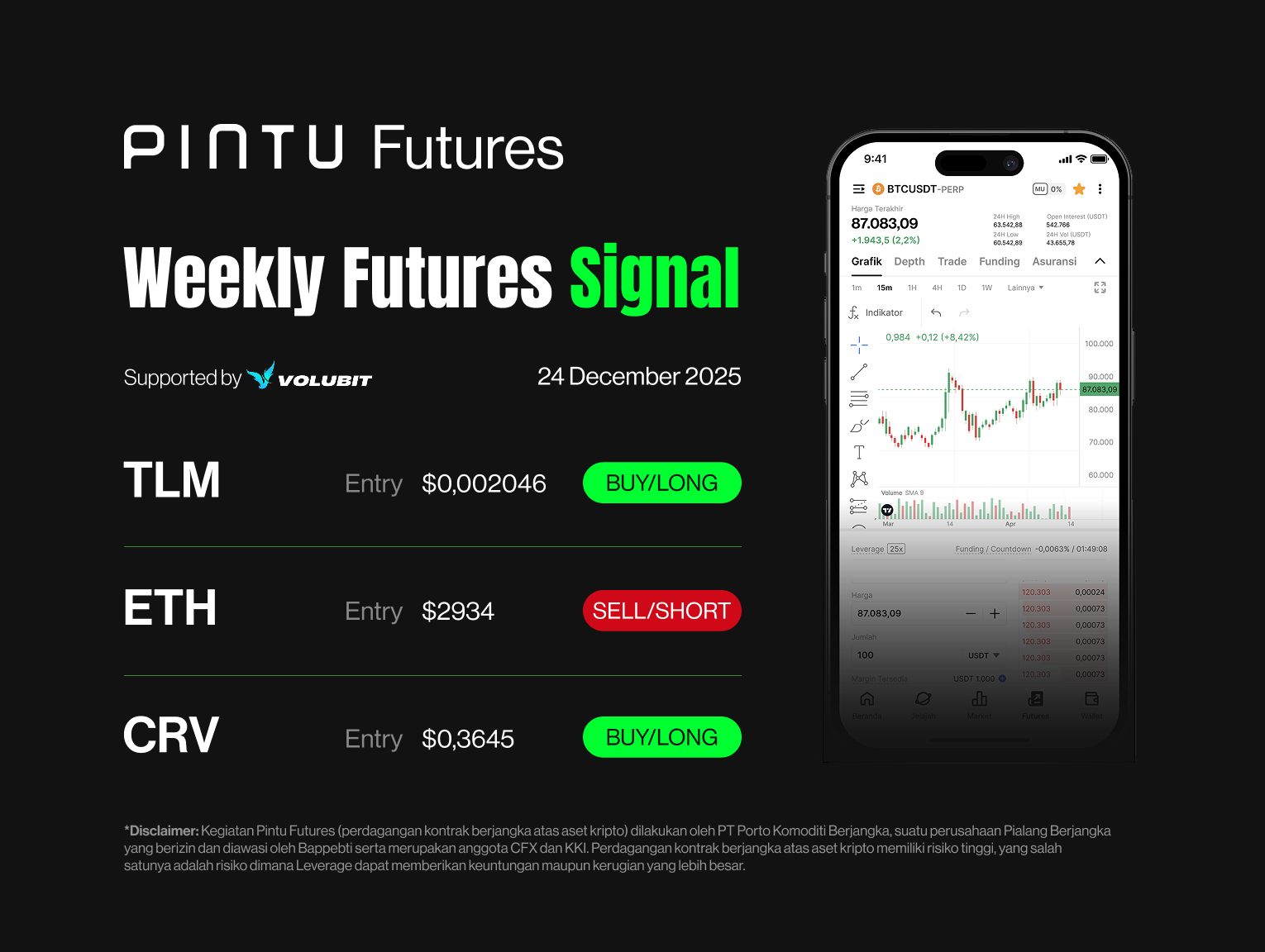

Weekly Signal Pintu Futures X Volubit – December 24, 2025

Signal Trading Summary:

- TLM

- Entry [Long]: $0.002046 – $0.002095

- Stop Loss [SL]: $0.001906

- Take Profit [TP]:

- TP1: $0.002450

- TP2: $0.002804

- Ethereum

- Entry [Short]: $2.934 – $2.986

- Stop Loss [SL]: $3.058

- Take Profit [TP]:

- TP1: $2.779

- TP2: $2.623

- Curve Dao

- Entry [Long]: $0.3645 – $0.3614

- Stop Loss [SL]: $0.3338

- Take Profit [TP]:

- TP1: $0.4

- TP2: $0.415

1. TLM

TLM showed an impulsive movement and broke the 21 EMA on the 4-hour timeframe. This shows the potential for TLM to experience an upward trend .

To look for a more probable buy position, we can wait for TLM to test its 21 EMA or at the resistance become support area around the $0.02046-$0.002095 area and target the high formed in the impulsive move that just formed.

TLM Potential Buy/Long Setup:

Entry: $0.002046 – $0.002095

Stop Loss [SL]: $0.001906

Take Profit [TP]:

- TP1: $0.002450

- TP2: $0.002804

2. Ethereum (ETH)

ETH is currently experiencing a breakdown of the 21 EMA on the 4-hour timeframe accompanied by the formation of a bearish candlestick, indicating a strong downside.

We can expect a correction to at least the $2779 area as long as ETH can’t breakout from the 21 EMA on the 4-hour timeframe.

ETH Sell/Short Potential Setup:

Entry: $2,934 – $2,986

Stop Loss [SL]: $3.058

Take Profit [TP]:

- TP1: $2,779

- TP2: $2,623

3. CRV

CRV looks to have a bullish structure change as seen by the higher high and breakout of the 21 EMA on the 1-day timeframe.

We can expect CRV to increase up to the $0.4 and $0.45 area as long as it does not break the 21 EMA on the 4-hour timeframe.

CRV Potential Buy/Long Setup:

Entry: $0.3645 – $0.3614

Stop Loss [SL]: $0.3338

Take Profit [TP]:

- TP1: $0.4

- TP2: $0.415

Important Notes:

Always apply risk management and capital management with discipline. For trading, especially those using leverage, we recommend using a risk per transaction of: 1% of total capital.

*Disclaimer: Pintu Futures activities (trading futures contracts on crypto assets) are carried out by PT Porto Komoditi Berjangka, a Futures Brokerage company licensed and supervised by Bappebti and is a member of CFX and KKI. Trading futures contracts on crypto assets has high risks, one of which is the risk that Leverage can provide greater profits or losses.

Share

Table of contents

Related Article

See Assets in This Article

1.9%

0.0%

ETH Price (24 Hours)

Market Capitalization

-

Global Volume (24 Hours)

-

Circulating Supply

-