressure.

- 💻 Miners: Miners’ are selling holdings in a moderate range compared to its one-year average. Miner’s revenue is in a moderate range, compared to its one-year average.

- ⛓️ On-chain: More investors are selling at a profit. In the middle of a bull market, it can indicate a market top. Long term holders’ movement in the last 7days were lower than the average. They have a motive to hold their coins. Investors are in a belief phase where they are currently in a state of high unrealized profits.

- 🏦 Derivative: Long position traders are dominant and are willing to pay to short traders. Buying sentiment is dominant in the derivatives market. More buy orders are filled by takers. As OI decreases, it indicates investors are closing futures positions and possibility of trend reversals. In turn, this might trigger the possibility of long/short-squeeze caused by sudden price movement or vice versa.

- 🔀 Technicals: RSI indicates a neutral condition. Stochastic indicates a neutral condition where the current price is in a moderate location between the highest-lowest range of the last 2 weeks.

News About Altcoins

- Volatility Shares Proposes Three XRP ETFs. Volatility Shares has proposed three XRP-based ETF products, including a spot XRP ETF, a 2x leveraged XRP ETF, and a -1x inverse XRP ETF. The spot ETF will track XRP’s price directly, while the leveraged version will double its daily movement, and the inverse ETF will allow investors to bet against XRP’s price. This move follows growing expectations of regulatory approval, with a 77% probability this year, according to Polymarket, although the chances of approval before July 31 are only 35%. Volatility Shares joins other asset managers, such as Grayscale, WisdomTree, and Bitwise, in the race to launch an XRP ETF in the U.S., while Brazil prepares to launch its first spot XRP ETF after securing regulatory approval.

News from the Crypto World in the Past Week

- Trump Invites Crypto Leaders to the White House to Discuss Government Bitcoin Reserves. U.S. President Donald Trump held a historic meeting with crypto industry elites at the White House to discuss plans for establishing a government-owned Bitcoin strategic reserve. The meeting was attended by prominent figures such as Michael Saylor (MicroStrategy), Brian Armstrong (Coinbase), and Cameron & Tyler Winklevoss. Trump emphasized that this reserve will be funded using Bitcoin assets seized through criminal and civil forfeitures, without placing any burden on taxpayers. While this initiative marks a significant step toward government-level crypto adoption, its long-term impact remains to be seen.

Cryptocurrencies Market Price Over the Past Week

Cryptocurrencies With the Best Performance

- Bitcoin Cash +9.94%

- PAX Gold +2.02%

Cryptocurrencies With the Worst Performance

- Sonic (S) -38.32%

- Jupiter (JUP) -37.69%

- Worldcoin -32.20%

- Bonk -31.05%

References

- Francisco Rodrigues, Volatility Shares Files for 3 XRP ETFs, Coindesk, accessed on 9 March 2025.

- Nandita Bose, Crypto leaders meet at Trump’s summit with strategic reserve in focus, reuters, accessed on 9 March 2025.

Share

Related Article

See Assets in This Article

BTC Price (24 Hours)

Market Capitalization

-

Global Volume (24 Hours)

-

Circulating Supply

-