What Is Initial Margin Buffer?

Trading is not just about being able to understand technical analysis or market fundamentals. In futures trading, understanding basic concepts such as Initial Margin Buffer is also very important. This article will discuss what the initial margin buffer is, how it works, how to use it, and the importance of using the Initial Margin Buffer in Futures Trading.

Article Summary

- 🔎 Definition of Initial Margin Buffer: An additional margin reserve that can provide extra protection to keep positions safe when markets experience high volatility.

- ⚙️ How it works: The smaller the leverage, the larger the margin locked in as an IM Buffer to provide additional room before a position is at risk of liquidation.

- 🧰 Function: IM Buffer serves as an extra layer of protection to keep open positions safe.

What Is Initial Margin Buffer?

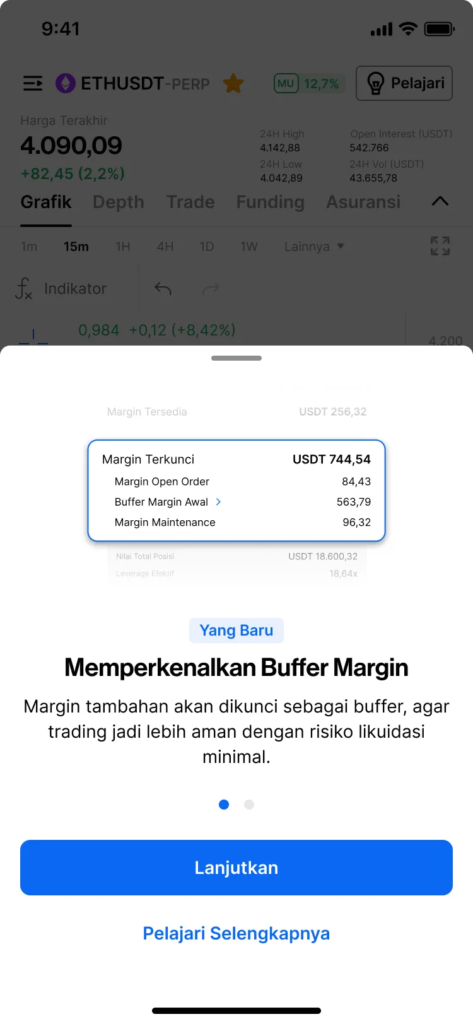

Initial Margin Buffer (IM Buffer) is a margin that is locked in as an additional reserve to protect positions from potential liquidation. The purpose of the IM Buffer is to provide extra safety space so that your positions have a margin cushion when the market moves to extremes.

On Pintu Futures, IM Buffer is optional, users can choose whether or not to enable it. Of course, this choice also affects the Available Margin, which you can use to open new positions or pay funding fees.

This means that if you enable IM Buffer, your Available Margin will be smaller than if you don’t enable it.

How the Initial Margin Buffer Works

| Item | IM Buffer = OFF | IM Buffer = ON |

|---|---|---|

| Margin Balance | $250 | $250 |

| Leverage | 10x | 10x |

| Position Size | $1.500 | $1.500 |

| Initial Margin (IM) | $150 | $150 |

| Maintenance Margin (MM) | $15 | $15 |

| Locked Margin | $15 (MM) | $150 (MM + IM Buffer) |

| Available Margin | $235 | $100 |

Since Pintu Futures currently supports leverage settings ranging from 1x to 25x, the example above uses 10x leverage to provide a variation from the previous discussion on Crypto Futures.

In the table above, when you have an active position and activate the IM Buffer feature, the locked balance is $150 (MM + IM Buffer). Meanwhile, if this feature is not enabled, the system will only lock $15 (MM).

This mechanism causes a significant difference in Available Margin between the IM Buffer on and off conditions.

| Margin Balance | $500 | $500 | $500 |

| Leverage | 5x | 10x | 15x |

| Position Size | $1.500 | $1.500 | $1.500 |

| IM Buffer (Locked balance) | $300 ($15 + $285 IM Buffer) | $150 ($15 + $135 IM Buffer) | $100 ($15 + $85 IM Buffer) |

| Maintenance Margin | $15 | $15 | $15 |

| Available Margin | $200 | $350 | $400 |

In the IM Buffer mechanism, the smaller the leverage used, the larger the locked balance.

It should be noted that the IM Buffer (locked balance) may change according to the amount of leverage used. Let’s take a closer look at the table above.

- 5x Leverage = 1/5 = 0.2 = 20% of $1,500 (position value) = $300 (1% MM + 19% Buffer)

- 10x Leverage = 1/10 = 0.1 = 10% of $1,500 (position value) = $150 (1% MM + 9% Buffer)

- 15x Leverage = 1/15 = 0.0666 = 6.67% of $1,500 (position value) = $100 (1% MM + 5.67% Buffer)

Pros and Cons of Initial Margin Buffer

- Pros:

By enabling IM Buffer, your trading positions will have an additional layer of protection against potential liquidation. This is because IM is locked as a backup Buffer to keep positions safe in the event of extreme price movements. For traders who want to be safer and reduce the risk of sudden liquidation due to market volatility, enabling this feature could be the right choice.

- Disadvantages:

On the other hand, if IM Buffer is enabled, the remaining Available Margin will be smaller, reducing the flexibility of margin usage. You also need to recalculate your remaining margin balance before opening additional positions, as each new position may increase Margin Usage and increase the risk of liquidation.

Read also: What is Margin in Futures Trading?

Why is Initial Margin Buffer Important?

IM Buffer is important because it provides an additional layer of protection for open positions. When this feature is active, the system locks the MM + IM Buffer as a margin reserve to give your position a safe space before it reaches the liquidation limit. In other words, IM Buffer helps you have a clearer distance before touching the MM amount, minimizing the risk of sudden liquidation.

By utilizing the IM Buffer feature, margin usage focuses more on protecting open positions rather than adding new positions so that Margin Usage can still be controlled.

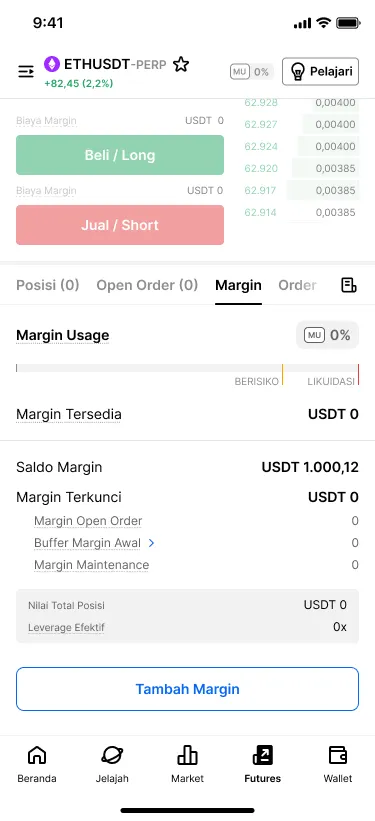

How to use the Initial Margin Buffer

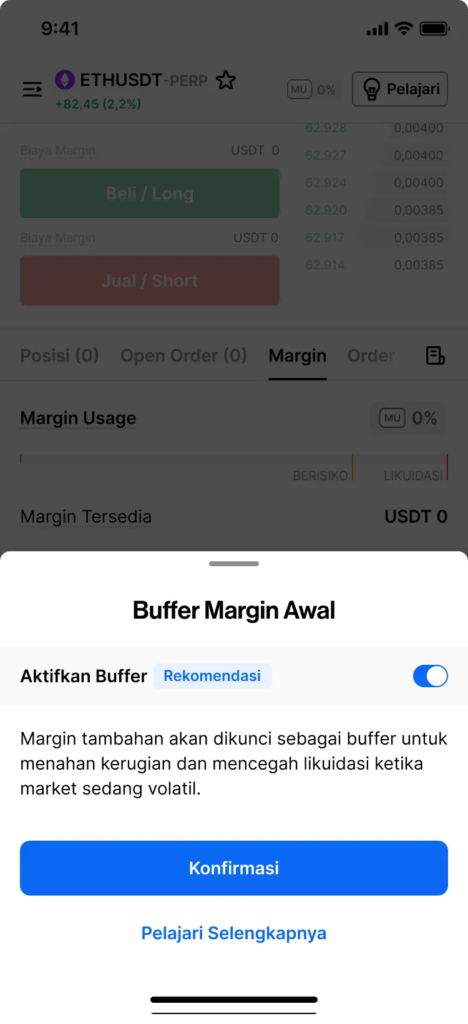

- Make sure you have updated the Pintu app to the latest version, then open the app.

- Enter the Futures menu in the Pintu app.

- Open the Margin tab

- Select Initial Margin Buffer

- Slide the Enable Buffer button to the right to turn it on and click confirm.

- Congratulations! You have enabled IM Buffer. To disable it, slide the button to the left.

How to Use Pintu Futures in Web

In addition to spot trading on the Pintu Pro feature, you can also trade Futures on the Pintu app. Here are the steps to use Pintu Futures on Pintu Web:

- Go to https://pintu.co.id/

- Click the Futures button.

- Click Trading Futures on Desktop.

- Then click Register or Login if you have already registered.

You can also access Pintu Futures directly through the Pintu app, by selecting the Futures tab on the main page, or access it through the Market page on Pintu.

Conclusion

Overall, IM Buffer serves as an additional layer of protection that helps you keep your positions safe when the market experiences high volatility. By enabling this feature, a portion of the margin will be locked as a reserve to reduce the risk of liquidation, although it does make the Available Margin smaller. Therefore, the decision to turn on IM Buffer should be tailored to each trader’s strategy and risk tolerance, whether it prioritizes position safety or flexibility in opening new positions.

Disclaimer: All articles from Pintu Academy are intended for educational purposes and do not constitute financial advice.

Share