Market Signals June 11th, 2024: RWA Sector Tokens Poised to Soar

BTC has successfully maintained the $69,000 level as support over the past week. It even managed to rise 5% above the $71,000 mark, nearly breaking through the $72,000 resistance level. However, BTC lost momentum and returned to the $69,000 area.

In contrast to BTC’s performance, most other major altcoins were in the red zone over the past week. As a result, the total crypto market capitalization is stagnant at around $2.47 trillion.

The Pintu Academy team has compiled valuable insights from several crypto projects. We analyze that information to determine its potential impact on various asset prices. Will these be bullish or bearish catalysts? Find out in the following article.

It should be noted that all information in this Market Signal is intended for educational purposes, not as financial advice. Do your own research before making any financial decisions!

Bitcoin (BTC) ➡️ Bullish 🚀

BTC is likely to remain in a positive sentiment this week. Last week, the funds flowing into Bitcoin spot ETFs reached $1.83 billion. It is nearly ten times higher than the previous week’s $170.9 million. If the accumulation trend continues, BTC will be one of the bullish tokens this week.

Moreover, BTC’s technical movement shows a bullish structure. Currently, BTC is showing a flag pattern that indicates that it could experience an up to 45% rally. However, a more realistic target for BTC at this time is to break above the $73,650 level. If successful, BTC will set a new All-Time High (ATH).

On a macro level, the FOMC meeting on June 12 is worth the investor’s attention. So far, the market expects the Fed to maintain interest rates. However, they will be looking for clues as to when the central bank finally could cut its key rate and how many times it might do so this year. The price of BTC will move again in response to the meeting’s outcome.

At the same time, the May Consumer Price Index (CPI) data, which measures US inflation, will be released. If the figure is hotter than expected, it could influence the Fed's stance on rate cuts.

RWA Tokens (ONDO, CPOOL, TRU, MPL) ➡️ Bullish 🚀

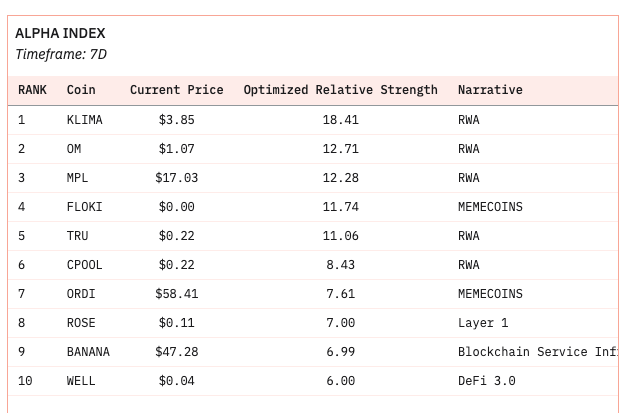

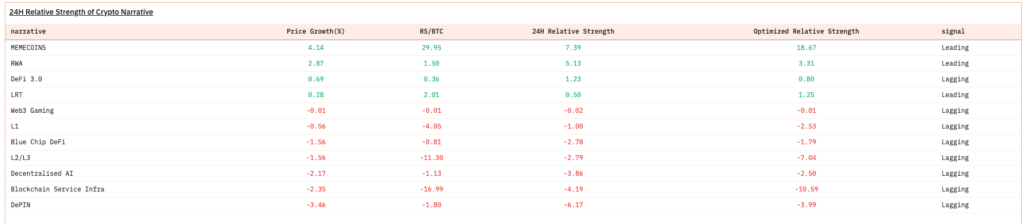

So far, tokens in the RWA sector have managed to maintain their performance despite the massive drop from most altcoins. Based on the @dyorcrypto dashboard on Dune, five of the ten tokens with stronger performance than BTC are tokens from the RWA sector: KLIMA, OM, MPL, TRU, and CPOOL.

Overall, the RWA narrative also has strong sentiment compared to other narratives, especially in the past 24 hours. The solid performance of the RWA sector cannot be separated from the role of institutional investors. Thanks to tokenization technology, institutional investors with large managed funds can store them in RWA protocols.

With the strong performance of OM, MPL, TRU, and CPOOL, the positive trend is not impossible to continue. In addition, the RWA protocol with the largest TVL and market cap, ONDO, is also worth paying attention to. If BTC continues its rally, the RWA sector will likely be the first to feel the positive impact.

FET, AGIX, OCEAN ➡️ Uncertain⚖️

Fetch.ai (FET), SingularityNET (AGIX), and Ocean Protocol (OCEAN) will merge into a single entity with a new name, Artificial Superintelligence Alliance (ASI). After the merger, the three ticker tokens will be replaced by $ASI. ASI is an open-source protocol focused on decentralized networks in the Artificial Intelligence (AI) industry.

The merger process involving three protocols at once is the first of its kind in the crypto industry. On the one hand, the movements of the three tokens have tended to consolidate and have consistently failed to break out recently. Therefore, it will be interesting to see how the market reacts after the merger.

If the merger does not meet expectations or is instead used as a “sell the news” event, sell pressure could trigger a correction. However, it is also possible that the merger’s success will trigger buying activity. The assumption that ASI could be a potential token in the AI sector could drive up prices.

Aptos (APT) & StarkNet (STRK) ➡️ Uncertain⚖️

The Aptos and StarkNet (STRK) protocols will unlock tokens this week. On June 12, 2024, APT will unlock 11.3 million tokens, or about 2.58% of the total circulation. This equals $96 million, which will be unlocked for Aptos investors and the team.

On June 15, 2024, STRK will unlock 64 million tokens, or about 4.92% of the total circulation. At STRK’s current valuation of $1.14, this token unlock is equivalent to $72.96 million.

The additional supply of tokens could trigger volatility in the price of APT and STRK in the short term. Moreover, the tokens are being released to the developer team and investors, who may sell their tokens immediately. However, if demand is strong enough to offset the sell pressure, APT and STRK prices could stagnate or even rise slightly.

Crypto Performance Over the Past Week

Here are the best and worst performing cryptos on Pintu:

Cryptocurrencies With the Best Performance

- Brett (BRETT): 🔼70,75% (Rp 2,830)

- Mantra : 🔼23,90% (Rp 17.671)

- Ordinals : 🔼23,40% (Rp 932.560)

Cryptocurrencies With the Worst Performance

- Highstreet : 🔽51,19% (Rp 60.504)

- My Neighbor Alice : 🔽36,84% (Rp 26.840)

- Portal (PORTAL): 🔽31,28% (Rp 13.083)

References

- Aaryamann Shrivastava, ASI Formation by FET, AGIX, and OCEAN: What It Means for Prices, Bein Crypto, accessed on 10 June 2024.

- Medora Lee, It’s almost a sure bet the Fed won’t lower rates at its June meeting. So when will it? USA Today, accessed on 10 June 2024.

Share

Related Article

See Assets in This Article

ALICE Price (24 Hours)

Market Capitalization

-

Global Volume (24 Hours)

-

Circulating Supply

-