Market Analysis Sep 2nd, 2024: August Ends with a Downtrend for Bitcoin

Historically, Bitcoin has frequently closed August in the red, causing significant concern among crypto investors and prompting questions about potential catalysts for price growth. The key question remains: could September be a month of positive momentum for BTC? Please find the analysis below.

As usual, the Pintu trading team has gathered critical information and analyzed the general economic situation and the crypto market’s movements over the past week. However, it should be noted that all information in this Market Analysis is intended for educational purposes, not as financial advice.

Market Analysis Summary

- 🚨 The key price level for BTC is $59,000; if it drops below this threshold, market volatility may increase, raising concerns that the price could continue to decline.

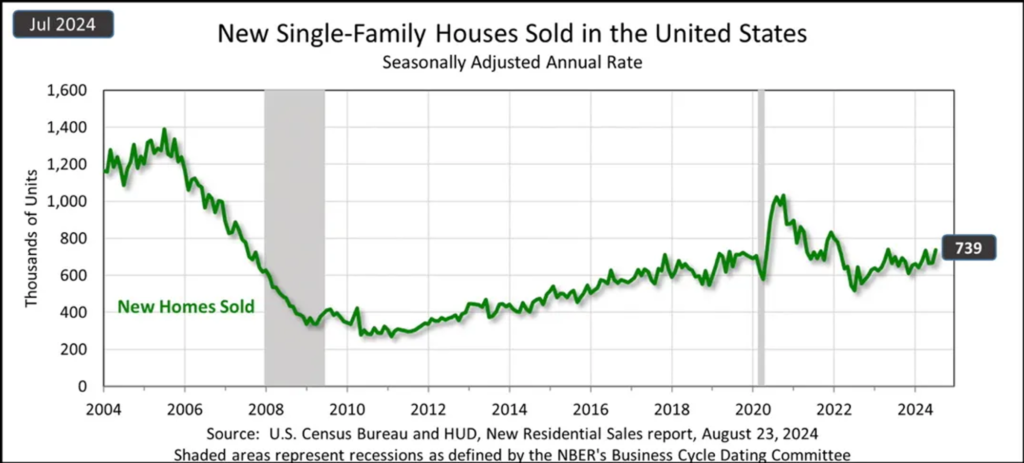

- 🏠 Sales of new single-family homes in the United States reached a seasonally adjusted annual rate of 739,000 in July 2024.

- 📈 New orders for manufactured durable goods in July increased for the fifth time in six months.

- 🟢 The U.S. GDP growth rate for the last quarter was revised upward to 3.0% annually, from the previously reported 2.8%.

Macroeconomic Analysis

New Home Sales

In July 2024, sales of new single-family houses reached a seasonally adjusted annual rate of 739,000, as reported by the U.S. Census Bureau and the Department of Housing and Urban Development. This figure is 10.6% higher than the revised June rate of 668,000 and 5.6% higher than the July 2023 estimate of 700,000.

The median sales price for new houses sold in July 2024 was $429,800, while the average sales price stood at $514,800.

At the end of July, the seasonally adjusted inventory of new houses for sale was estimated at 462,000, which corresponds to a 7.5-month supply at the current sales pace.

Other Economic Indicators

- Durable Goods: In July, new orders for manufactured durable goods rose for the fifth time in six months, increasing by $26.1 billion, or 9.9%, to $289.6 billion, according to the U.S. Census Bureau. This comes after a 6.9% decline in June. Excluding transportation, new orders fell by 0.2%. When excluding defense, new orders saw a 10.4% increase. The rise was primarily driven by transportation equipment, which saw an increase of $26.4 billion, or 34.8%, to $102.2 billion, marking its second increase in the last three months.

- Jobless Claim: Initial claims for state unemployment benefits dropped by 2,000 to a seasonally adjusted 231,000 for the week ending August 24. Economists had predicted 232,000 claims for the week. Claims have decreased from an 11-month high in late July. Last week, the Bureau of Labor Statistics (BLS) estimated that employment growth was overstated by 68,000 jobs per month for the 12 months leading up to March.

- Continuing Claims: The number of people receiving benefits after their first week of aid, a measure often used as a proxy for hiring, rose by 13,000 to a seasonally adjusted 1.868 million during the week ending August 17, according to the claims report. These continued claims are close to levels last seen in late 2021, suggesting longer periods of unemployment.

- GDP: GDP grew at a 3.0% annualized rate in the last quarter, revised up from the 2.8% rate initially reported, according to the Commerce Department’s Bureau of Economic Analysis in its second estimate for second-quarter GDP released on Thursday. The economy expanded at a 1.4% pace in the first quarter.

BTC Price Analysis

The recent decline in BTC follows dovish remarks from the Fed and a lack of bullish momentum this week. The pullback was largely due to the liquidation of long positions in a market with low liquidity, as there was no apparent catalyst for the drop.

On-Chain Analysis

- 📊 Exchange: As the exchange reserve continues to fall, it indicates lower selling pressure. Net deposits on exchanges are high compared to the 7-day average. Higher deposits can be interpreted as higher selling pressure.

- 💻 Miners: Miners’ are selling holdings in a moderate range compared to its one-year average. Miner’s revenue is in a moderate range, compared to its one-year average.

- 🔗 On-Chain: More investors are selling at a loss. In the middle of a bear market, it can indicate a market bottom. Long term holders’ movement in the last 7 days was lower than the average. They have a motive to hold their coins. Investors are in a anxiety phase where they are currently in a state of moderate unrealized profits.

- 🏦 Derivatives: Short position traders are dominant and are willing to pay long traders. Selling sentiment is dominant in the derivatives market. More sell orders are filled by takers. As open interest decreases, it indicates investors are closing futures positions and possibility of trend reversals. In turn, this might trigger the possibility of long/short-squeeze caused by sudden price movement or vice versa.

- 🔀 Technicals: RSI indicates a neutral condition. Stochastic indicates a neutral condition where the current price is in a moderate location between the highest-lowest range of the last 2 weeks.

News About Altcoins

- Hamster Kombat Token Launch and Mega Airdrop Set for September 26, 2024. After multiple delays, the creators of the viral Telegram game Hamster Kombat have finally announced the launch of the $HMSTR token and a massive airdrop on September 26, 2024. Originally scheduled for late July, the delays have led to a significant drop in active followers from 155 million to 87 million. Promoted as the largest airdrop in the history of Telegram-based play-to-earn games, Hamster Kombat will introduce new features, additional content, and partnerships to enhance gameplay and community engagement.

News from the Crypto World in the Past Week

- Telegram CEO Pavel Durov Acquitted but Subject to Travel Ban. Pavel Durov, the CEO of Telegram, was acquitted of charges by French authorities on August 28. However, despite the acquittal, he was placed under judicial supervision and prohibited from leaving France. Additionally, Durov was required to post a bail of 5 million euros. The ordeal began on August 24 when Durov was detained at an airport near Paris. Following a court appearance, his detention was extended until his eventual release.

Cryptocurrencies Market Price Over the Past Week

Cryptocurrencies With the Best Performance

- Helium +6,43%

Cryptocurrencies With the Worst Performance

- SATS -28,43%

- Polygon (MATIC) -25,15%

- dYdX -23,35%

- Celestia -23,07%

References

- Jahnu Jagtap, Hamster Kombat Token Launch: What Players can Expect post Sept 26, Cryptotimes, accessed on 1 September 2024.

- Editorial Staff, Telegram CEO Pavel Durov charged and released, barred from leaving France, Cointelegraph, accessed on 1 September 2024.

Share

Related Article

See Assets in This Article

BTC Price (24 Hours)

Market Capitalization

-

Global Volume (24 Hours)

-

Circulating Supply

-