Market Signal 30th July 2024: The Bull Keeps on Charging!

The positive trend in the crypto market appears to be continuing this week. Last week, several significant events acted as positive catalysts for the crypto market. These included the launch of the spot Ethereum ETF and a speech by US presidential candidate Donald Trump at a Bitcoin conference held in Nashville.

At the conference, Trump stated that if elected as US president, he would make Bitcoin a strategic reserve for the US, fire Gary Gensler, and appoint a new SEC Chair. Additionally, he made several positive statements regarding Bitcoin and the crypto market.

The weekly BTC candle closed above the $68,000 level in response to these positive sentiments. This serves as valuable momentum for BTC to continue its upward movement this week. Now, BTC will test the $70,000 level as a psychological resistance level.

The Pintu Academy team has compiled valuable insights from several crypto projects. We analyze that information to determine its potential impact on various asset prices. Will these be bullish or bearish catalysts? Find out in the following article.

It should be noted that all information in this Market Signal is intended for educational purposes, not as financial advice. Do your own research before making any financial decisions!

Jupiter (JUP) ➡️ Bullish 🚀

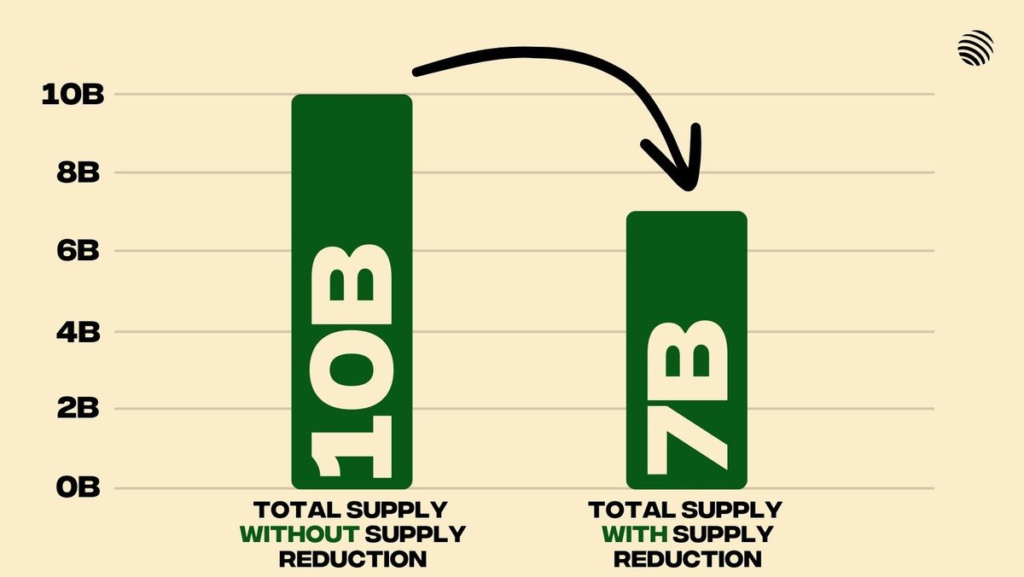

The JUP token should be added to your watchlist this week as it has the potential for an upward movement. This is based on Jupiter’s upcoming discussion and voting on a proposal to reduce long-term emissions and the JUP supply by 30%. This 30% allocation will be taken from the holdings of the core Jupiter team.

JUP is one of the few tokens without direct investors. Therefore, this supply reduction plan can alleviate the Fully Diluted Valuation (FDV) burden. Additionally, it will address concerns regarding the high emission rate of JUP. If approved, the JUP token supply will decrease from 10 billion JUP to only 7 billion JUP.

The voting process will begin on August 1, 2024, and conclude in 2024. If most Jupiter DAO members approve the proposal, the reduction in JUP supply could be a positive catalyst for the token’s price movement.

Currently, JUP is trading at Rp 17,505. Over the past week, it reached a high of Rp 19,864 and a low of Rp 15,191.

MakerDAO (MKR) ➡️ Bullish 🚀

MakerDAO is a token that could trend upward this week. MakerDAO’s newly initiated Real World Asset (RWA) initiative is a positive catalyst that can potentially boost MKR’s price.

The Spark Tokenization Grand Prix program aims to facilitate the onboarding of tokenized RWAs worth up to $1 billion. The program is scheduled to launch on August 12th. So far, Securitize (a BlackRock partner), Ondo Finance, Paxos, and Superstate have expressed interest in participating.

The Spark Tokenization Grand Prix is part of MakerDAO’s broader Endgame strategy. The Endgame Plan aims to improve the governance and tokenomics of the Maker ecosystem to reach a self-sustainable equilibrium called the Endgame State. In this state, “the ecosystem is resilient, and the scope and complexity of Maker Core will no longer change,” claims MakerDAO’s documentation.

If this program successfully drives the onboarding of tokenized RWAs, it could strengthen MakerDAO’s fundamentals in the long term. As a result, the price of the MKR token is also likely to increase.

Jito (JTO) ➡️ Bullish 🚀

In addition to JUP, another Solana ecosystem token, JTO, also has the potential to be in an upward trend this week. The reason for this is Jito’s upcoming launch of Jito Restaking, a new open-source code that can potentially revolutionize the staking mechanism on the Solana blockchain.

This new code allows protocols built on Solana to implement economic security mechanisms for almost all on-chain applications. Jito Restaking is designed to increase token utility, support diverse staking strategies, and secure L2 sequencer networks and cross-chain bridges.

It is currently undergoing code verification and auditing. Once the audit is complete and the feature is launched, it could be a positive catalyst that drives up the price of JTO.

Currently, JTO is trading at Rp 50,111. Over the past week, it has increased by 14.86% and reached a high of Rp 54,321

Zeta Chain (ZETA) & Wormhole (W) ➡️ Uncertain⚖️

This week, two protocols are scheduled for token unlocks: ZetaChain and Wormhole (W). ZETA will unlock 53.89 million tokens, or approximately 18.92% of its total circulating supply, on August 1, 2024. This equates to $34.58 million that will be released to investors and ZetaChain ecosystem incentives.

Meanwhile, on August 3, 2024, W will unlock 600 million tokens, or around 33% of its total circulating supply. With the current ALT valuation at $0.287, this unlock represents $180.48 million.

The additional token supply could trigger volatility in the short term for ZETA and W. If demand does not keep pace with the increased supply, the prices of both ZETA and W will likely experience a correction, especially for W, given its significantly larger token unlock.

Crypto Performance Over the Past Week

Here are the best and worst performing cryptos on Pintu:

Cryptocurrencies With the Best Performance

- RSK Infrastructure Framework : 🔼30,27% (Rp 1.886)

- LayerAI (LAI): 🔼27,85% (Rp 280)

- Cortex : 🔼23,06% (Rp 3101)

Cryptocurrencies With the Worst Performance

- Pixelverse (PIXFI): 🔽34,06% (Rp 506)

- Inspect : 🔽26,28% (Rp 343)

- Heroes of Mavia (MAVIA): 🔽24,50% (Rp 30.580)

References

- Mehab Qureshi, BlackRock’s BUIDL to Participate in MakerDAO’s $1 Billion RWA Push, The Defiant, accessed on 29 July 2024.

- Jito Foundation, Announcing Jito Restaking, A Next-Gen Infrastructure Platform, Jito Blog, accessed on 29 July 2024.

Share

Related Article

See Assets in This Article

MKR Price (24 Hours)

Market Capitalization

-

Global Volume (24 Hours)

-

Circulating Supply

-