What is Market Sentiment?

What is market sentiment?

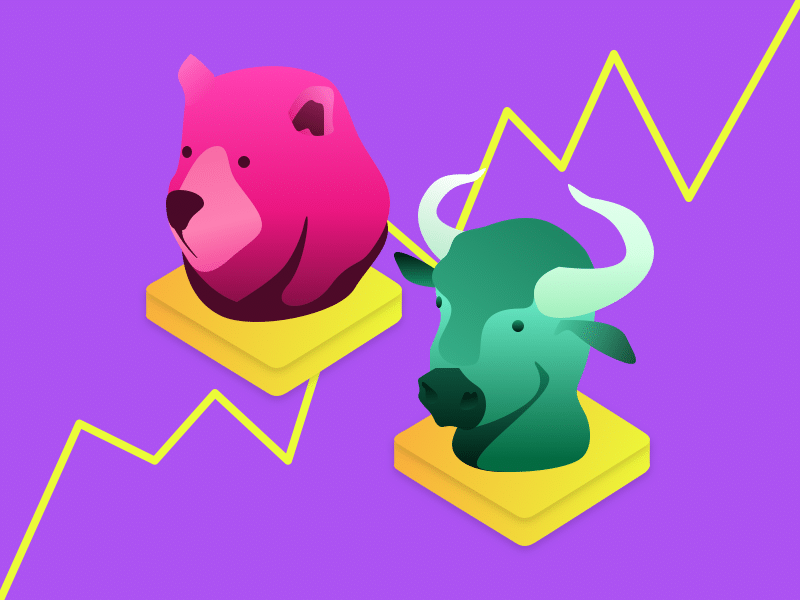

Market sentiment is the overall attitude of market players or investors towards the price action of a market. This is a psychology that comes from trading activity and market price movements. In general, there are two popular terms that often describe market sentiment, bullish (positive & optimistic) and bearish (negative & pessimistic).

Why is understanding market sentiment important?

Knowing and understanding market sentiment has a number of advantages for investors. Successfully recognizing and evaluating market sentiment before investing allows investors to evaluate assets based on their fundamental benefits. Understanding market sentiment also allows us to identify the stages of the market sentiment cycle that we are entering.

Example:

In the case of crypto, we can see the market sentiment on Bitcoin. In 2017, as Bitcoin price rose from $2000 to $19,000 USD, Bitcoin received a lot of public attention from the media. At that time, the market sentiment were so positive and many people rushed to buy when Bitcoin is at its peak.

When Bitcoins ended up being sold a lot, it caused losses for investors who were late buying Bitcoin (buying at a high price). Investors who have grasped market sentiment tend to be more cautious when they see the market is crowded. They will re-analyze and avoid making investment decisions because they could potentially suffer losses.

How does market sentiment affect prices?

Sentiment drives demand and supply, which in turn leads to price movements. Market sentiment is bullish when prices are rising, while bearish when prices are falling. Usually, traders or investors combine market sentiment indicators with trading frameworks or other forms of analysis to refine market entry and exit signals. The key to getting the most for investors is to gauge the mood in the market properly and act faster when knowing forecasts.

There are two theories that can be studied to understand market sentiment:

The Behavioral Financial Theory

Kahneman & Tversky put forward this theory to show various forms of investor “irrationality” based on psychology. In investing, there is a lot of evidence or cases showing that investors often do not refer to fundamental rules. Instead, they often depend on their own investment decisions or those of other investors.

The habit of investors who often use personal perceptions finally creates a lot of bias. Kahneman & Tversky call them cognitive and emotional biases. The characteristics of cognitive and emotional biases are as follows; too confident in the ability to predict, using the rule of thumb in investment allocation, having difficulty adjusting their views to new information, excessive reliance on past performance. These things give rise to biased investment decisions.

The Animal Spirit Theory

When the market is up, investors will flock to it, expecting more unrealistic returns to allocate their portfolios into that market. When the price drops drastically, they will be pessimistic but still maintain their portfolio to avoid capitalization losses. This is what makes this kind of behavior tied to market sentiment and allows for irrational enthusiasm.

Conclusion

From the article above we can see that before jumping into a market, apart from understanding the fundamental rules, understanding market sentiment also brings benefits. Being aware of the impact of market sentiment can help us to see market trends before making an investment decision.

Share