What is Aevo?

Trading crypto derivatives can be very rewarding. However, most platforms use liquidity pools and automated market maker-based setups. Unfortunately, these systems have complexity in user experience and interface, which became a barrier for amateur traders.

Aevo, with its Central Limit Order Book (CLOB) mechanism, aims to provide a derivatives trading experience similar to a centralized exchange. This makes Aevo intuitive and easy to use, even for beginners. In addition, the Aevo platform also comes with great scalability and robust security. So, what is Aevo? How does it work? Find out more in the following article.

Article Summary

- 🌐 Aevo is a decentralized crypto derivatives trading protocol allowing users to trade perpetual options and other derivative products.

- 💨 Aevo is a Layer-2 platform built using OP Stack. It utilizes optimistic rollup technology to process up to 5,000 transactions per second.

- 🏆 Aevo’s features include Aevo Exchange for perpetual trading, Aevo Vault for yield optimization strategies, and Aevo OTC for altcoin transactions with institutional-level liquidity.

- 🪙 AEVO is the native token in the Aevo ecosystem. It can be used for governance and staking. In addition, AEVO holders will also get a discount on trading fees.

What is Aevo?

Aevo is a decentralized crypto derivatives trading platform allowing users to trade perpetual options and other derivative products. It provides traders with the familiar trading experience using a centralized exchange. Moreover, it also ensures the security of the trade with Ethereum’s robustness.

Aevo combines off-chain Central Limit Order Book (CLOB) technology with on-chain trade settlement. As Aevo was built using OP Stack technology, a framework based on Optimism’s optimistic rollup, it inherits the underlying Ethereum security aspect. As a Layer-2 platform, it’s not surprising that Aevo can execute hundreds to thousands of trades simultaneously.

Aevo was originally known as Ribbon Finance before rebranding to Aevo in July 2023.

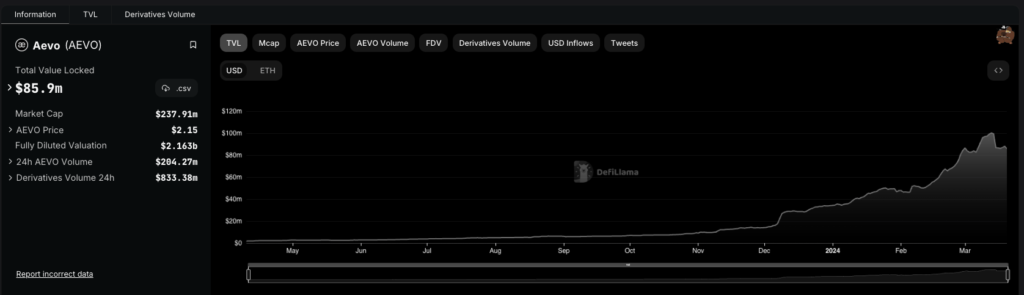

According to its official page, Aevo currently has a trading volume of more than $10 billion. It also has more than $50 million in open interest. Performance-wise, Aevo can process as many as 5,000 transactions per second (TPS) with a latency of less than 10ms. Meanwhile, according to Defi Llama, Aevo has a total value locked (TVL) of $85.9 million.

Learn more about what decentralized exchange is and how it works in the following article.

How Aevo Works

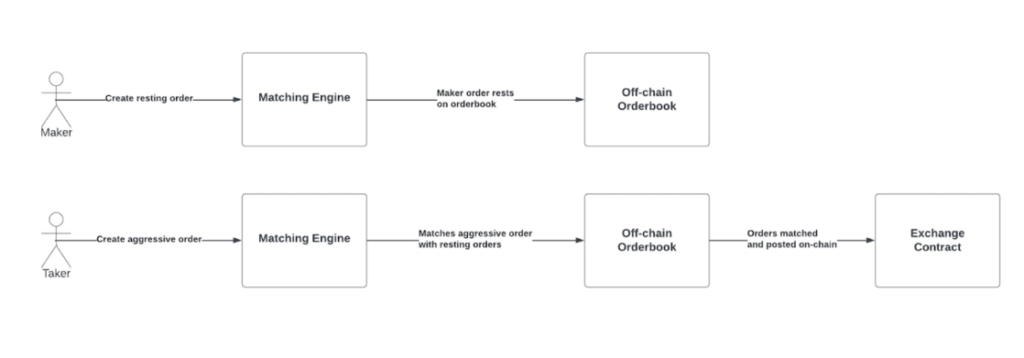

The process starts with Aevo matching makers and takers’ orders off-chain. Within this mechanism, a risk evaluation engine assesses the margin eligibility requirements for the transacting account.

Following the off-chain transaction, Aevo’s optimistic rollup will process the matched orders through its smart contracts. All aggregated transactions will be transmitted in batches through the Ethereum blockchain. Aevo’s sequencer node is operated by Conduit, a Rollup-as-a-Service (RaaS) platform.

As Aevo utilizes L2 technology via OP Stacks, it can execute settlement orders efficiently and quickly. Aevo only needs an average of 10 seconds to confirm a block transaction.

However, since Aevo uses optimistic roll-up technology, it sends all transactions to L1 (Ethereum), assuming they are fraud-free. If you want to submit proof of fraud, the deposition confirmation takes approximately 10 minutes.

As for the withdrawal process, Aevo takes about two to three hours. This is because the Aevo sequencer sends a batch of transactions from the Aevo rollup to the Ethereum mainnet every hour. Meanwhile, the dispute period for each transaction takes two hours. This is significantly faster than the Optimism mainnet, which takes seven days.

With this infrastructure, Aevo can provide a decentralized trading experience with the performance associated with trading on CEX. This is one of Aevo’s advantages over other DeFi trading platforms.

You can learn more about OP Stack and how optimistic rollups work here.

Aevo’s Features

The following are the features of Aevo:

Aevo Exchange

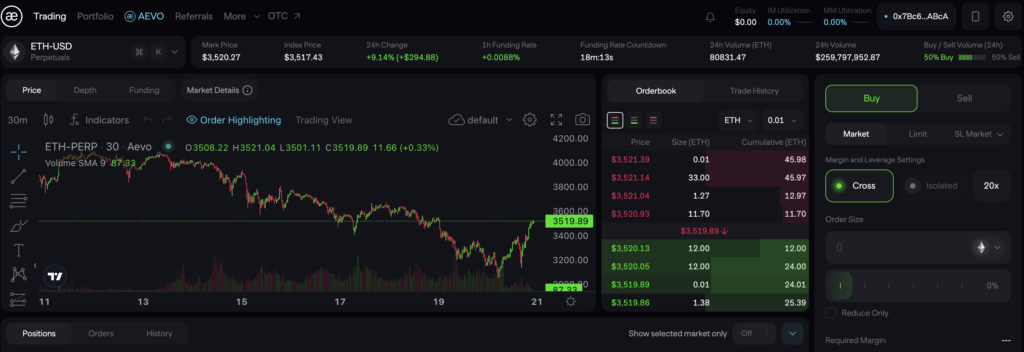

Aevo Exchange is the main feature of Aevo. It uses the CLOB system, which makes its trading mechanism similar to a centralized exchange. Aevo Exchange is also equipped with features such as order book, market depth, and various technical analysis tools to enhance the user experience.

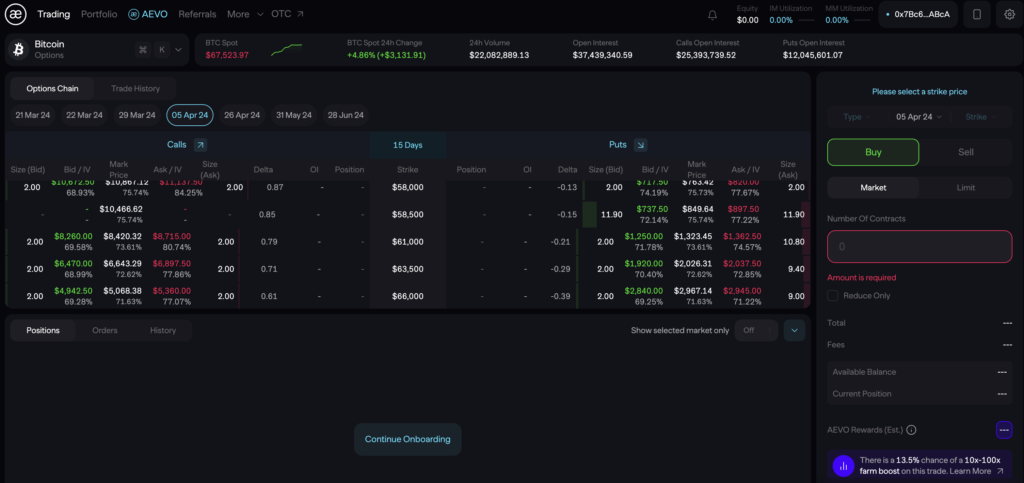

Perpetuals and options are the two derivative products traded on the Aevo Exchange. Aevo has supported 72 crypto pairings containing large, medium, and small-cap cryptos for perpetual. As for options, there are currently only two types of crypto, BTC and ETH.

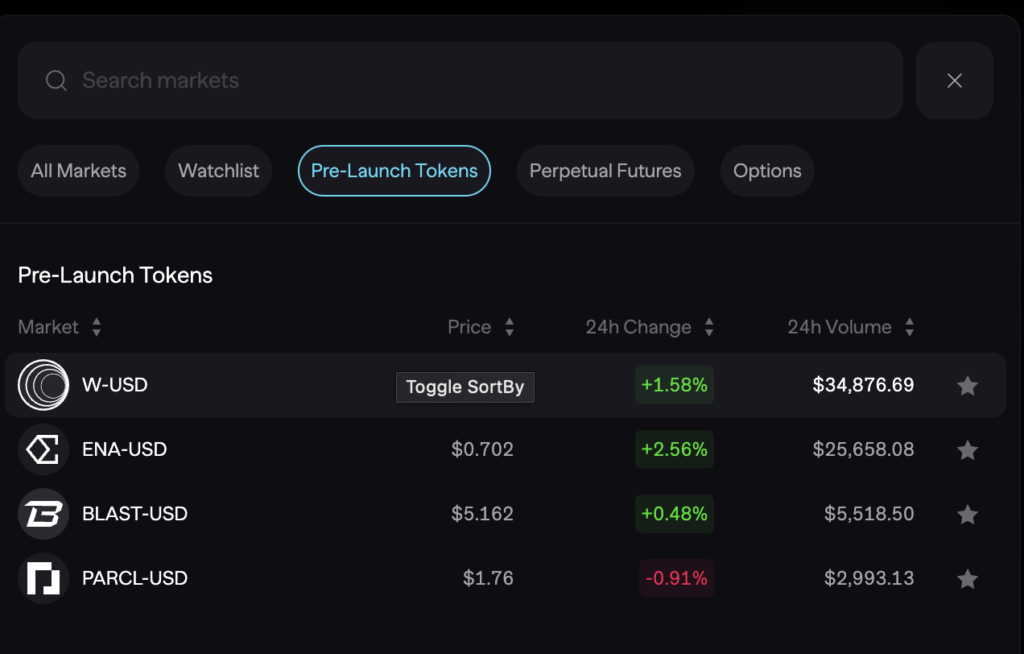

Aevo also has a feature called Pre-Launch Token Futures. It is a financial product that allows users to trade the anticipated value of a new token before it is listed on an exchange.

The feature seeks to capitalize on speculative interest in new projects. It also gives traders early exposure to potential market-mover assets. Once the tokens are traded on exchanges, the Pre-Launch Token Future will turn into a perpetual future.

Pintu Academy has prepared an article that goes deeper into the Initial DEX Offering.

Aevo Vault

Another Aevo feature is Aevo Vault, an automated derivatives strategy that uses smart contracts to generate yield. There are two types of vaults in Aevo: Theta Vaults and Earn Vaults.

- Theta Vaults

Theta Vaults allows users to execute European-style put or call options. The main difference between European-style and American-style options is their settlement. In the European-style, settlement can only be exercised on the contract expiry date. Each option contract in Theta Vaults expires seven days after the vault is created.

- Earn Vaults

An Earn Vault is designed to maximize the strategy by combining lending and exotic options exposed to short-term volatility in the market. This strategy can potentially boost the yield earned. This type of vault can be complementary to a Theta Vault, potentially delivering better overall yields. Earn Vaults also offers a principal protection feature.

Aevo OTC

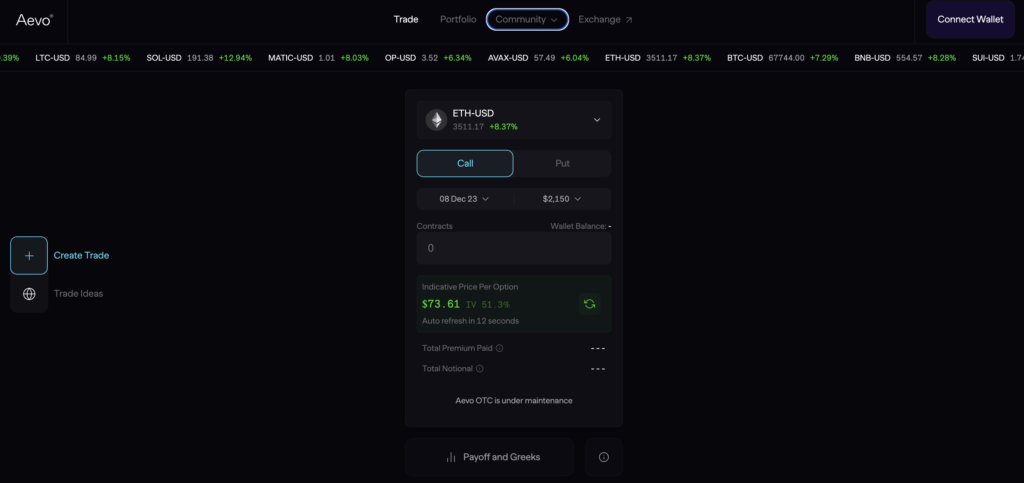

Aevo OTC is an on-chain altcoin options trading solution against institutional-grade liquidity providers. It uses a request-for-quote (RFQ) mechanism with a dynamic on-chain margin system.

Users can trade across weekly, biweekly and monthly maturities on 13 different coins. The list of coins will rotate monthly depending on the market’s most popular coins.

Aevo’s Advantages

- ⚡ Transaction Speed. As an exchange, transaction processing speed is crucial to ensure optimal trading. Aevo, as an L2 with optimistic roll-up technology, allows them to process up to 5,000 TPS.

- 🔐 Secured by Ethereum. Aspect As an L2 on the Optimism network, Aevo inherits the security and privacy aspects of its underlying L1, Ethereum.

- ✨ Familiar user experience. Thanks to the use of CLOB, Aevo has a CEX-like operational system. This can ease the onboarding process of new users who are used to trading on CEX.

AEVO as Investment

AEVO is the native token in the Aevo ecosystem. It was recently launched through a Token Generation Event (TGE) on March 13, 2023. At the same time, Aevo shared an AEVO token airdrop campaign for protocol early adopters. They used trading volume-based for airdrop eligibility.

You can check if you got the AEVO airdrop on the following page. Relax. Those of you who don't qualify can still farm and stake AEVO. Rewards will be claimable starting April 10, 2024.

AEVO can be used to participate in governance as well as to stake. By staking AEVO, users will get sAEVO, which has 2x more voting power. In addition, by owning AEVO, users also get discounted trading fees on the AEVO platform.

Aevo, which is a rebranding of Ribbon Finance, has also transitioned the RBN token into an AEVO token. The Aevo team has announced that 45% of RBN owned by the DAO treasury, which has since transitioned into AEVO, will be distributed as follows:

- 16% for incentives (including airdrop)

- 9% for token liquidity

- 5% for community growth and bounties

- 16% reserved for future DAO spending.

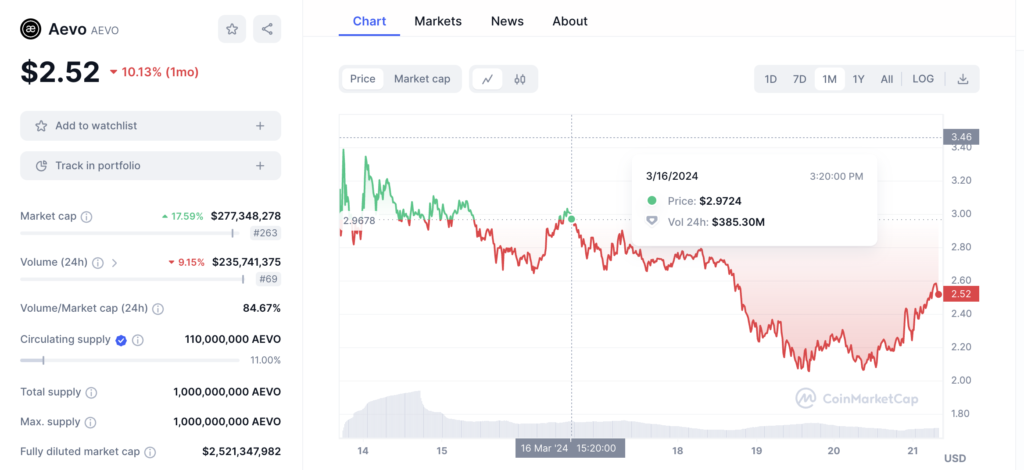

AEVO has a total supply of 1 billion AEVO, of which only 110 million AEVO tokens are circulating in the market. Regarding price movement, AEVO is in the middle of a price decline post the TGE. At the time of writing, it stands at US$2.52, down 24.7% from its highest price.

AEVO Token Potential

The DEX perpetual sector is getting more competitive by the day as protocols in this sector become more prevalent. AEVO will compete with competitors such as GMX, dYdX, Gains Network, etc.

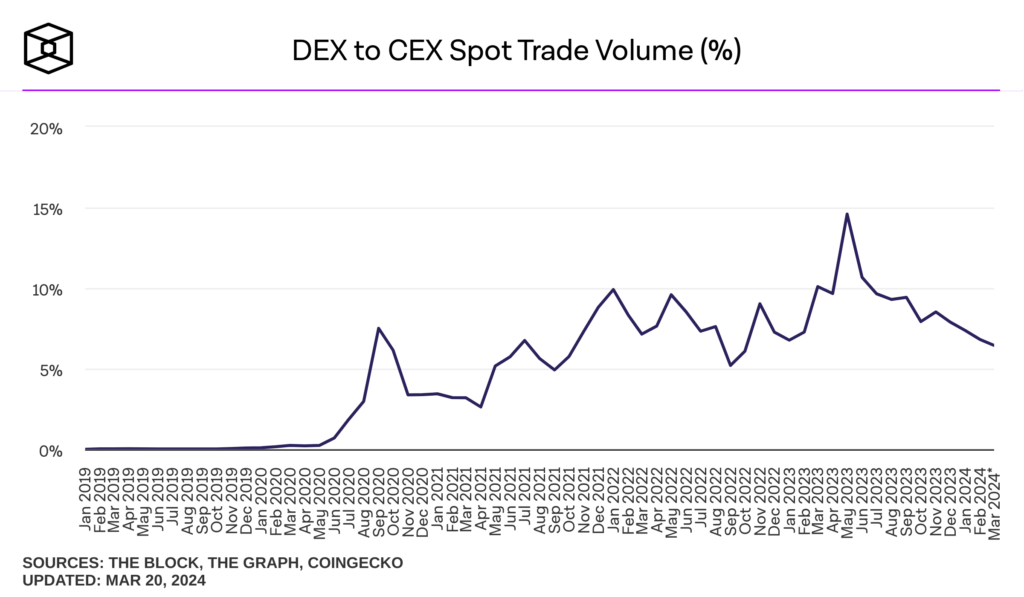

On the one hand, perpetual trading is in high demand, given its potential to generate profits even in bearish conditions. Moreover, the leverage feature also attracts retail or institutional traders who aim higher returns. Unfortunately, perpetual trading transactions are currently still predominantly done on CEX.

Despite the decline, the chart above shows increased spot trading volume transactions on DEX against CEX. If the trading volume on DEX goes back up, then it is likely that the same will happen in perpetual trading. As more traders switch from CEX to DEX for perpetual trading, the number of users and transactions on Aevo could increase. Thus, the valuation of AEVO will also be increased.

This article will help you understand perpetual trading and its potential in the future.

Conclusion

Aevo is a decentralized crypto derivatives platform that offers perpetual and options trading. It has a mechanism and interface similar to CEX. Aevo is built with Optimism’s OP Stack technology. As a Layer-2, Aevo can process transactions at high speed while inheriting the security aspects of Ethereum.

Aevo’s features include Aevo Exchange for perpetual trading and Aevo Vault for yield optimization strategy. AEVO is the native token in the Aevo ecosystem used to participate in governance, staking, and earn discounted trading fees.

How to Buy AEVO on Pintu

After knowing what Aevo is, you can start investing in AEVO by buying it on Pintu app. Here is how to buy crypto on Pintu application:

- Create a Pintu account and follow the process of verifying your identity to start trading.

- On the homepage, click the deposit button and top up the Pintu balance using your preferred payment method.

- Go to the market page and look for AEVO.

- Click buy and fill in the amount you want.

- Now you have AEVO!

In addition to AEVO, you can safely and conveniently purchase a wide range of cryptocurrencies such as BTC, ETH, SOL, and others safely and easily on Pintu. Pintu diligently evaluates all its crypto assets, highlighting the significance of being cautious.

Pintu is also compatible with popular wallets such as Metamask to facilitate your transactions. Download Pintu app on Play Store and App Store! Your security is guaranteed because Pintu is regulated and supervised by Bappebti and Kominfo.

In addition to buying and trading crypto assets, you can expand your knowledge about cryptocurrencies through various Pintu Academy articles. Updated weekly, all Pintu Academy articles are made for knowledge and educational purposes, not as financial advice.

References

- Aevo Docs, Introduction to Aevo, accessed on 20 March 2024.

- Aevo Blog, AEVO Trading & Staking Incentive Program, accessed on 20 March 2024.

- Antony Bianco, What is Aevo? Data Wallet, accessed on 20 March 2024.

Share