51% Attack on Blockchains Explained: How Does It Work?

Bitcoin is superior to fiat currencies or government-issued currencies because of its blockchain technology. Blockchain is a digital ledger, whose data cannot be changed, ensuring double-spending or transactions using the same bitcoin more than once do not occur. This technology guarantees that no one can manipulate bitcoin transactions.

Is blockchain technology guarantee all bitcoin transactions truly immutable and free of threat? Actually, if a person or a group of users or miners control more than 50% of the computing power within the bitcoin network, this group of users or miners can make changes to the consensus that has been established or agreed upon. And they can manipulate bitcoin transactions, including conducting double-spending.

This attack is known as the 51% attack. The 51% attack has happened before on Ethereum Classic and Bitcoin Cash. What does this 51% attack actually mean? How likely is this threat to occur? See further explanation below.

What is a 51% attack?

A 51% attack occurs when a group of users or miners has 51% or more of the total mining hash power and can reverse an ongoing bitcoin transaction.

What can the attacker do?

When more than 50% of the computing power on the Bitcoin network is controlled by attackers, the things they can do are including:

- preventing transaction confirmation,

- reversing the confirmed transactions. This means they can do double-spending – or spend the same coin twice.

- creating a new blockchain

- not allowing other miners to mine new blocks (selfish mining)

What are the things they cannot do?

Even if attackers control 51% of computing power, they are unable to:

- create new coins or change data from old blocks.

- restore transactions that have occurred

- steal funds from wallet addresses

- make fake transactions

How does the 51% attack work?

Before understanding further how the 51% attack works, you should first learn about how Bitcoin works. As you know, Bitcoin transactions are chained together, which is why it is called a blockchain.

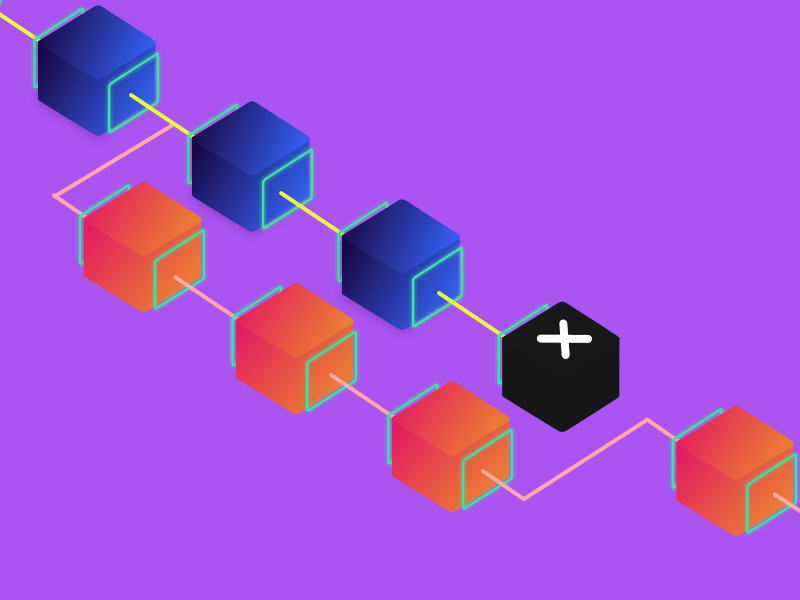

The 51% attacker can create two different blockchains. When a new block along with a hash or mathematical solution is found, it will be broadcasted to all miners. If any miner or group of miners control more than 50% of the computing power, they may decide not to broadcast their hashing. This can result in two different blockchains.

With two blockchains, miners who want to manipulate can enter bitcoin transactions on the new version of the blockchain. They can buy an item using bitcoin, and before the bitcoin is confirmed, they can mine an alternative blockchain where the bitcoin transactions they did are not included.

Blockchain mining holds the principle of democracy and follows the majority. In this case, the longest chain in the blockchain will be considered the most correct chain by all miners.

This method is not very cost-effective. A 51% attacker has to keep verifying new transactions and keep racing to create new blocks and compete with the original blocks. This effort requires a lot of energy and is almost impossible to do on a large network like Bitcoin.

How to prevent a 51% attack in the blockchain?

Satoshi Nakamoto explained that the Bitcoin network’s transaction fees are the incentive for miners to stay honest. A 51% attack can be prevented by ensuring that the Bitcoin network is increasingly decentralized.

Due to its large network, a 51% attack on Bitcoin is theoretically not possible. The probability of a 51% attack on the bitcoin network is very unlikely and close to zero. A miner or a group of miners must require tremendous computing power to make this happen. They have to beat millions of bitcoin miners from all over the world. A miner would need billions of dollars worth of equipment to use such massive hash power. This is what makes the argument that Bitcoin is considered not environmentally friendly because it uses a lot of energy to maintain the Bitcoin network. Another alternative, Proof of stake is theorized can prevent a 51% attack.

Miners also cannot use supercomputers to do this because supercomputers cannot beat the millions of computers currently working to mine Bitcoin. Besides being difficult, not to mention the cost of electricity to run this is so large that a 51% attack is not profitable to do.

Conclusion

A 51% attack on the Bitcoin blockchain is highly unlikely due to the size of the network. As the network grows, the possibility of a single person or entity obtaining enough computing power to outperform all the other participants becomes increasingly impossible.

Therefore, a 51% attack is highly unlikely on large networks, especially on the Bitcoin blockchain, which is considered the most secure cryptocurrency network. While it is quite difficult for attackers to gain control of Bitcoin networks, it is easier to attack smaller cryptocurrencies. When compared to Bitcoin, altcoins have a relatively low amount of hashing power. Some notable examples of cryptocurrencies falling victim to the 51% attack include Monacoin, Bitcoin Gold, and ZenCash.

Share