What is Bitcoin ETF?

Bitcoin adoption is experiencing significant growth every day. It is being recognized as a commodity in several countries and has also been utilized as a security through the introduction of Exchange Traded Funds (ETF). A notable development in this regard is the recent interest of BlackRock, the world’s largest investment manager, who has registered a Bitcoin ETF. Find out more about Bitcoin ETF and how it works through this article.

Article Summary

- 📈 Bitcoin ETFs are securities that contain various assets related to Bitcoin. It was traded on traditional exchanges – instead of crypto exchanges. Bitcoin ETFs allow investors to have Bitcoin exposure without directly owning the asset.

- 🚀 By trading Bitcoin ETFs, investors do not need to go through the process of storing crypto. So there is no risk of losing digital wallet keys. Making Bitcoin ETFs a simpler and “less risky” way to invest in Bitcoin.

- Currently, the only Bitcoin ETFs on the market are those that track the price of Bitcoin futures contracts. Meanwhile, Bitcoin ETFs that track the spot Bitcoin price are not yet available due to regulatory hurdles.

- ⚠️ A futures-based Bitcoin ETF allows investors to only get BTC price exposure in the short term instead of the full and long term. This is because futures contracts have expiration dates.

What are ETFs?

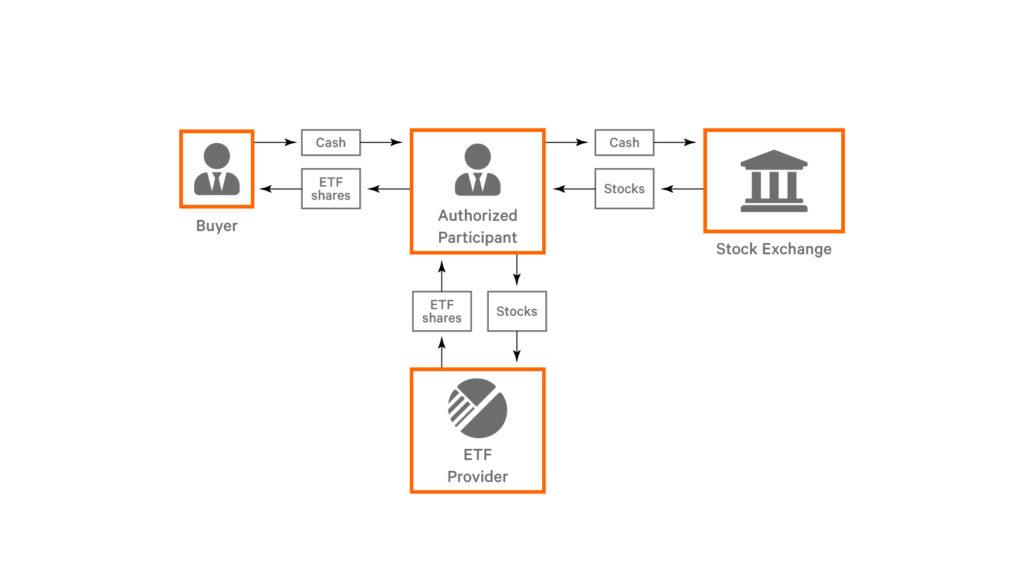

An Exchange Traded Fund (ETF) is a type of security that tracks the price of a specific investment asset where it can be traded on a stock exchange like stocks. ETFs can be designed to track the price of any investment asset. It ranges from indices, stock sectors, commodities, and large & diverse collections of securities.

Some popular types of ETFs are stock ETFs, bond ETFs, industry ETFs, currency ETFs, and, more recently, ETFs that track the price of Bitcoin, also known as Bitcoin ETFs.

Through ETFs, investors can diversify their investments without owning the asset. In addition, ETFs also allow investors to have different types of assets in one basket instead of buying one type of asset individually. The share price of the ETF will change throughout the trading day as the stock is traded in the market.

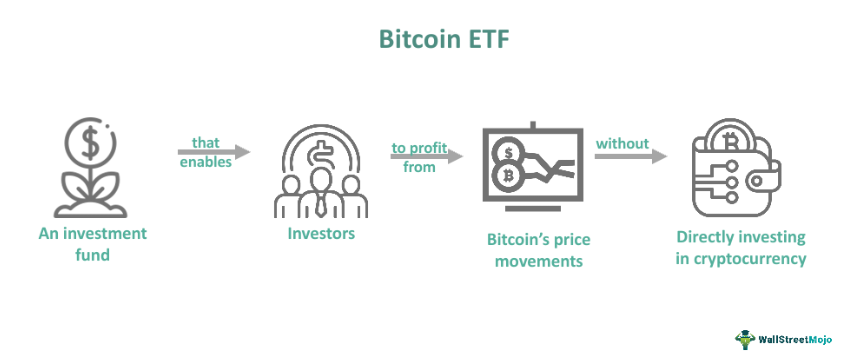

What is Bitcoin ETF?

Bitcoin ETFs are securities that contain various assets related to Bitcoin and are traded on traditional exchanges instead of crypto exchanges. Bitcoin ETFs aim to provide access for investors who are hesitant to fully own Bitcoin. As mentioned earlier, ETFs allow investors to access certain assets, in this case, Bitcoin, without holding them.

Theoretically, Bitcoin ETFs are created by investment managers buying securitized Bitcoin. After that, the Bitcoin ETF can be traded on the stock exchange, just like any other stock.

The United States Securities and Exchange Commission (SEC), which has the authority to oversee and regulate securities in the US, has yet to authorize a spot Bitcoin ETF. Several fund managers have repeatedly submitted Bitcoin ETF proposals that track the spot BTC price. However, the SEC has always rejected them. They cite concerns about market manipulation, lack of regulation, and the risk of fraud in the crypto market.

As a result, no Bitcoin ETF represents BTC spot price as its underlying. So far, the Bitcoin ETF in the market only tracks the price of Bitcoin futures contracts traded on the Chicago Mercantile Exchange. It has been categorized as a regulated financial product, so Bitcoin ETFs are traded on stock markets like NASDAQ or NYSE.

Don’t forget to deepen your knowledge about Bitcoin in the following article.

How does a Bitcoin ETF Work?

Bitcoin ETFs use futures contracts because most Bitcoin ETFs track the Bitcoin price without physically holding it in a wallet. Futures are contracts to buy or sell an asset at a predetermined price. This means you can buy the asset below or above the current market price at the end of the contract (called the expiration date).

Futures contracts are used to help protect producers and suppliers from price volatility by allowing each party to "lock in" a selling or buying price - the goal is to manage risk rather than maximize profits.

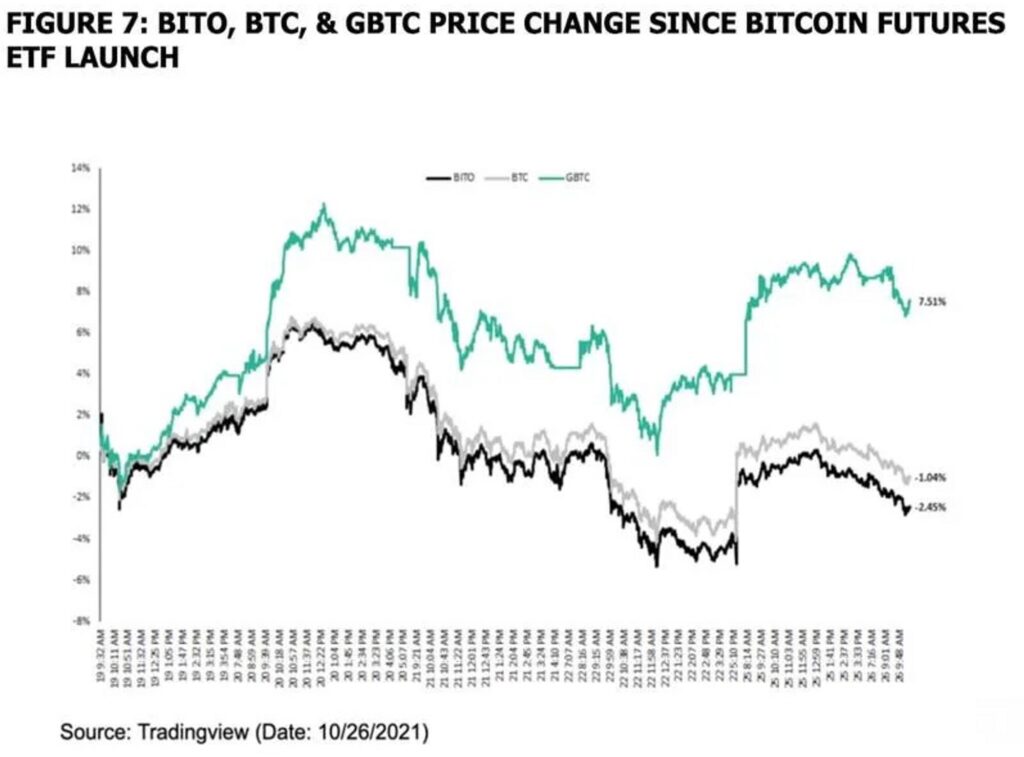

Since the current Bitcoin ETFs are futures contracts, owning them is like betting on the price of Bitcoin when a particular contract expires. This means you don’t get long-term exposure to Bitcoin. Unfortunately, these Bitcoin ETFs struggle to accurately track the price of BTC due to their reliance on speculative futures contracts. The result is that the price of the Bitcoin ETF deviates from the actual price of BTC, making the price of the Bitcoin ETF either too expensive or too cheap.

The problem occurs because fund managers cannot purchase BTC directly. Only spot Bitcoin ETFs allow direct BTC purchases. Therefore, Blackrock’s recent Bitcoin spot ETF proposal has the potential to be a game changer.

List of Popular Bitcoin ETFs

- Grayscale Bitcoin Trust (GBTC). Owned by GrayScale Investment, which has Asset Under Management (AUM) of US$ 18.9 billion.

- ProShares Bitcoin Strategy ETF (BITO). Owned by ProShares, which has an AUM of US$ 1.03 billion.

- ProShares Short Bitcoin Strategy ETF. Owned by ProShares, which has an AUM of US$ 83.36 million.

- VanEck Bitcoin Strategy ETF. Owned by VanEck, which has an AUM of US$ 45.05 million.

- Valkyrie Bitcoin Strategy ETF. Owned by Valkyrie Funds LLC, which has an AUM of US$ 29.87 million.

Apart from the US, Bitcoin ETFs have also been popular in Hong Kong, one of the countries that support the crypto industry. Some of the major Bitcoin ETFs in Hong Kong are CSOP Bitcoin Futures ETF and Samsung Bitcoin Futures Active ETF. Investors can even buy these Bitcoin ETFs directly through HSBC Hong Kong.

Pintu Academy has prepared an article on the impact and potential of Hong Kong crypto regulation.

Listed Spot Bitcoin ETF Candidates

Unlike the Bitcoin ETF (tracking the price of futures contracts) that exists in the market today, the new ETF that is currently being registered will track the BTC spot price. Not only that, the investment manager that registered the Bitcoin ETF this time is also a company with large assets under management.

- Blackrock. A company with US$10 Trillion in assets under management.

- Fidelity Investment. A company with US$4.5 trillion in assets under management.

- Invesco. A company with US$1.49 trillion in assets under management.

- Wisdom Tree. A company with US$87 billion in assets under management.

- Valkyrie. A company with US$ 1 billion in assets under management.

Why could Blackrock’s Bitcoin ETF Spot be a game changer?

BlackRock’s entry into the crypto industry by listing a Bitcoin ETF spot was welcomed by crypto players. The reason is BlackRock’s ETF application appears extremely promising. They have an impressive record of 575-1 in favor of the approval. Historically, BlackRock has also demonstrated a remarkable ability to navigate the regulatory landscape. Two things that were difficult to achieve by the previous institution. Moreover, BlackRock’s move responds to the high demand for related products from its customers. Another reason that will emphasize BlackRock’s steps were going forward.

Furthermore, BlackRock has asked Nasdaq to help track customer identification and market trading data. They also partnered with Coinbase as the custodian of the actual bitcoins purchased. Both of these will add greater levels of protection for investors. But it also looks to have hammered solutions to the SEC’s concerns over investor protection.

If BlackRock’s spot Bitcoin ETF is approved, the impact on the crypto industry is expected to be huge. To give you an idea, BlackRock currently manages US$10 trillion in customer funds. Meanwhile, the total BTC supply on all exchanges is 2.2 million BTC. With a BTC price of US$ 30,000, this is worth US$ 66 billion: a tiny amount or only 0.7% compared to BlackRock’s total portfolio.

Not to mention the potential for soaring demand from institutional and retail investors when the spot Bitcoin ETF is already trading. Combined, these things could create a new wave of crypto investors and mass adoption that could reshape the crypto market. Of course, these are just hypotheses. The above may not be the case. The SEC may reject the Bitcoin ETF spot application again, and the crypto market conditions do not change at all.

Read a full explanation of the SEC and its role in the crypto industry here.

Advantages of Bitcoin ETF

The following are some of the advantages of investing through Bitcoin ETFs:

- ⚡ Practical. Through Bitcoin ETFs, investors do not need to go through the process of cryptocurrency exchange, crypto storage, and there is no risk of losing digital wallet keys. Investors can simply purchase Bitcoin ETFs on the stock exchange.

- 🔍 Clarity. Institutional investors need investment instruments that work within existing and transparent regulations and frameworks. Bitcoin ETFs have that, unlike crypto assets.

- ⚖️ Tax Certainty. As a security, the taxation rules of ETFs are very clear. This is an essential aspect for investors, especially institutions.

- 🎯 More Measurable Risks. The ETF’s investment manager will handle all security risks related to Bitcoin. This allows investors to gain exposure to Bitcoin without the need to own it and avoid the risks that come with it.

Disadvantages of Bitcoin ETF

The following are some of the drawbacks of investing through Bitcoin ETFs (futures-based):

- 🔦 Limited exposure. Investors only get BTC price exposure on a short-term basis, instead of an overall and long-term basis. This is because futures contracts have expiration dates.

- 💲 Additional costs. The practicality of Bitcoin ETFs comes with additional management fees. Not to mention, the price offered by Bitcoin ETFs is usually higher than the price on the spot market.

- 🏢 Dependence on other parties. Investors depend on the ETF manager to buy and look after their Bitcoin, which can be risky if the manager fails to do a good job.

Conclusion

Bitcoin ETFs provide an opportunity for retail and institutional investors to gain exposure to the price of Bitcoin. Right now, the existing product only follows the price of Bitcoin futures contracts, doesn’t exactly match the actual price of Bitcoin. Bitcoin ETF spot, on the other hand, is securities that accurately reflect the price of Bitcoin.

However, regulators still need to approve Bitcoin ETF spot, and some fund managers have already tried without success. Ultimately, only time will tell what the end of the Bitcoin ETF drama will look like. One thing is for sure: a Bitcoin ETF spot is eagerly awaited to open the gates for more mass and massive Bitcoin adoption.

Apart from Bitcoin and Bitcoin ETF, Altcoin can also be a crypto investment option. Find out a more complete explanation in the following article.

Buy Crypto Assets in Pintu

Looking to invest in crypto assets? No worries, you can safely and conveniently purchase a wide range of cryptocurrencies such as BTC, ETH, SOL, and others safely and easily at Pintu. Pintu diligently evaluates all its crypto assets, highlighting the significance of being cautious.

Pintu is also compatible with popular wallets such as Metamask to facilitate your transactions. Download Pintu app on Play Store and App Store! Your security is guaranteed because Pintu is regulated and supervised by Bappebti and Kominfo.

Aside from buying and trading crypto assets, you can expand your knowledge about cryptocurrencies through various Pintu Academy articles. Updated weekly, all Pintu Academy articles are made for knowledge and educational purposes, not as financial advice.

Reference

Kate Dore, What to know about crypto investing as regulators weigh the first spot bitcoin exchange-traded funds, CNBC, accessed on 27 June 2023.

Nathan Rieff, Bitcoin ETF: Definition, How It Works, and How to Invest, Investopedia, diakses pada accessed on 27 June 2023.

Ki Chong Tran, Bitcoin ETF: Everything You Need To Know, Decrypt, accessed on 27 June 2023.

George Kaloudis, BlackRock’s Bitcoin ETF Would Be a Big Deal, Coindesk, accessed on 27 June 2023.

RJ Fulton, BlackRock’s Game-Changing Bitcoin ETF: What Every Investor Needs to Know, The Motley Fool, accessed on 27 June 2023.

Ronaldo Marquez, BlackRock Edges Closer To Bitcoin ETF Filing: Bullish Impact On BTC’s Price? Bitcoinist, accessed on 28 June 2023.

Share

Table of contents