Market Signals July 2nd, 2024: BTC Slowly Recovering, What About Altcoins?

BTC started a recovery trend at the beginning of this week after experiencing a bearish trend throughout the previous week. Before entering a consolidation phase, BTC briefly touched a monthly low of $58,555. The pressure on BTC’s price also negatively impacted the price of altcoins.

Fortunately, BTC started this week strongly by breaking through the nearest resistance level at $62,650. At the time of writing, BTC is trading at $62,873, up 7.37% from its low. Meanwhile, the performance of altcoins has not yet fully recovered, as many altcoins are still in the red zone for the past week.

Despite this, the rise in BTC’s price has successfully lifted the crypto market capitalization from US$2.11 trillion to US$2.26 trillion.

The Pintu Academy team has compiled valuable insights from several crypto projects. We analyze that information to determine its potential impact on various asset prices. Will these be bullish or bearish catalysts? Find out in the following article.

It should be noted that all information in this Market Signal is intended for educational purposes, not as financial advice. Do your own research before making any financial decisions!

ZKsync (ZK) ➡️ Bullish 🚀

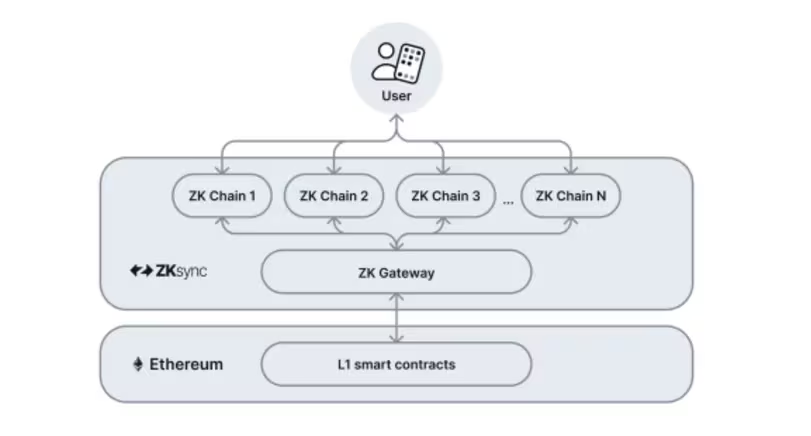

ZKsync is a token that can potentially enter a bullish zone this week. The driving force behind this anticipated price surge is the announcement of more detailed information regarding the Elastic Chain.

Elastic Chain is a significant update in the ZKsync 3.0 roadmap with a grand goal of seamlessly connecting their ecosystem. It aimed at making the ecosystem more interconnected, bearing some resemblance to Polygon’s AggLayer. Elastic Chain is composed of multiple chains in the ZKsync ecosystem, but users will feel like they are using a single chain, according to the team.

"Elastic Chain ensures that ZK chains can efficiently interact and transact with other chains. Additionally, it inherits Ethereum's security and forms a scalable network without sacrificing its other core properties," Matter Labs explains about Elastic Chain.

ZK’s price has been trending upward for the past seven days. It is currently trading at Rp 2,944, with its lowest level at Rp 2,480.

EtherFi (ETHFI) ➡️ Bearish 📉

Etherfi’s airdrop schedule could potentially trigger a bearish trend for the token this week. The distribution of airdrop season 2 is set for July 8, 2024. Before claiming ETHFI tokens, Etherfi will open a portal to check eligibility on July 5, 2024. This season’s airdrop is valued at approximately $150 million.

The airdrop event is anticipated to be a negative catalyst for ETHFI tokens. This is because airdrop recipients are more likely to sell their tokens, increasing the existing supply. Simultaneously, demand for the token tends to be low during such periods. As a result, the price of ETHFI tokens may experience a short-term decline.

Adding to the potential bearish pressure, Etherfi has also announced the opening of airdrop season 3 with a distribution of 25 million ETHFI tokens. The point collection process will commence on July 1 and conclude in early September. The distribution of airdrop season 3 will take place after the completion of season 3.

Over the past week, ETHFI’s price has already been under pressure, experiencing a decline from Rp 55,474 to Rp 44,874 within that timeframe.

Bitcoin (BTC) ➡️ Uncertain⚖️

Bitcoin is expected to remain uncertain this week. The significant catalysts stemming from the release of the Fed FOMC minutes and June’s non-farm payroll data.

Market participants anticipate the unemployment rate at 4%, the highest since February 2022. Meanwhile, the latest unemployment claims data reached 1.84 million, the highest since November 2021. These two data points have raised concerns about the potential for US economic growth to fall below expectations.

From a technical standpoint, BTC’s bullish momentum could persist if it holds above the $62,650 level and the trendline. Closing above this trendline could propel prices towards the $65,000 resistance zone.

However, if BTC reverses its direction, the nearest support will be around $60,150, with the first significant support being near $58,500. A breach below this support zone could trigger further bearish activity, potentially pushing prices down to the $56,500 support level.

Io.net (IO) ➡️ Uncertain⚖️

Io.net (IO), a decentralized AI protocol, is set to unlock approximately 8.27 million tokens for its community this week. This unlock will release 7.89% of the current circulating supply, equivalent to $27.2 million.

The influx of additional token supply could trigger volatility in IO’s price in the short term. Moreover, since these unlocked tokens are distributed to the community, there is a higher likelihood of direct selling, potentially increasing the supply further. If this increase in supply is not followed by proportional demand, IO’s price could experience a correction.

IO is currently trading at Rp49,139. Over the past week, IO's price has ranged from a low of Rp48,869 to a high of Rp62,320.

Crypto Performance Over the Past Week

Here are the best and worst performing cryptos on Pintu:

Cryptocurrencies With the Best Performance

- Popcat (POPCAT): 🔼49,72% (Rp 10.165)

- Zignaly : 🔼43,79% (Rp 1.945)

- Ethereum Name Service : 🔼526.376% (Rp 525.540)

Cryptocurrencies With the Worst Performance

- Inspect : 🔽35,47% (Rp 389)

- RSS3 : 🔽34,02% (Rp 3.057)

- TENET(TENET): 🔽30,63% (Rp 253)

Share

Related Article

See Assets in This Article

1.0%

0.0%

0.0%

0.0%

0.0%

BTC Price (24 Hours)

Market Capitalization

-

Global Volume (24 Hours)

-

Circulating Supply

-