Market Analysis Nov 25th, 2024: Bitcoin Nears $100K as Crypto Market Surges with Positive News

The crypto market continues to be flooded with positive news every day. Starting with Bitcoin almost reaching $100,000, Solana price hitting an all-time high, to the positive reception from crypto investors regarding the resignation of Gary Gensler, the Chairman of the U.S. Securities and Exchange Commission. Check out the macro and crypto analysis prepared by the Pintu trader team below.

Market Analysis Summary

- 🚀 BTC futures expiring in March, June, and September 2025 on Deribit are trading above $100,000, with $100,000 call options now holding over $2 billion in open interest, signaling traders’ confidence in further price increases.

- 💪🏻 The NY Empire State Manufacturing Index has experienced a remarkable recovery, with the latest reading coming in at 31.20—far exceeding the forecast of -0.70.

- 📈 The Census Bureau’s Advance Retail Sales Report for October showed a 0.4% increase in headline sales, surpassing the anticipated 0.3% growth in consumer spending for the month.

- 📉 Initial jobless claims dropped by 6,000 from the previous week to 213,000.

Macroeconomic Analysis

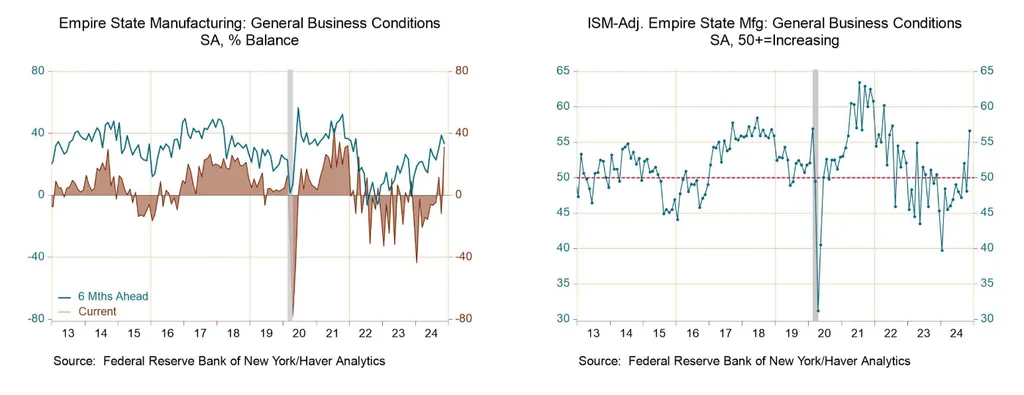

NY Empire State Manufacturing Index

The NY Empire State Manufacturing Index, a key measure of business conditions in New York state, has experienced a remarkable recovery, with the latest reading coming in at 31.20—far exceeding the forecast of -0.70.

This index, derived from a survey of approximately 200 manufacturers in the state, assesses the relative level of general business activity. A reading above 0.0 indicates improving conditions, while a reading below 0.0 reflects a decline. The recent surge highlights a significant improvement in the business climate.

The actual figure surpassed expectations by an impressive 31.50 points, showcasing a much stronger performance in the manufacturing sector than anticipated. Such a positive surprise typically supports a bullish outlook for the USD, as stronger economic indicators tend to bolster the currency.

Compared to the previous reading of -11.90, the current figure represents a dramatic turnaround, with an increase of 43.10 points. This sharp recovery suggests that New York’s manufacturing sector has bounced back strongly from a challenging period.

The robust rise in the index underscores the resilience and adaptability of the state’s manufacturers, reaffirming their critical role in driving economic growth and supporting the USD.

This unexpected improvement is likely to enhance investor confidence in New York’s manufacturing industry and overall economic prospects. It also signals a brighter outlook for the state’s economic growth, with potential positive implications for the USD in the months ahead.

In summary, the latest NY Empire State Manufacturing Index reveals a positive and robust snapshot of the state’s business environment. The substantial improvement, surpassing both forecasted and previous figures, highlights a strong recovery and an optimistic outlook for the state’s manufacturing sector and the USD.

Other Economic Indicators

- Retail Sales: U.S. Department of Commerce reported that U.S. retail sales increased by 0.4% month-over-month in October (not adjusted for inflation), surpassing expectations of 0.3%. The September figure was significantly revised upward from 0.4% to 0.8%, while August was revised downward to a 0.1% decline.

- Building Permits: In October 2024, U.S. building permits declined by 0.6% to a seasonally adjusted annual rate of 1.416 million, falling short of market expectations of 1.43 million. Approvals for units in buildings with five or more units dropped by 3% to 393,000, while single-family authorizations increased by 0.5% to 968,000. Regionally, permits decreased in the Midwest (-4% to 193,000), the South (-1.8% to 752,000), and the West (-1.2% to 327,000), but rose significantly in the Northeast, up 13.4% to 144,000.

- Jobless Claim: According to the Department of Labor, Americans filed for unemployment benefits at a slower pace in the week ending November 16. Initial jobless claims dropped by 6,000 from the previous week to 213,000, marking the lowest level since April and falling well below expectations of an increase to 220,000. The four-week moving average, which smooths out weekly fluctuations, declined by 3,750 to 217,750. Meanwhile, the unadjusted claim count decreased by 17,750 to 213,035.

- Existing Home Sales: The National Association of Realtors (NAR) reported on Thursday that home sales rose by 3.4% to a seasonally adjusted annual rate of 3.96 million units. This exceeded economists’ expectations of 3.93 million units and rebounded from September’s 3.83 million units, the lowest level since October 2010.

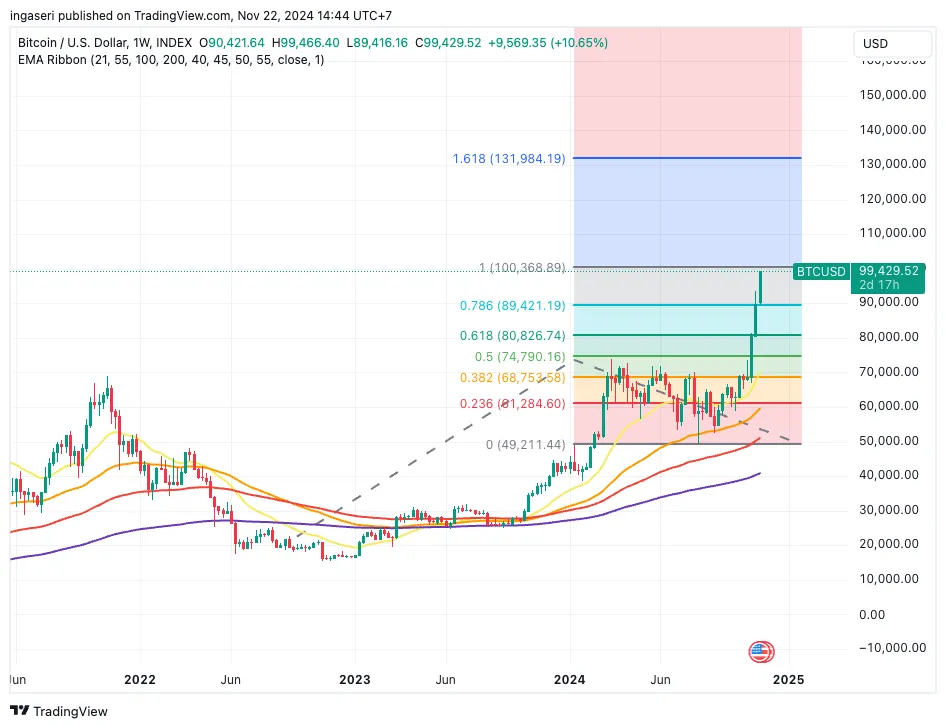

BTC Price Analysis

BTC surged past $99,200 early Friday, briefly dipping to $98,600 before stabilizing above $99,000 during the Asian afternoon trading hours. The total crypto market capitalization reached an all-time high of $3.4 trillion, gaining 4.5% in the past 24 hours, driven largely by BTC’s 2% rise. BTC now accounts for over 56% of the market cap.

U.S. spot Bitcoin exchange-traded funds (ETFs) saw net inflows exceeding $1 billion, with BlackRock’s IBIT leading the pack with $600 million in purchases. Fidelity’s FBTC followed with inflows of over $300 million, and no outflows were recorded across the 11 ETFs currently offered.

BTC’s strength is driving a rotation into other major tokens, supported by renewed optimism surrounding a pro-crypto Trump administration set to take office in January.

Ether surged nearly 9% in the last 24 hours, boosting indexes tracking the decentralized finance (DeFi) sector by at least 8%. Ethereum-based memecoins such as Mog (MOG) and Pepe (PEPE) saw gains of up to 27%, reflecting their tendency to mirror ETH’s upward momentum.

Solana (SOL) gained 8%, reaching new highs above $260 amid increasing interest in ETF filings in the U.S. and the blockchain’s continued use for speculative trading. Cardano rose 12%, posting the second-largest gains among major tokens after XRP.

XRP led the rally with a 25% jump, driven by news of SEC Chair Gary Gensler’s planned resignation in January, alleviating regulatory pressures on U.S.-linked tokens.

Traders anticipate continued strength in BTC prices in the near term. Demand for BTC remains robust, supported by easing global monetary policies as we approach year-end. Aggressive interest in March and June Calls this week is also observed, reflecting long-term bullish sentiment for 2025.

BTC futures expiring in March, June, and September 2025 on Deribit are trading above $100,000, with $100,000 call options now holding over $2 billion in open interest, signaling traders’ confidence in further price increases.

On-Chain Analysis

- 📊 Exchange: As the exchange reserve continues to fall, it indicates lower selling pressure. Net deposits on exchanges are high compared to the 7-day average. Higher deposits can be interpreted as higher selling pressure.

- 💻 Miners: Miners’ are selling more holdings compared to its one-year average. Miner’s revenue is in a moderate range, compared to its one-year average.

- ⛓️ On-chain: More investors are selling at a profit. In the middle of a bull market, it can indicate a market top. Long term holders’ movement in the last 7 days was higher than the average. If they were moved for the purpose of selling, it may have negative impact. Investors are in a belief phase where they are currently in a state of high unrealized profits.

- 🏦 Derivative: Long position traders are dominant and are willing to pay to short traders. Buying sentiment is dominant in the derivatives market. More buy orders are filled by takers. As open interest increases, it indicates more liquidity, volatility, and attention are coming into the derivative market. The increasing trend in open interest could support the current ongoing price trend.

- 🔀 Technicals: RSI indicates a overbought condition where 84% of price movement in the last 2 weeks have been up and a trend reversal can occur. Stochastic indicates a neutral condition where the current price is in a moderate location between the highest-lowest range of the last 2 weeks.

News About Altcoins

- XRP Surges on News of SEC Chair Resignation. Ripple’s XRP token experienced a significant 25% surge, surpassing $1.40, following the announcement of SEC Chairman Gary Gensler’s impending departure. The news has ignited speculation that the SEC might adopt a more lenient stance toward cryptocurrencies, potentially leading to a resolution of its ongoing legal dispute with Ripple. Industry leaders, including ConsenSys CEO Joe Lubin and Pantera’s legal head Katrina Paglia, anticipate a more favorable regulatory landscape for digital assets. These expectations, combined with rumors of a potential meeting between Ripple executives and a former U.S. president, have bolstered investor sentiment. Analysts have projected that XRP could reach $2. Furthermore, the recent launch of a physically backed XRP ETP in Europe and the prospect of a U.S.-based XRP ETF are expected to provide additional upward momentum for the cryptocurrency. XRP’s impressive 138% year-to-date performance has outpaced both Ethereum and is nearing Bitcoin’s gains.

News from the Crypto World in the Past Week

- El Salvador’s Massive Bitcoin Investment Gains. El Salvador’s President Nayib Bukele announced that the country has realized a significant 113.84% profit on its Bitcoin portfolio. With a current balance of $573 million, the initial investment of $268 million has yielded substantial returns, particularly after Bitcoin’s recent surge to nearly $99,000. In 2021, El Salvador made history by becoming the first country to adopt Bitcoin as legal tender. The majority of these Bitcoin holdings are securely stored in a “cold wallet.” While international organizations such as the IMF have expressed concerns about this strategy, President Bukele remains steadfast and proud of the decision.

Cryptocurrencies Market Price Over the Past Week

Cryptocurrencies With the Best Performance

- Stellar (XLM) +145.65%

- The Sandbox +10.3.32%

- Decentraland (MANA) +65.37%

- Tezos (XTZ) +60.70%

Cryptocurrencies With the Worst Performance

- Peanut the Squirrel (PNUT) -36.15%

- Popcat (POPCAT) -24.57%

- dogwifhat (WIF) -14.61%

- Sui (SUI) -14.30%

References

- Vivian Nguyen, XRP jumps 25% as SEC may not pursue appeal after Gensler’s departure, cryptobriefing, accessed on 23 November 2024.

- Christian K. Caruzo, Nayib Bukele Shows Off El Salvador’s Bitcoin Profits, Breitbart, accessed on 23 November 2024.

Share

Related Article

See Assets in This Article

BTC Price (24 Hours)

Market Capitalization

-

Global Volume (24 Hours)

-

Circulating Supply

-