Market Analysis October 6: Bitcoin Makes New All-Time High!

The crypto market has shown strong dynamics over the past week, led by Bitcoin, which managed to set a new all-time high. Meanwhile, Ethereum retested its peak level, and Solana approached a key resistance area that will determine the next direction. This week, market volatility is expected to rise alongside the release of key U.S. economic data.

Key Takeaways

- Bitcoin successfully set a new ATH at $125,708 after moving sideways for the past few weeks.

- Ethereum is once again attempting to break through its ATH resistance from 2021 at $4,868.

- Solana is showing positive momentum after breaking out on the weekly close of August 18. SOL’s main target is the resistance area at $252.73–$264.39.

Macroeconomic Analysis

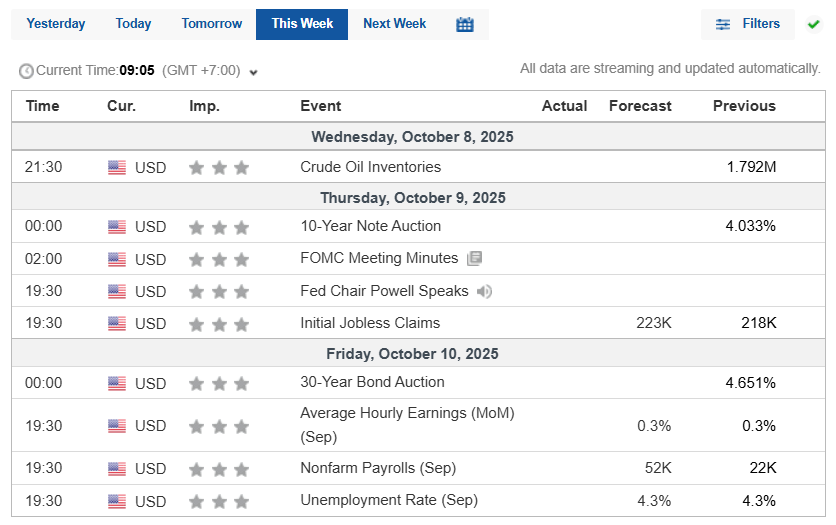

Global market focus this week will center on the release of high-impact U.S. economic data, which could significantly affect risk assets, including crypto.

- Interest Rate Sentiment (Thursday, October 9): The release of the September FOMC meeting minutes and a speech from Fed Chair Jerome Powell will be the main highlights. Market participants will be looking for clues about the Fed’s next monetary policy direction, especially regarding interest rates. A hawkish tone (tighter policy) may pressure risk assets, while a dovish tone (looser policy) could boost positive sentiment.

- Employment Data (Thursday & Friday): Initial Jobless Claims on Thursday. Average Hourly Earnings, Nonfarm Payrolls , and the Unemployment Rate on Friday.

Stronger-than-expected labor data could give the Fed room to keep interest rates higher for longer, potentially negative for crypto markets. Conversely, weaker-than-expected data may increase market expectations of monetary easing, which could have a positive impact. Market participants should stay alert to rising volatility before and after the release of this data.

Bitcoin (BTC) Analysis

New ATH Reached, Bullish Sentiment Holds Above Key Levels

Bitcoin took the spotlight after delivering an impressive 10.09% gain in the past week. This significant rally pushed the price to a new all-time high of $125,708.

The bullish momentum is supported by solid defense at key support levels:

- Crucial Support Level (RBS): $108,353, which was the weekly closing high on December 16, 2025, now serves as resistance-turned-support (RBS). This area has proven to be a strong defense against price declines.

- Support Validation: The strength of this RBS has been confirmed several times, such as on the weekly closes of March 31, April 7, and most recently August 25, when the price rebounded after testing this level.

- Upside Projection: As long as Bitcoin remains above the RBS level of $108,353, the bullish trend is likely to continue, with the nearest target at $129,165.

Ethereum (ETH) Analysis

Retesting Historical Peak

Ethereum’s bullish pace faces a challenge as it nears its 2021 ATH of $4,868. Price rejection at this level triggered a pullback.

Still, positive sentiment is supported by several factors:

- Strong Support: The RBS level at $4,093 held firmly, stopping ETH’s decline.

- Buying Pressure: Heavy buying around this support helped reverse price direction upward.

- Next Target: ETH is now set to retest the resistance cluster between the old ATH and a potential new ATH at $4,868–$4,956.

- Bullish Continuation Requirement: A breakout above this resistance area is crucial for ETH to sustain its bullish momentum. If successful, ETH could advance further toward $5,266–$5,660.

Solana (SOL) Analysis

Bullish Momentum Toward Key Resistance

Solana price action continues to show positive momentum after breaking out from the double-bottom neckline on the weekly close of August 18. SOL is now targeting the resistance zone at $252.73–$264.39.

Price reaction at this resistance zone will determine the next direction:

- Bullish Scenario: If SOL breaks above, bullish momentum could strengthen, targeting $310.11.

- Correction Scenario: If rejected, SOL could retrace, with the neckline level at $184.88 acting as key support.

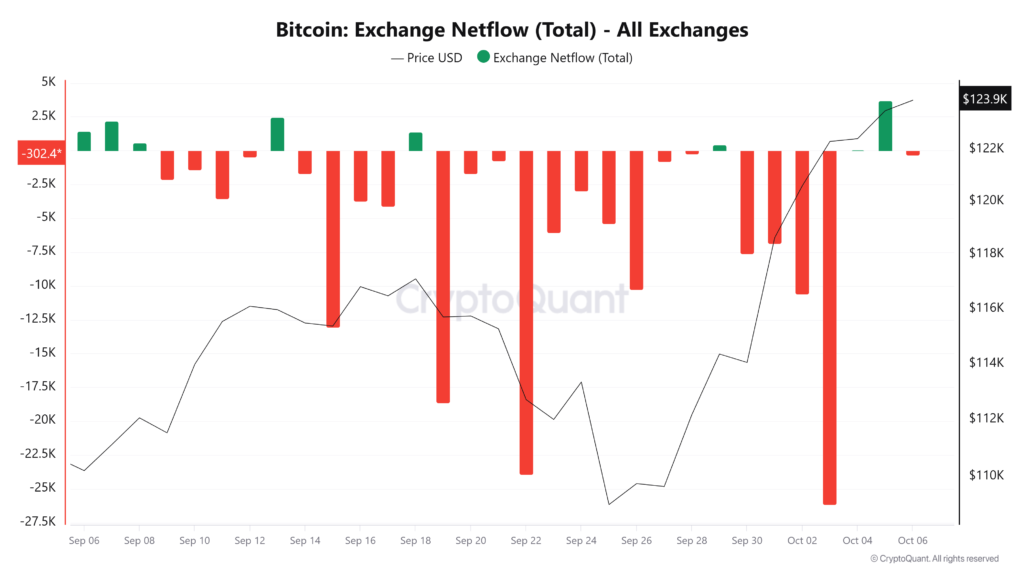

On-Chain Analysis: Caution from Exchange Flows

Exchange Netflow data shows interesting sentiment. Between September 18 and October 3, Bitcoin outflows dominated, signaling accumulation as market players moved assets off exchanges—a positive sentiment.

However, on October 5, the data showed dominant inflows. This could be an early warning of potential large-scale selling pressure in the market.

Altcoin Sector News

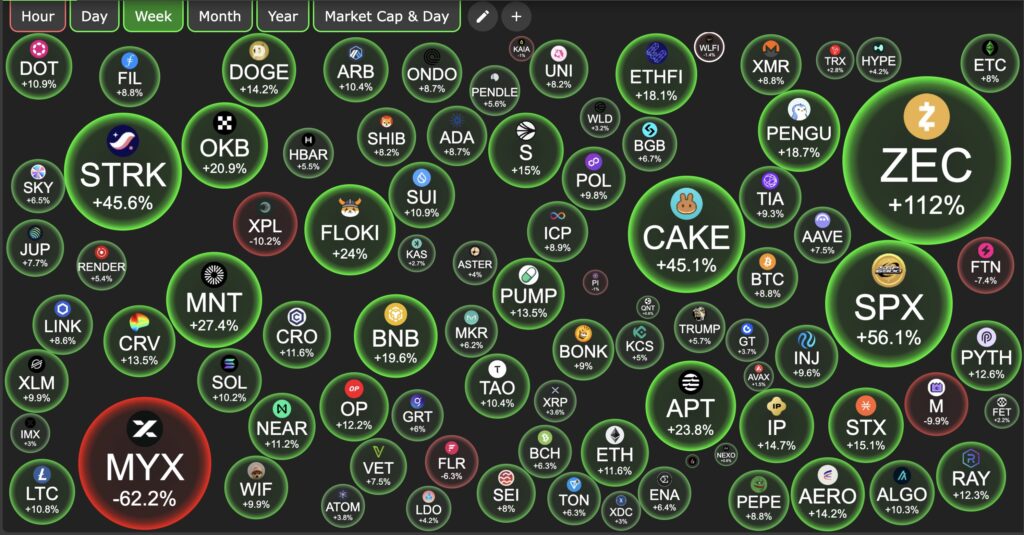

Privacy Sector Suddenly in the Spotlight:

In the past week, Zcash and the broader privacy crypto sector have suddenly become the talk of the community. Over the past two weeks, the price of ZEC has surged nearly 300%. Zcash drew attention in the crypto community after being mentioned by “Naval,” one of the iconic figures in the crypto and tech industry.

Perpetual DEX Competition Heats Up:

The competition among perpetual DEXs continues to intensify. Many new perpetual DEXs are emerging to challenge Hyperliquid. Aster is currently Hyperliquid’s biggest competitor in terms of volume. However, DeFiLlama delisted Aster due to suspicions of wash trading or inflated trading volume. In addition, Lighter, Avantis, and Apex have also become focal points as other rising competitors.

Weekly Crypto Asset Performance

Top Performers:

- CELO +65.50%

- SPX6900 (SPX) +54.35%

- Starknet +44.70%

- Launchcoin on Believe (LAUNCHCOIN) +43.95%

Worst Performers:

- Heima -15.31%

- Plasma (XPL) -14.35%

- Nomina (NOM) -13.06%

- Kaito (KAITO) -11.19%

Share

Related Article

See Assets in This Article

NFP Price (24 Hours)

Market Capitalization

-

Global Volume (24 Hours)

-

Circulating Supply

-